Market Brief: Pound Sets the Pace, but Strength May Be Short-Lived

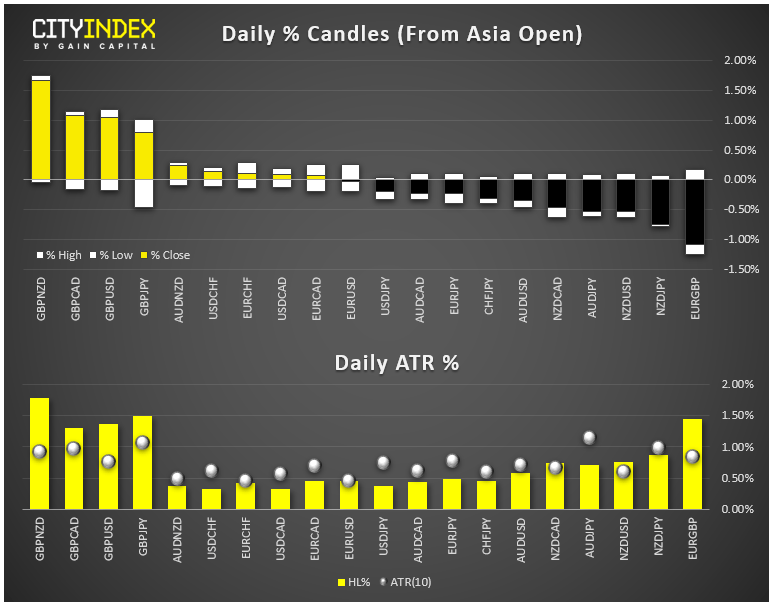

- FX: The pound was by far the strongest major currency on the day after German Chancellor Angela Merkel said that a solution on the Irish backstop is possible within 30 days (though it’s since been suggested that she was just being “polite”). The kiwi was the weakest major currency today.

- US data: Initial jobless claims came in at 209k, below estimates of 216k. Markit Manufacturing PMI missed estimates and dipped into contractionary territory at 49.9.

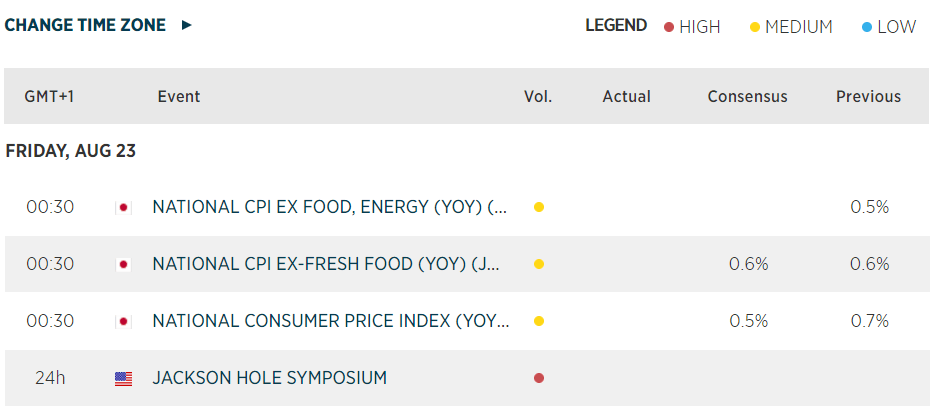

- In comments to media, two Fed Presidents (Kaplan and Harker) struck opposite notes on the economy and monetary policy (dovish and hawkish respectively). As we noted yesterday, Fed Chairman Powell’s speech at Jackson Hole tomorrow will be key given the diverging opinions among Fed policymakers.

- Commodities: Both gold and oil edged about 0.5% lower on the day.

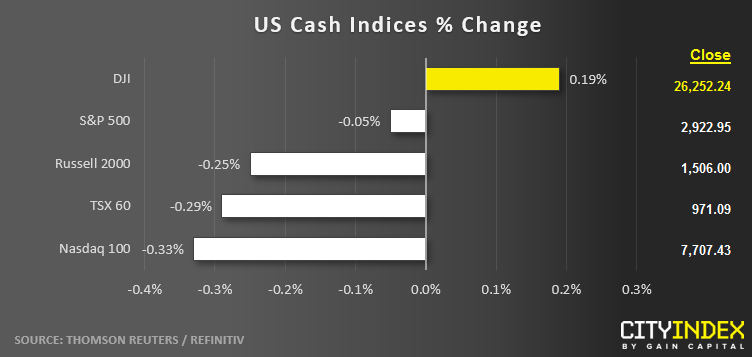

- US indices recovered from a late morning swoon to finish mixed on the day.

- Financials (XLF) were the strongest sector on the day while Materials (XLB) were the weakest.

- Stocks on the Move:

- Boeing (BA) surged more than 4% on news that company’s 737 MAX plane may be just 4-6 weeks from getting reapproved by the Federal Aviation Administration.

- Retailers remained strong again today after strong earnings from BJ’s Wholesale Club (BJ, +17%) and Nordstrom (JWM, +16%).

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM