Market Brief: Pound Pounded Ahead of Tomorrow’s UK Supreme Court Decision

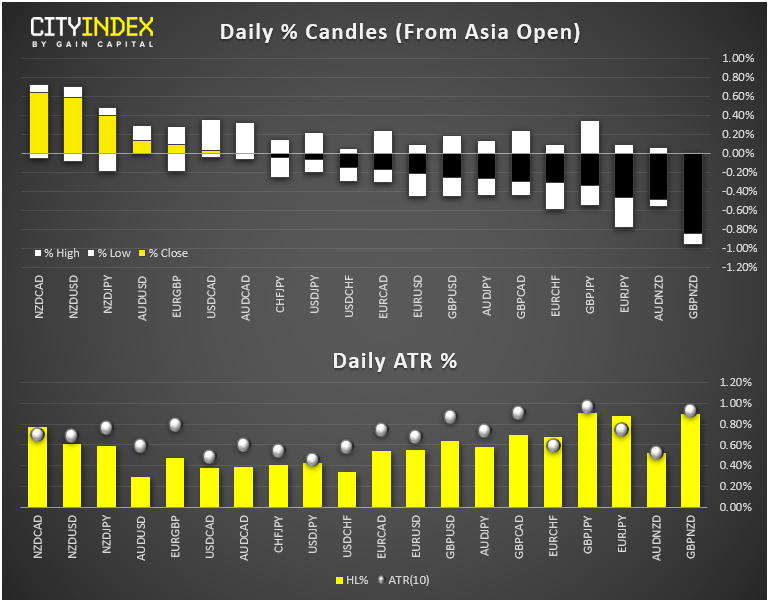

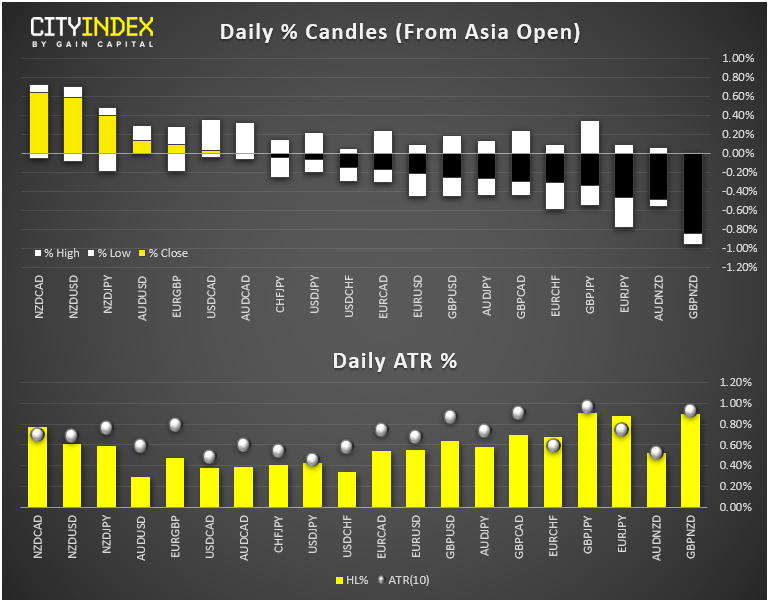

- FX: The pound was the weakest major currency today ahead of the UK’s Supreme Court’s ruling on Parliament’s prorogation tomorrow morning; separately, the EU’s chief Brexit negotiator Michel Barnier said that there was “no basis for a deal.” The New Zealand dollar was the day’s strongest major currency.

- US data: Markit’s Manufacturing and Service PMI figures both came in near 51, signaling slow growth, though the Services employment component did drop into contractionary territory for the first time since 2010.

- Commodities: Both oil and gold gained about 1% on the day.

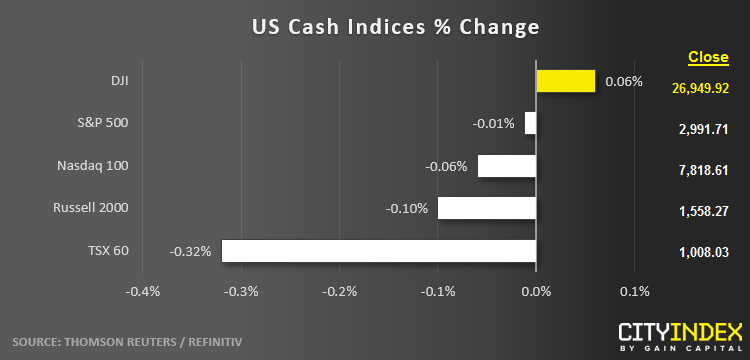

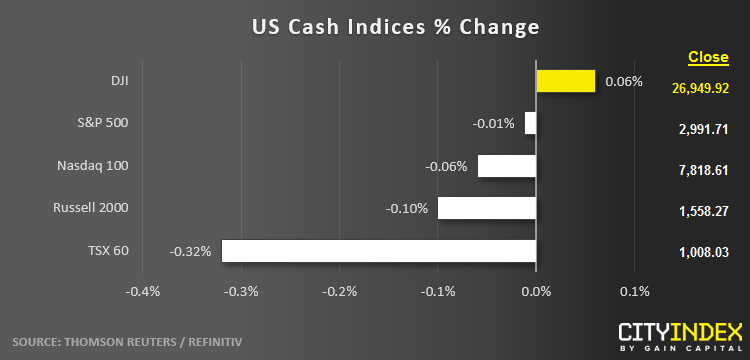

- US indices closed mixed in a generally quiet session as traders awaited new Brexit developments and more clarity in US-China trade tensions.

- Consumer Staples (XLP) were the strongest major sector on the day, while Health Care stocks (XLV) brought up the rear.

- Stocks on the move:

- Embattled online retailer Overstock.com (OSTK) dumped another -25% after the company revised down its guidance for Q3.

- Nike (NKE) gained 1% ahead of tomorrow’s after-the-bell earnings report.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM