- The pound continued to find support from short-covering and bargain hunting as risks of a no-deal Brexit receded after MPs passed a bill designed to stop a no-deal Brexit last night, which is expected to pass through the Lords into law. The cable has broken above the high of the previous week circa $1.2310, providing more reasons for the bears to rush for the exits.

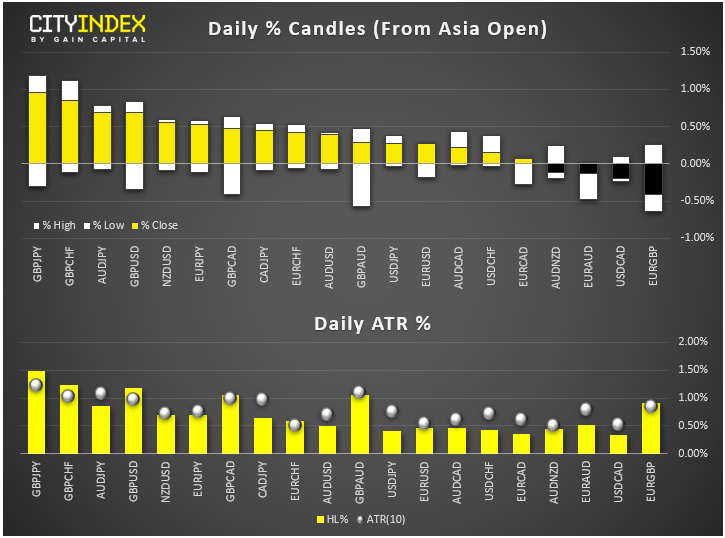

- The EUR/USD showed bullish follow-through on Wednesday and in this first half of Thursday’s session after it had created a reversal stick on the daily the day before in the form of a bullish hammer. It has been supported mainly by odds of a no-deal Brexit receding and US-China trade optimism, as well as weakness in the US dollar, following a poor manufacturing PMI report there. Indeed, Eurozone data hasn’t been too great with German factory orders diving 2.7% in July in the latest sign that the Eurozone’s economic powerhouse may be heading for a recession.

- The Canadian dollar rose further after the BoC was less dovish than expected yesterday.

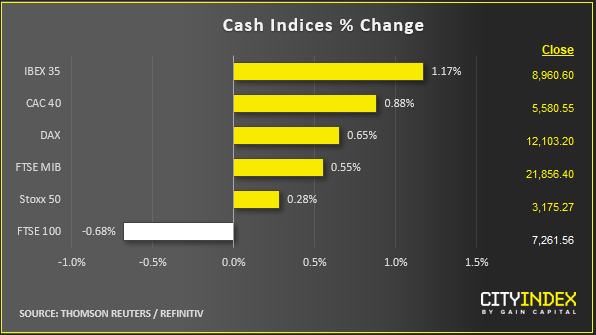

- Stock index futures jumped overnight. Sentiment was given an extra boost on news that US and China will resume trade talks in October. Sentiment had already been lifted by stronger China Service PMI the day before, along with news Hong Kong’s PM was to officially withdraw the extradition treaty.

- Once the European session got underway, however, the indices came off their best levels and the UK’s FTSE turned red on the day and took out the previous day’s low, hurt by a rallying pound. The German DAX showed resilience to euro strength and despite poor German factory data.

Latest market news

Today 08:33 AM

Yesterday 11:48 PM