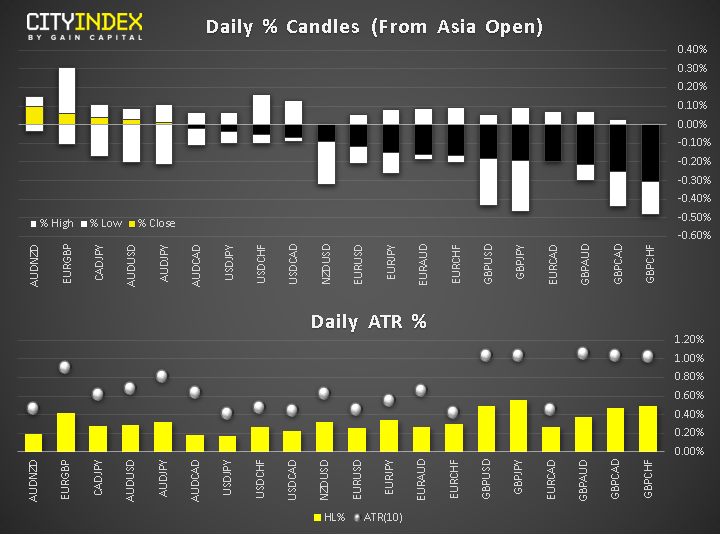

- Market update at 10:45 GMT: In FX, GBP remained the weakest major currency for the second straight day, while AUD and CHF were among the top risers. Stocks ended mixed in Asia, but were higher in Europe following Tuesday’s hiccup – expect the German DAX index. Gold and silver rose while copper and oil prices fell.

- UK inflation was slightly ahead of expectations but this failed to provide an immediate boost for the pound, which remained under pressure following heavy losses the day before amid renewed concerns over a hard Brexit, after Prime Minister Boris Johnson ruled out an extension for the Brexit transition period beyond end 2020. This gives the UK and EU 11 months to try and get a trade deal sorted out, which looks like tall order. Anyway headline UK CPI in Nov: 0.2% m/m as expected while on a y/y/ basis CPI beat at 1.5% vs. 1.4%. Core CPU was 0.2% m/m and 1.7% y/y, both in line with forecasts.

- USD failed to respond to President Donald Trump urging the Fed to use expansionary monetary policy to boost exports.

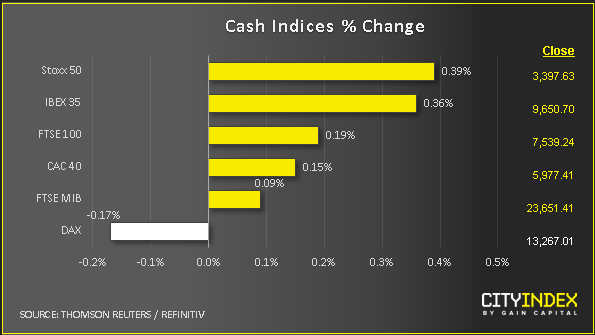

- Stocks rose after Tuesday’s slight falls in Europe. People’s Bank of China injected $29 billion into the financial system. Ratings agencies S&P and Fitch both revised upward their assessment of the UK’s credit outlook following Boris Johnson’s majority win last week. German IFO improved from 95.1 to 96.3, rising to a six-month high. Ifo economist Klaus Wohlrabe said Germany’s industrial sector is still in recession and will take a while to get out of it. But the German economy is heading into 2020 with more confidence.

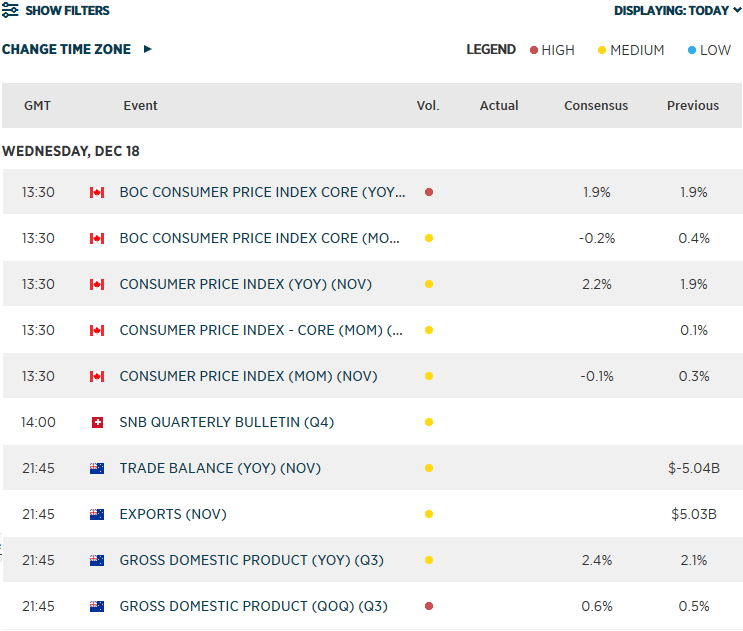

- Coming up:

View our guide on how to interpret the FX Dashboard

(CI) View our guide on how to interpret the FX Dashboard

View our guide on how to interpret the FX Dashboard

(CI) View our guide on how to interpret the FX Dashboard

View our guide on how to interpret the FX Dashboard

(CI) View our guide on how to interpret the FX Dashboard

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM