Market Brief: Parliamentary Pandemonium, Putrid US Manufacturing Data

- A Parliamentary showdown over Brexit drove trade in the FX market today, with the risk of an early election rising as MPs fight to block a no-deal Brexit. See the key Brexit dates we’ll be watching in the weeks to come.

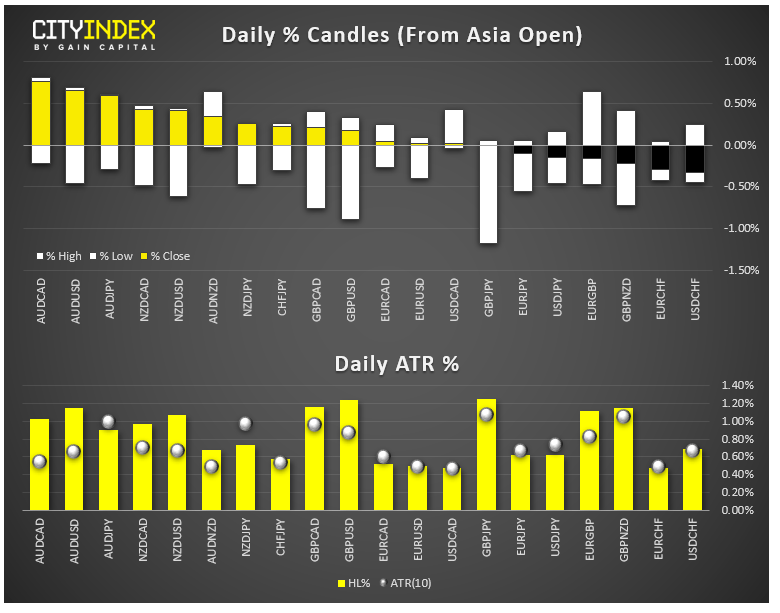

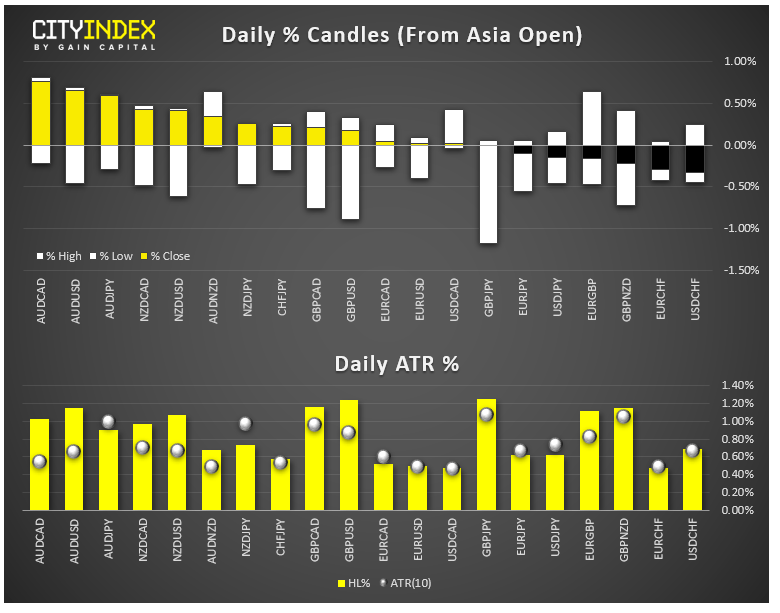

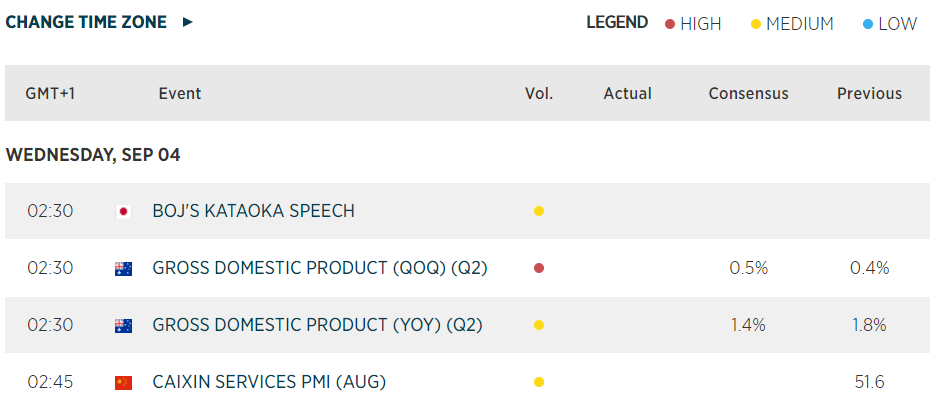

- FX: The aussie was the strongest major currency on the day after the RBA left interest rates unchanged. The loonie brought up the rear as oil prices slumped, taking USD/CAD to 1.3350, its highest level since mid-June (readers should note that the Bank of Canada meets later this week, though an outright cut looks unlikely at present).

- US data: ISM Manufacturing PMI printed weaker-than-expected at 49.1, the first sub-50 reading since early 2016 as US-China trade tensions took a toll.

- Commodities: Gold tacked on 1.5% to test its August highs; Oil (WTI) dropped nearly -2% on the day.

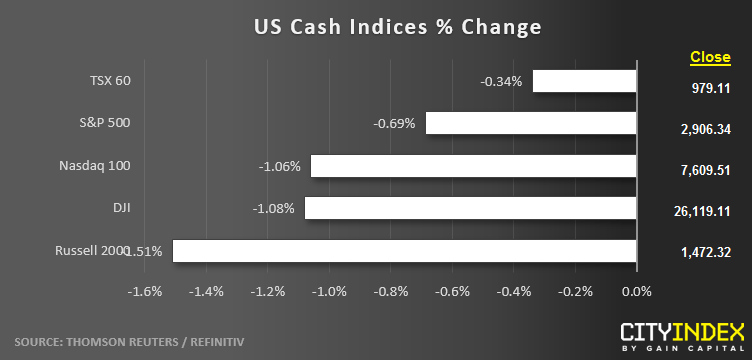

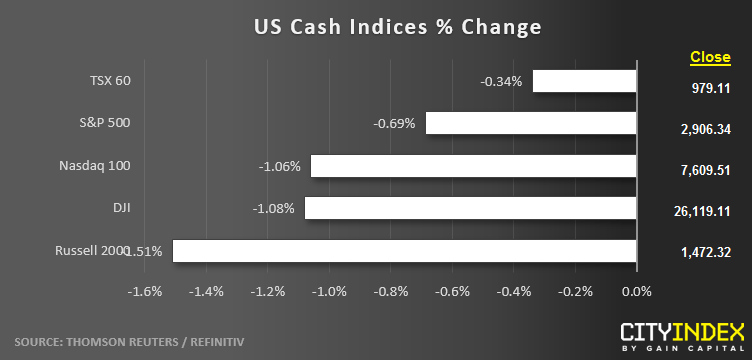

- US indices closed lower by roughly -1% on the first trading day of the month following a long holiday weekend in the US.

- Utilities (XLU) were the strongest major sector on the day, gaining about 1.5%. Industrial stocks (XLI) went from first on Friday to worst today, dropping nearly -1.5%.

- Stocks on the move:

- Chip stocks, which are seen as particularly sensitive to trade tensions, dropped across the board. Among widely-followed stocks, Intel (INTC, -1%), Advanced Micro Devices (AMD, -2%), and Micron (MU, -0%) all dipped.

- Apple (AAPL) shed over -1% as new tariffs hit some products, including the Apple Watch.

- Boeing (BA) lost -3% after a weekend WSJ report suggested the company had encountered further issues with its 737 Max jet.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM