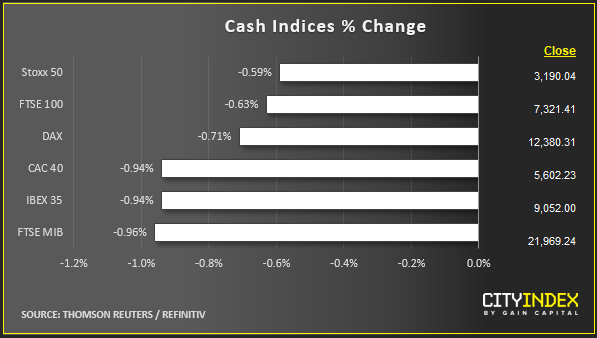

Stock market snapshot as of [16/9/2019 6:31 PM]

- The seriousness of the attacks over the weekend in Saudi Arabia and the impact on global markets should not be underestimated, but on the other hand, they should not be overplayed either. A spectacular surge in oil prices—possibly the biggest ever one-day move—was, perhaps predictably very short-lived. At last check Brent crude oil traded 12% higher, certainly still an eye-catching move, but around half its initial gush. As such, the more important medium-term oil move remains relatively undisturbed and stock markets are having a bad, though not disastrous day. It simply remains to be seen whether market participants will eventually have reason to revise assessment of risks to global markets as higher in the near term

- In the meantime, investors are shifting to markets deemed to be relatively safe, in a move typical of times when global risks are thought to be heightened, giving the developed market bond rally seen over the last few months fresh legs, in synch with rebounds across gold, the yen and to an extent the U.S. dollar

Stocks/sectors on the move

- Aside from underpinned oil company shares, automobile shares are a standout on the downside in the U.S. session, partly on fears related to the cost of petrol

- Overall, a stricken global oil supply is not proving to be positive for the overall market and certainly not for most S&P 500 industrial segments, Energy and Real Estate were the only risers half way through Wall Street trading. The gap between the two moves—up 3% and up 0.7%—says a lot about underlying sentiment. Materials, comprising the segments construction materials, metals & mining, chemicals and containers & packaging led on the downside. Again, a possible rise the price of energy needed for production is in focus

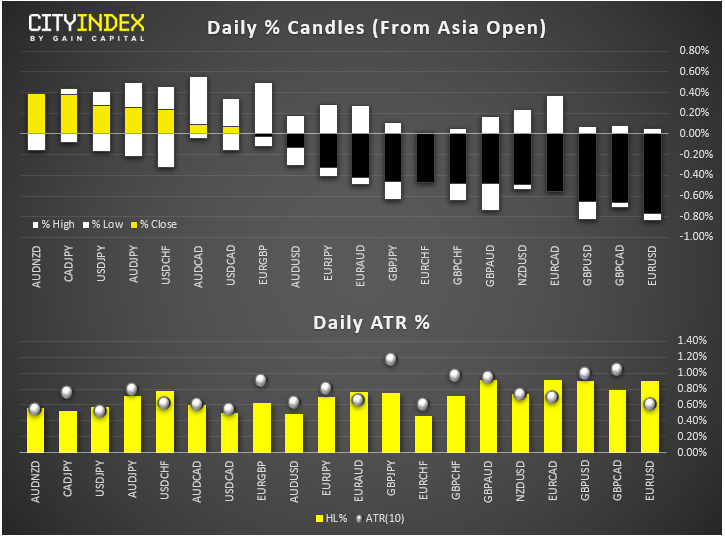

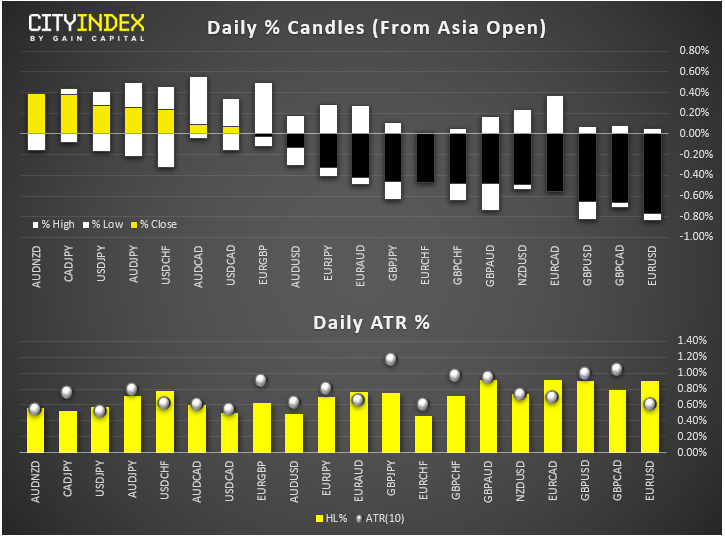

FX snapshot as of [16/9/2019 4:41 PM]

FX markets and gold

- Predictably, the outsize proportion of Canada’s GDP constituted of oil production underpinned the country’s dollar. However, the U.S. dollar was a component of more powerful moves against the euro and sterling. Europe’s troubled growth outlook, Brexit and the dollar’s frequent. Haven characteristics come to mind. Like USD/CAD, USD/NOK is a purer venue to judge the strength of market expectations in light of the ‘oil supply shock’. With Norway’s krone strengthening vs. the dollar, ultimately the U.S. economy is not expected to be a major beneficiary of a volatile oil price leap

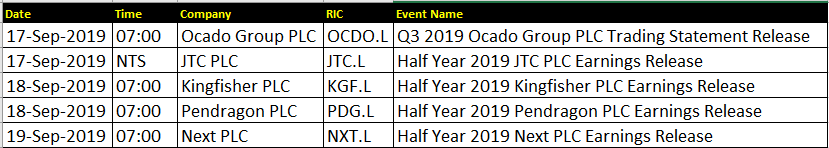

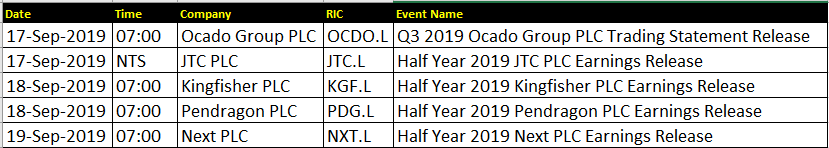

Upcoming corporate highlights

NTS: no time specified

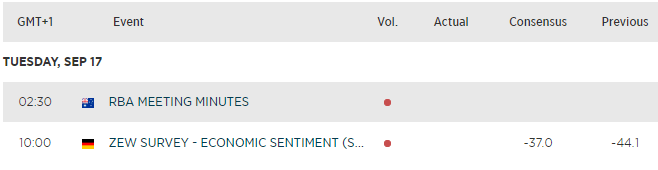

Upcoming economic highlights

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM