Market Brief: Oil Surges 14% on Saudi Oil Strike, FX Impact Limited

- The weekend’s drone strikes on oil refineries in Saudi Arabia dominated markets, with oil prices ultimately finishing the day around 13% higher, its fourth-largest one day rise on record. Tensions in the region remain elevated with US authorities blaming the attack on Iran.

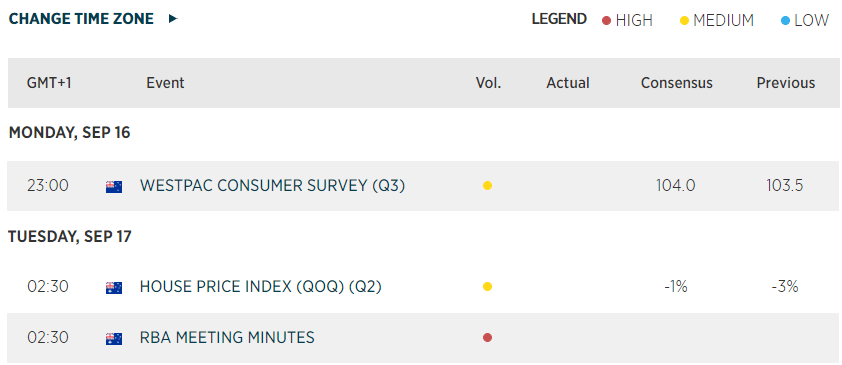

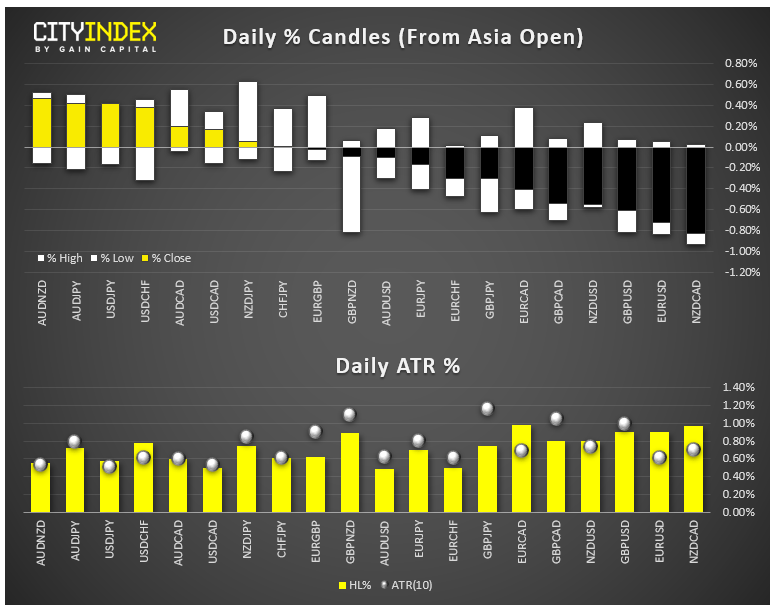

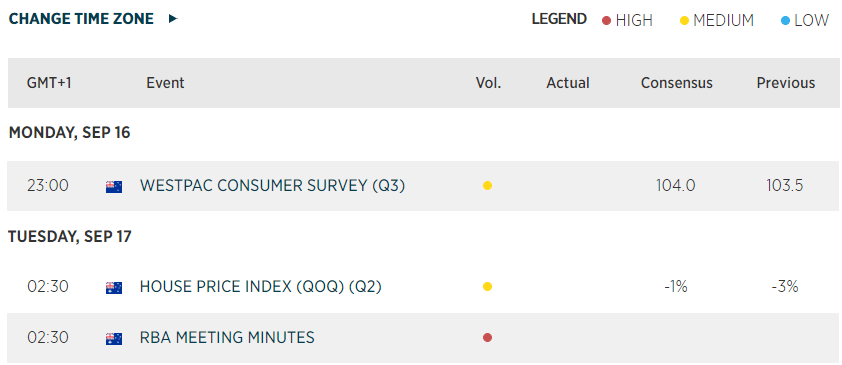

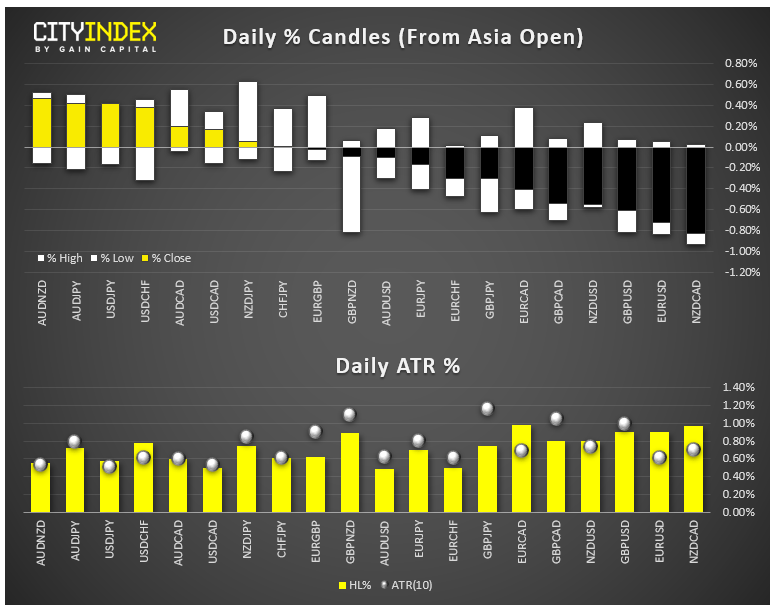

- FX: The oil-sensitive loonie was predictably the strongest major currency today, though it only rose about 0.3% against the greenback. European currencies brought up the rear, with both the euro and pound falling against their rivals.

- Commodities: Gold tacked on about 0.5% in general risk-off trade.

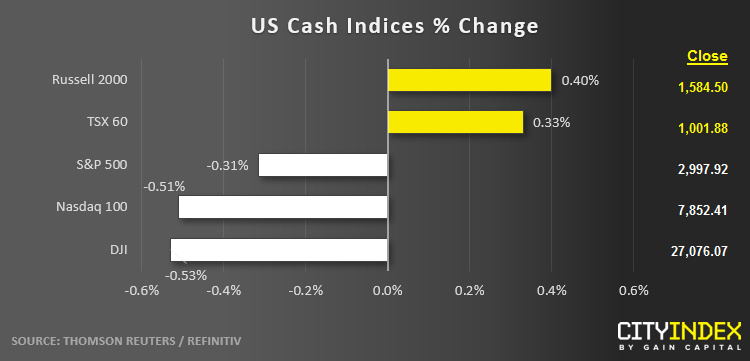

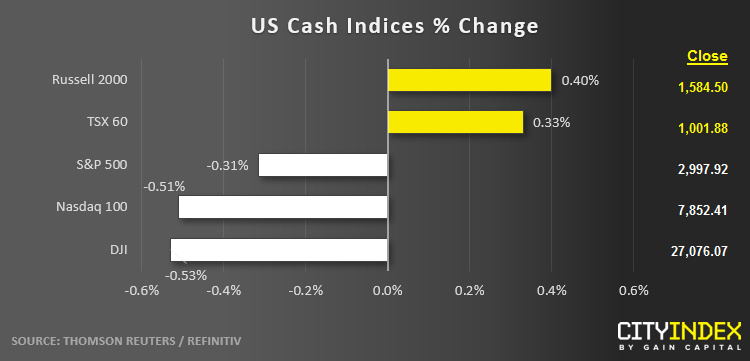

- US indices finished roughly 0.5% lower today, as oil prices represent a key cost for most firms (not to mention the potential impact on consumer spending).

- Energy (XLE) was by far the strongest sector, gaining roughly 4% in its biggest one-day rise this year. Material stocks (XLB) were the weakest sector on the day.

- Stocks on the move:

- Oil companies were big beneficiaries of the surge in oil prices, with megacaps Exxon Mobile (XOM, +1%) and Chevron (CVX, +2%) both bucking the bearish trend in broader markets.

- General Motors (GM) dropped -4% after 50k UAW workers began a potentially long strike.

- Overstock.com (OSTK) fell another -21% to unwind about half of the short squeeze that was driving the troubled retailer in the first half of the month.