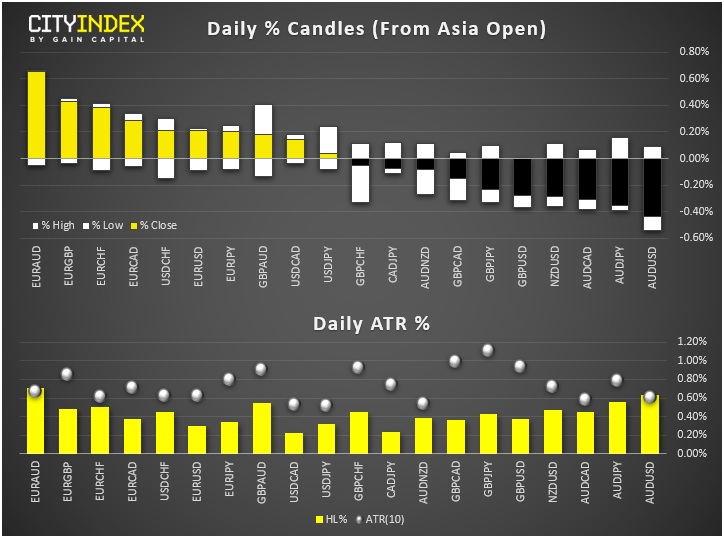

- At midday in London, the EUR was the strongest and AUD the weakest.

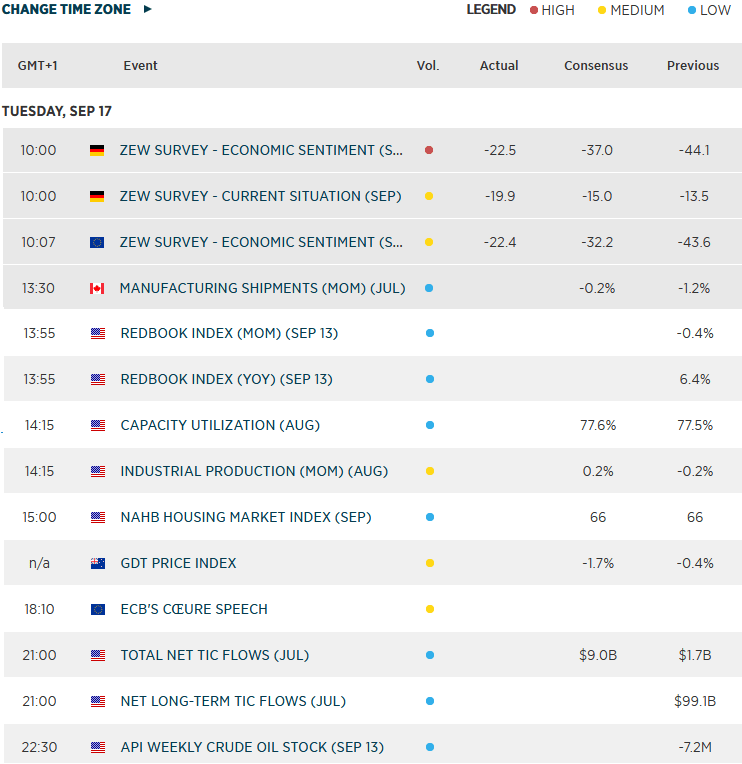

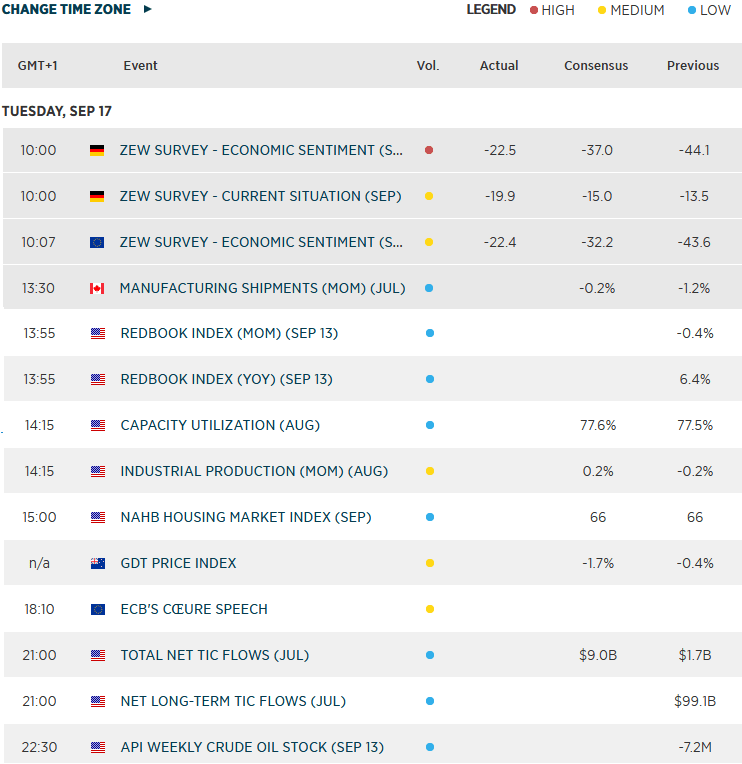

- EUR found support as German ZEW economic sentiment survey improved to -22.5 from -44.1, beating expectations of -38.0. AUD was weighed down by dovish RBA minutes, while NZD struggled as NZ consumer confidence slipped for a third consecutive quarter, to its lowest since Q3 2012. GBP edged lower as judges convened at the Supreme Court to decide whether U.K. Prime Minister Boris Johnson’s decision to suspend Parliament was lawful - keep an eye on any breaking news on our twitter handle.

- Oil prices remained volatile, initially rising before turning flat. Market participants are still weighing up the implications of the weekend’s attacks on Saudi Arabia’s oil infrastructure. It remains unclear how long it will take Saudi to restore output after half of the nation’s daily crude production went offline due to the attacks. US President Donald Trump, who said the US has reached a trade deal with Japan, reiterated that the US could release oil from their reserves. Separately, Japan’s Industry Minister released a statement, saying they’ll consider a coordinated release of oil reserves if it’s required.

- Gold fell back below $1.5K as investors look ahead to the FOMC announcement tomorrow.

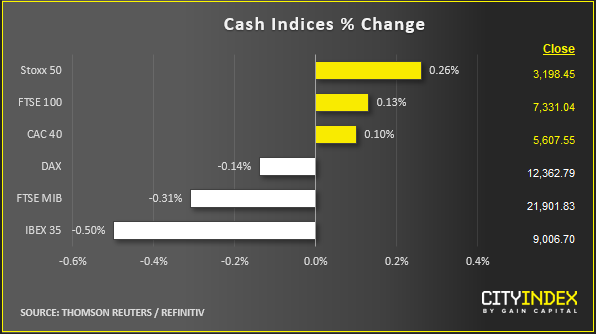

- Europe’s major stock indices turned mixed after a weaker open, as investors looked ahead to this week’s central bank meetings where the Fed is expected to cut rates by 25 basis points. Energy stocks such as Shell and BP propelled the FTSE to the positive territory thanks to elevated oil prices, although the biggest risers were IT firm Aveva and drug maker AstraZeneca.

- WeWork postponed its IPO after struggling to attract investor interest in what would have been a multibillion-dollar listing for the property group.

- Ocado shares rose 1% on Q3 earnings, the first to include its new joint-venture with Marks & Spencer

Latest market news

Today 07:55 AM

Today 04:47 AM

Yesterday 11:23 PM

Yesterday 10:19 PM

Yesterday 08:00 PM