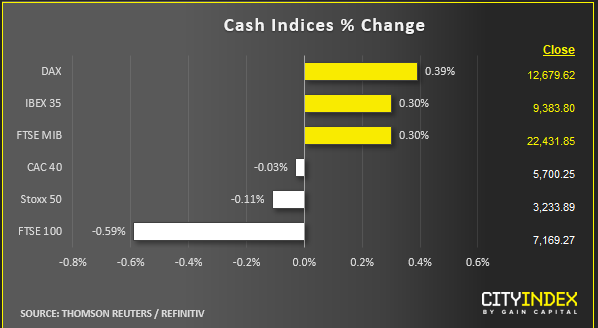

Stock market snapshot as of [16/10/2019 3:59 PM]

- Rising gilts and USTs in above average volumes are a sure enough sign that regardless of still fairly elevated sterling, safety seekers are not sparing much expense as the UK and the EU head into a crunch summit with no deal in sight. Bunds reacted to a report that Angela Merkel’s CDU was considering softening its fiscal policy stance, joining the developed market fixed income rally

- Italy’s 10-year BTP’s spread to benchmark bunds also tightened, with a little help from the government approving draft 2020 budget plans

- European equities moved sideways-to-lower, one part moved by a surprisingly smooth start to the earnings season here, another part fixated by Brexit drama

- Elsewhere, the U.S.’s trade ‘handshake’ with China continues to show worrying signs of unravelling, as Beijing keeps being handed fresh reasons not to comply; the latest being an unfortunately timed move by Congress to remove Hong Kong’s special trade status if China is deemed not to have respected human rights during protests. Note U.S. lawmakers have yet to pass the bill. China vows “strong measures” if they do

- A shock negative U.S. retail sales report has been another reason why this week’s risk bulls are beginning to hesitate

Stocks/sectors on the move

- Bank of America posted a near-stellar set of earnings, despite the impact of a $1.6bn charge that took some of the shine off its Q3 results. Stronger than expected advisory fee revenues and a big surprise in trading that trumped Wall Street rivals helped lift EPS well above forecasts. The shares traded 2.5% higher at last look

- Roche was among the giant names to report in Europe, though its stock fell 2% even after a solid quarterly report and raised outlook for Q3. An early morning TV interview of the pharma group’s Severin Schwann failed to convince investors that the deal’s bid to buy a smaller rival Spark Therapeutics would clear regulatory hurdles in the current quarter, though Schwann said he still expected the deal to close by year end

- Miners were among the worst performing sectors in Europe. Iron ore extends losses, and then there’s the China news.

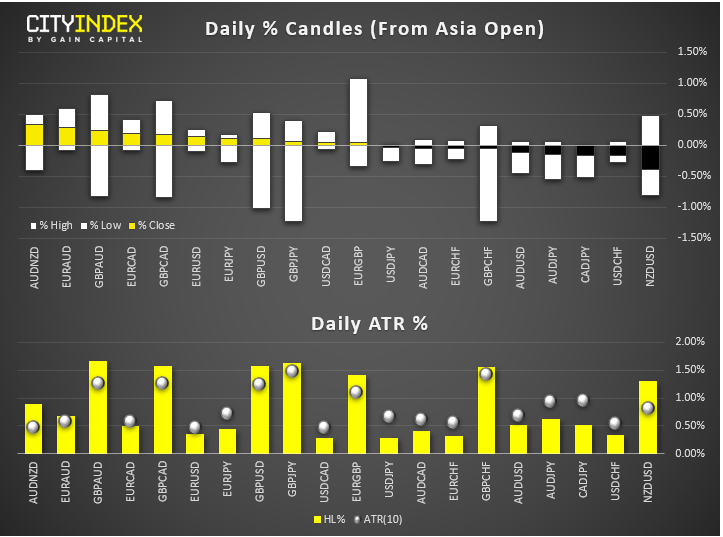

FX snapshot as of [16/10/2019 4:00 PM]

FX markets

- Lopsided interest in the pound again, which incidentally shrugged off inflation data which held below the BOE’s target. GBP/AUD volatility stands out, though sterling’s concession vs. euro, is telling, given signs that German fiscal easing may be on the cards

- EUR/USD reversed a trip up to 1.1060 to trade flat. A euro break out against the Kiwi of all currencies backed the impression that underlying single currency strength is simmering

- NOK underperformed G-10 peers; the Canadian dollar also looked listless; both may partly reflect crude futures’ drift sideways in slight negative territory

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM