Market Brief: New Week, New Record Highs for US Indices

View our guide on how to interpret the FX Dashboard.

- Economic Adviser Kudlow reported that the “Phase One” trade deal between the US and China will be signed in Washington in early January. While the agreement still hasn’t been formalized, the reduction in tariffs was enough to support risk assets again today.

- US data: The Markit PMI surveys came in around 52, roughly in-line with expectations and consistent with 1.5% GDP growth. The NAHB Housing Market Index surged to a 20-year high of 76, painting a bullish picture for the housing market heading into 2020.

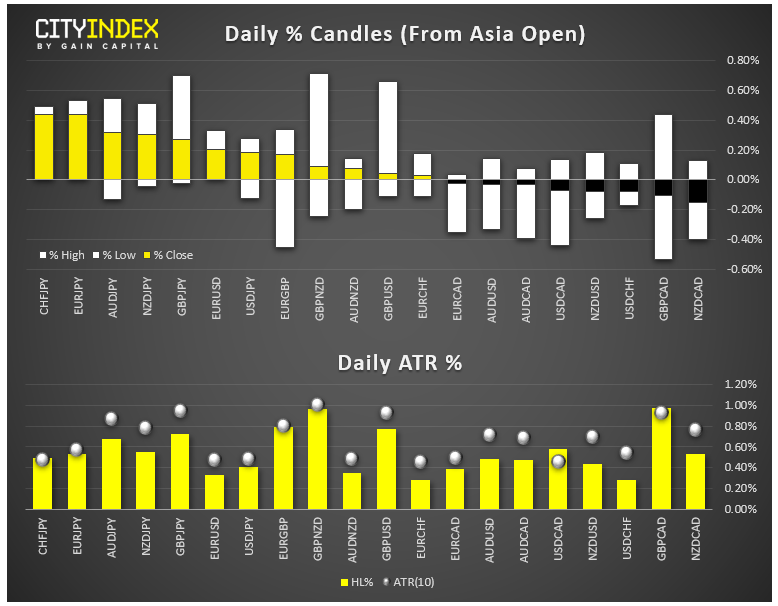

- FX: The euro was the strongest major currency, with the safe haven Japanese yen seeing the worst performance on the day. We’re also keeping a close eye on USD/SEK after last week’s Riksbank meeting.

- Commodities: Oil ticked higher in quiet trade (see some longer-term factors that could drive crude’s price) while oil was essentially flat. Bitcoin slipped below the $7k level for the first time this month.

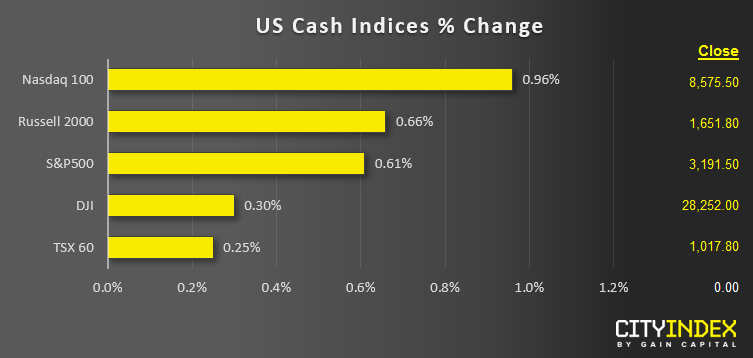

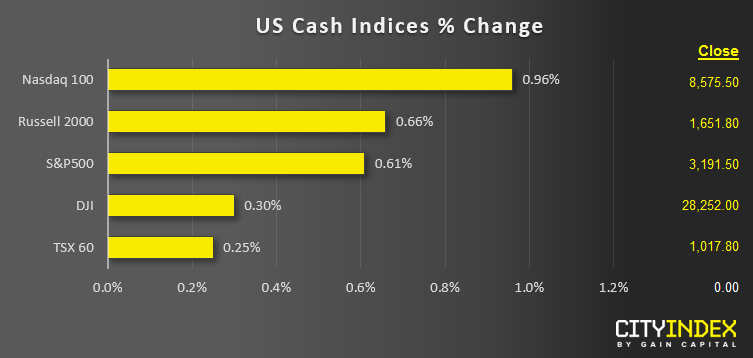

- US indices closed between 0.5% and 1.0% higher across the board on lingering good vibes from last week’s Phase One trade deal.

- Energy (XLE) was the strongest sector on the day, while Industrials (XLI) were the weakest. All eleven major sectors gained ground today.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM