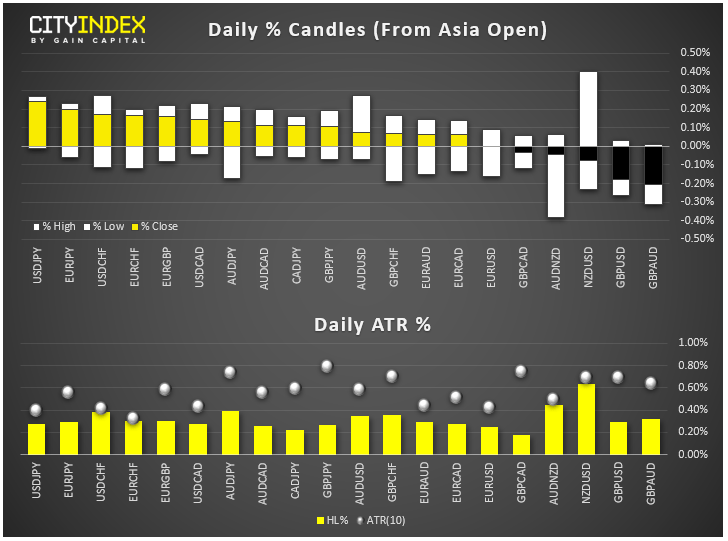

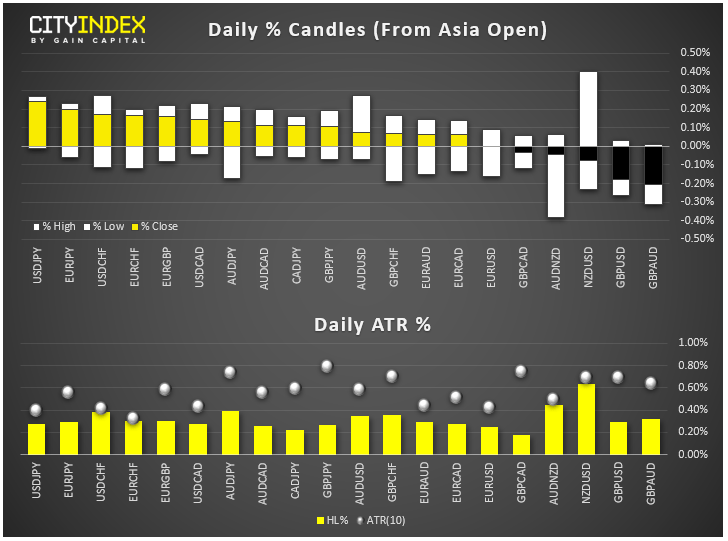

View our guide on how to interpret the FX Dashboard

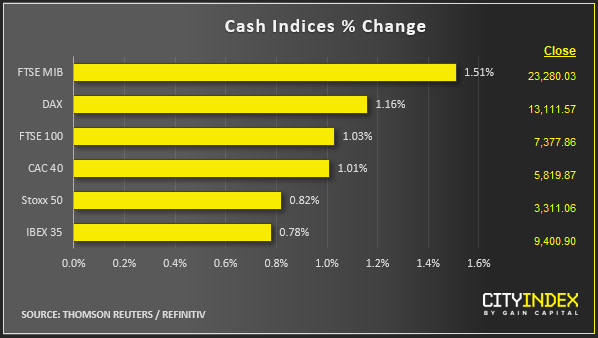

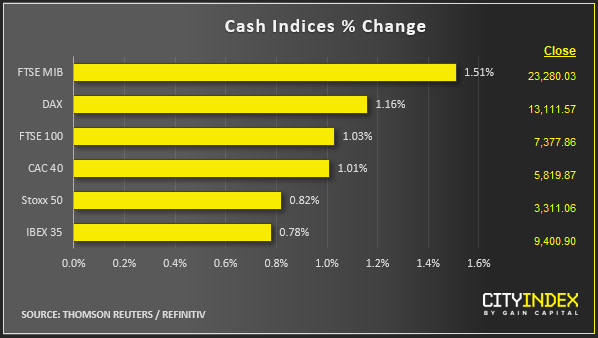

- Markets update: Risk-ON at start of the new week so far, with European stocks, US index futures and crude oil all rallying, while in FX safe-haven yen was falling and risk-sensitive Aussie and kiwi dollars rising. Sentiment has remained supported by positive signals around US-China trade negotiations, while concerns over an economic slowdown have eased following the release of some above-forecast macro data of late. But will the optimism carry on once Wall Street opens for trading?

View our guide on how to interpret the FX Dashboard

- USD/JPY, supported by risk-on rally, was approaching the pivotal 109.50 level as US investors slowly made their way to their trading desks. The EUR/USD was flat, with the euro on the one hand undermined by weakness in Spanish flash manufacturing PMI, while on the other hand it was helped by upward revisions for German, French and Eurozone final PMIs.

- The Sentix Investor Confidence, a barometer of investor sentiment towards the Eurozone economy, improved sharply to -4.5 from -16.8. However, as the latest reading remained below zero again, which meant that investors still remained pessimistic. However, despite the still negative investor sentiment, European equities remained in the rally mode, with major indices breaking to fresh highs with solid gains. Wall Street futures pointed to another record high for the S&P and Nasdaq.

- Stocks in focus by colleague Ken Odeluga:

- Under Armour plunges 15% in early deals ahead of Wall Street's open on an accounting probe, eclipsing the sporting goods company's Q3 report

- Uber reports after the U.S. market close, with another quarter of huge losses expected though revenues are forecast to rise 15% to $3.5bn

- McDonalds is also in the spotlight after CEO Steve Easterbrook's abrupt resignation following what the company called a "recent consensual" relationship with an employee that violated company policy. The stock traded about 2% lower in the pre-market

- Ryanair beat Q2 revenue forecasts, lifting the stock $6.66 by mid-morning. An 18% rise in sales of 'add-ons', known as ancillary services, propelled overall sales above expectations

- Saudi Aramco, the Kingdom's massive state oil company, finally started its initial public offering (IPO) on Sunday, when it announced its intention to float on the domestic bourse. This could be the world's biggest listing, as Saudi Arabia seeks to diversify its economy away from crude oil.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM