- US and China are to resume in person trade talks in September, after Trump said discussion were already on the way later today. On Sunday, the US is set to collect a further 15% on Chinese imports worth over $125 billion.

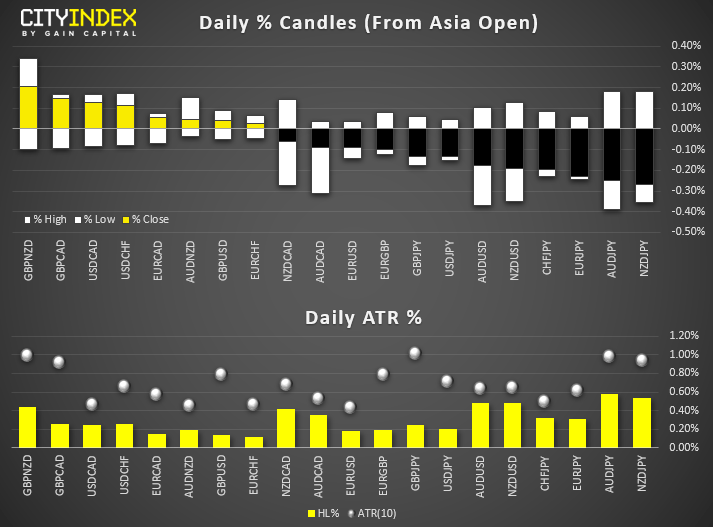

- Whilst this provided a slight tailwind for equities, currency markets were less convinced. AUD and NZD trading firmly lower and are today’s weakest majors (JPY and UD are the strongest). Still, NZD is still reeling form yesterday’s dire business confidence reads, and AUD is under the added pressure of weaker building approvals and housing credit. And looking tariffs which kick on Sunday, along with lower iron ore prices for AUD are also piling on the pressure.

- Mixed data from Japan saw industrial production rebound and retail sales slump. Production rose 1.3% in July (although is -1% % YoY) with expectations for the next 1-2 months at 2.7% and 0.6% respectively, despite concerns over the trade war. Whilst this is good for the business sector, retail sales slumped by 2.5% (fastest contraction since November 2015) to take the YoY rate to -2%. Unemployment fell to 2.2%, its lowest rate since August 1992.

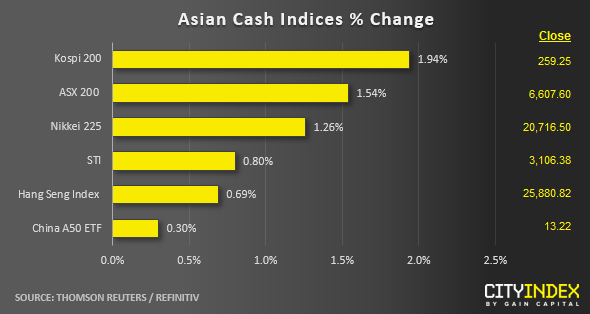

- Asian stock indices have continued to recoup last week’s losses on the theme of “U.S/China trade deal optimism’” where China’s commerce ministry commented yesterday that a Sep meeting was being discussed but added it was important for Washington to cancel a tariff increase. A new round of U.S. tariffs, 15% on US$550 billion worth of Chinese goods is scheduled to take effect on this Sun.

- The best performers are Kospi 200, ASX 200 and Nikkei 225 which have gained by more than 1.00% as at today’s Asian mid-session.

- Interestingly, China A50 has underperformed against the rest where it has inched up only by 0.30%. A firm USD/CNH could be the reason that prevent traders from taking aggressive long positions. The USD/CNH (offshore yuan) has started to recoup yesterday’s losses where it rebounded by 196 pips at the 7.1400/1300 key short-term support to print a current intraday high of 7.1602 in today’s Asia session.

- Hong Kong’s Hang Seng Index’s gains have been lacklustre due to on-going localised social unrest. It has been reported that local police have arrested three prominent protest leaders ahead of planned mass demonstrations this weekend. Key property developer stocks underperformed where Sun Hung Kai Properties, Swire Pacific and CK Assets have traded down by -2.65%, -1.22% and -1.28% respectively.

Up Next

- Hong Kong Retail Sales for Jul out later today at 0830 GMT. Data for Jun came in at -7.6% y/y/ where another round of weak data for Jul is likely to reinforce a technical recession in Q3 for Hong Kong. Q2 GDP came in at -0.4% q/q.

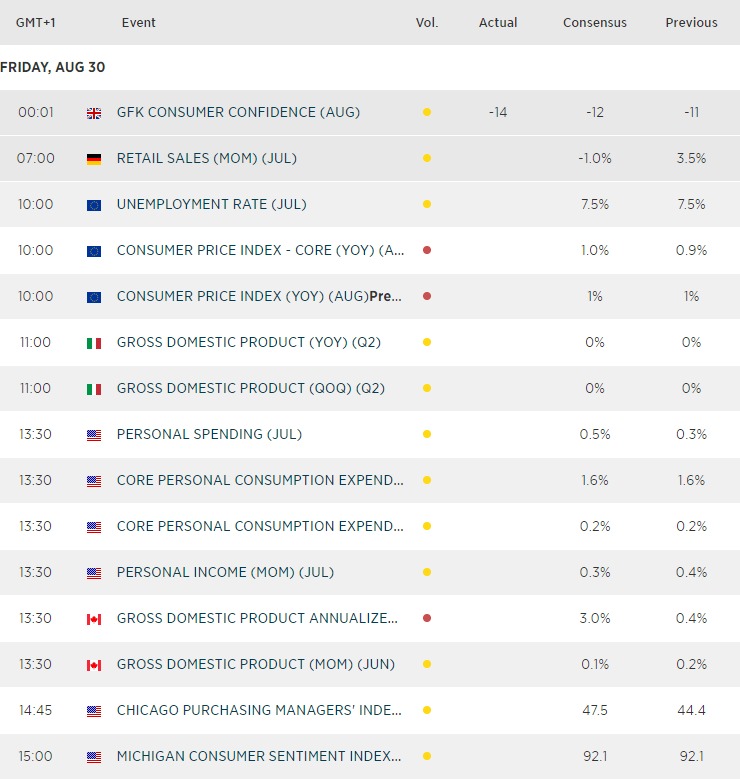

- Canadian GDP is expected to rebound from 0.4% YoY to 3%. Whilst data overall continues to favour BoC not easing, a miss for GDP later today could rattle CAD crosses. However, hittig or exceeding expectations could provide a tailwind for their stock index (TSX 60) which appears to the first of the major indices to break higher form its range.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM