View our guide on how to interpret the FX Dashboard

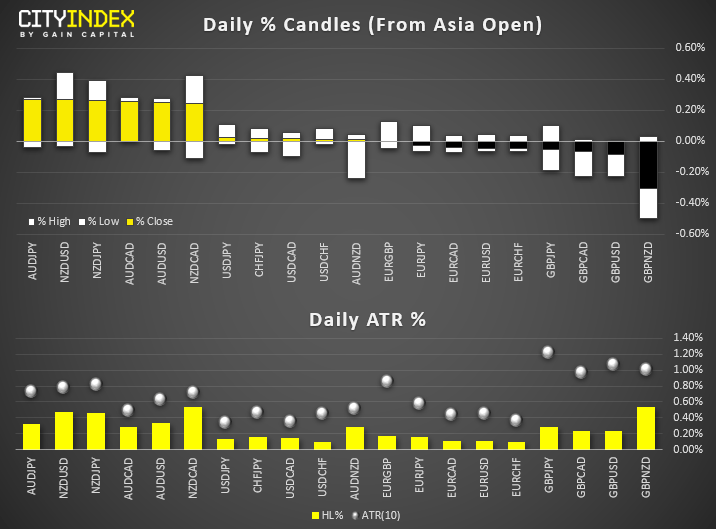

- NZD spiked lower on comments from New Zealand’s Treasury that they suspect S&P may remove their positive ratings outlook. Still, it currently trades just off a 2-day high.

- US Treasury are considering whether to further delay tariffs on $34 billion in Chinese goods, allowing USD to remain supported on trade optimism.

- DXY (US dollar index) trades in a narrow range and within yesterday’s bearish candle, AUD/USD hit s 3-day high and USD/JPY briefly touched an intraday 3-month high.

- AUD and NZD are the strongest majors. All pairs remain well within their typical daily ranges, with the overall average daily range at just 39% of its 10-day ATR.

Equity Brief:

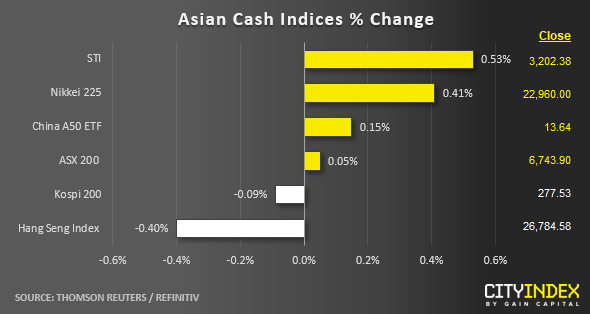

- Most Asian stock markets have continued to extend their gains in place since last week reinforced by the increased possibility of a “Phase 1 U.S-China trade deal” being signed off by mid Nov when President Trump meets his counterpart, China’s Xi at the APEC Summit on 16-17 Nov. In addition, key U.S. benchmark stock indices; the S&P 500 and Nasdaq 100 have also broken new record highs.

- Singapore’s Strait Times Index (STI) has continued to rally for a 3rd consecutive session after a public holiday break yesterday, it is upped by 0.53% as at today’s Asian mid-session ahead of the big three banks Q3 earnings releases with UOB out on Fri, 01 Nov follow by OCBC on 05 Nov and lastly, DBS on 11 Nov.

- The current up move of the STI has hit a 3 -month high of 3227 on an intraday basis led by Jardine Matheson Holdings and Jardine Strategic Holdings that has rallied by 2.5% and 1.7% respectively.

- Hong Kong’s Hang Seng Index has continued to underperform, down by -0.40% after its failure to breach above the 27000 psychological level. Banks and heaving weight component stocks are the main drag where HSBC and Hang Seng Bank have declined by -1.66% and -1.57% respectively. Asia largest technology firm, Tencent which is also the 2nd largest component stock in the HSI has shed -1.49% to print an intraday low of 317.00, a whisker away from a major support level of 316.80.

- In addition, a Hong Kong key official, Financial Secretary Paul Chan has written a blog post that has highlighted the 4-month long street protests have caused Hong Kong to enter into a technical recession; Hong Kong will announce its Q3 GDP data on Thurs, 31 Oct.

Up Next

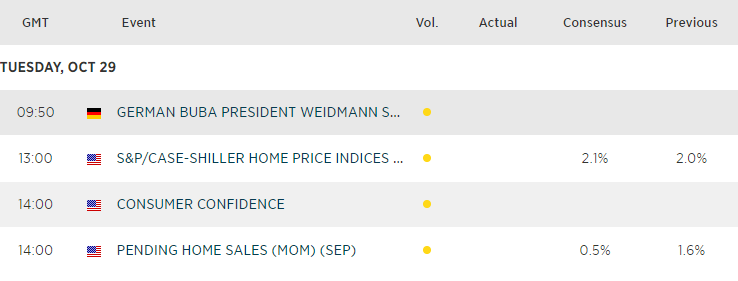

- UK parliament are set to vote again on Boris Johnson’s proposed Dec 12th election, GBP crosses will be the main focus.

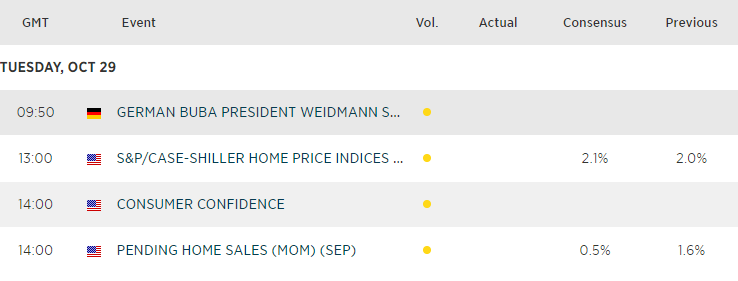

- Quiet in terms of economic data, so ranges may be limited without a catalyst.

- RBA's Governor Philip Lowe is due to speak at 6:45am GMT

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM