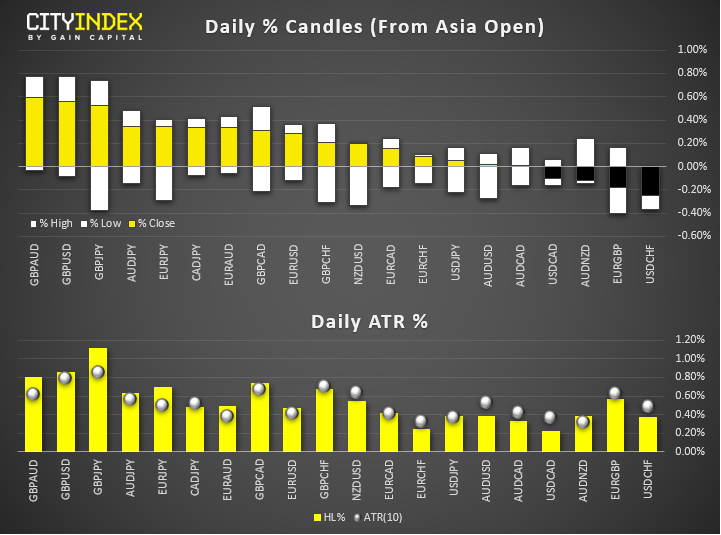

- Market update at 12:07 GMT: In FX, GBP and EUR were the strongest while USD and AUD were the weakest among the majors; stocks were lower but off their worst levels; gold and silver were sharply higher, and crude oil was off its best level after gapping higher at the open.

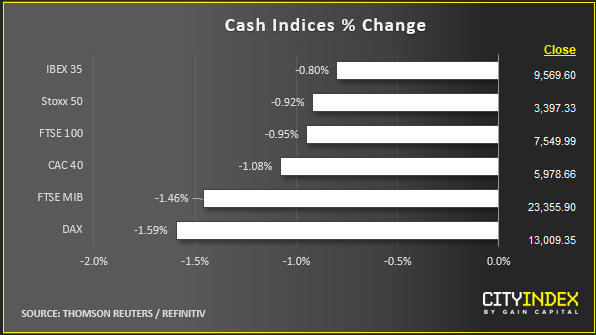

- Today marks the start of the first full week of 2020, with more market participants coming back as the festive period ends. The new year has started with a bang in so far volatility is concerned. This is mainly due to the escalation of tensions between the US and Iran after Tump ordered the assassination of Iranian military commander Qasem Soleimani, who was killed by a drone strike in Iraq on Friday. Iran has promised "severe revenge" for the death of Soleimani and has already pulled back from the 2015 nuclear accord. The markets have reacted with crude oil spiking on concerns over further supply disruptions in the Middle East, while gold has soared past its 2019 high on raised safe-haven demand. Stocks have fallen sharply, although the downside has been limited due to expectations that the raised tensions will have minimal impact on global growth.

View our guide on how to interpret the FX Dashboard

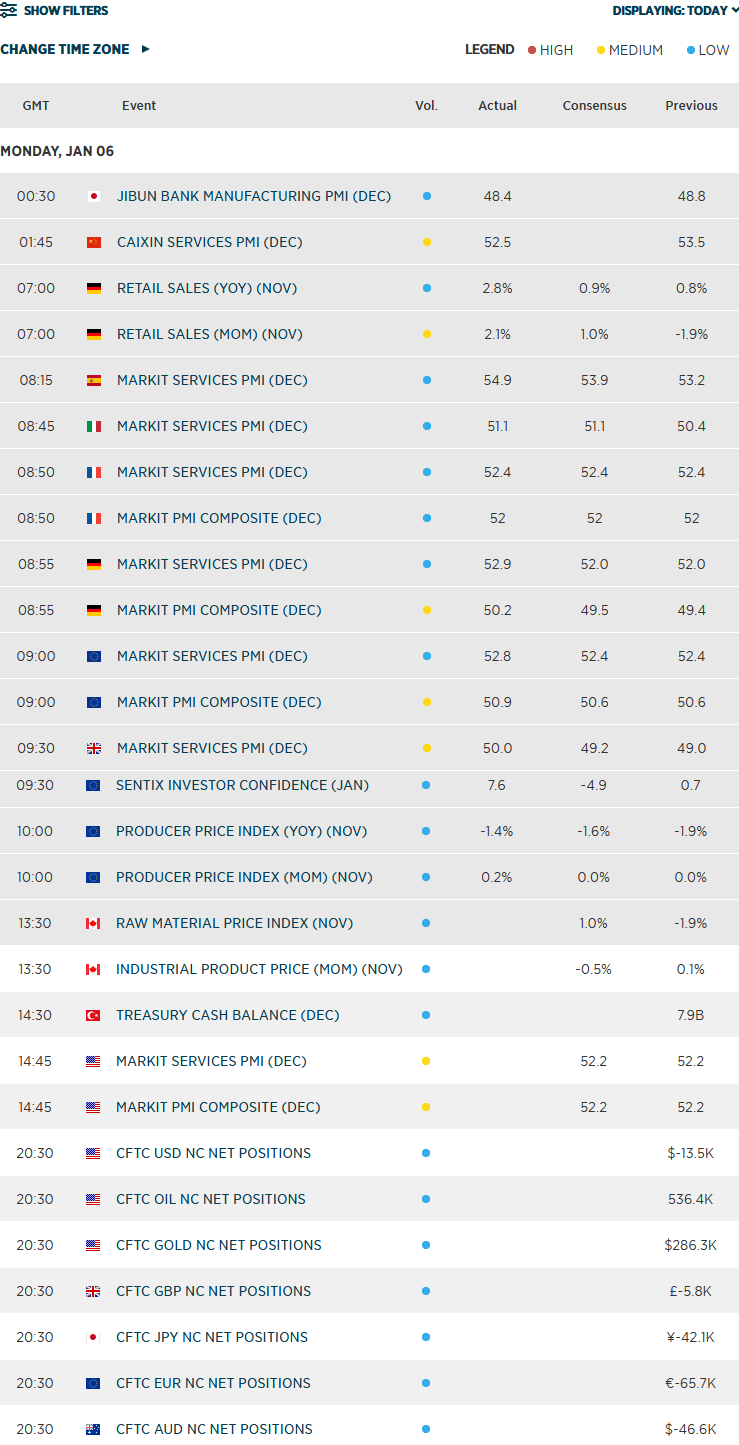

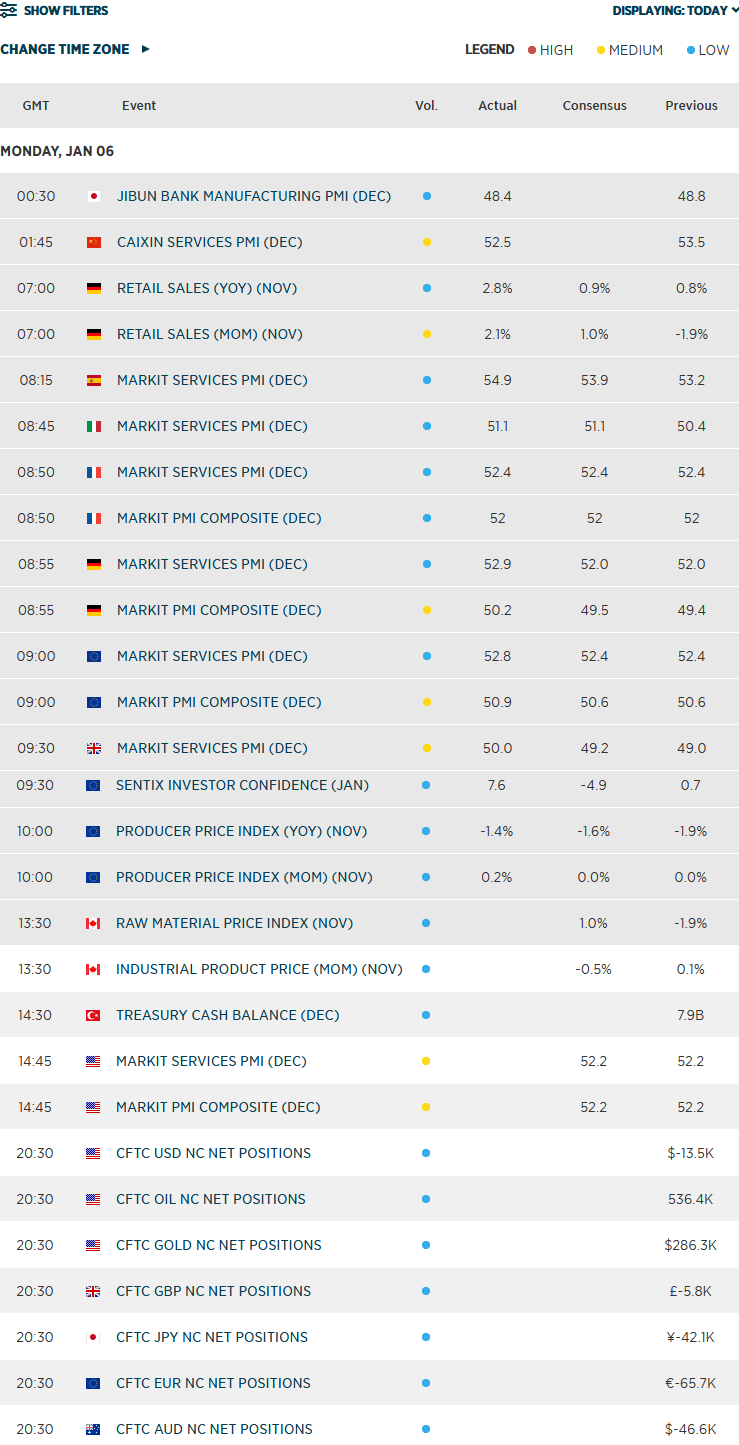

- EUR higher as this morning’s Eurozone data surprised with the latest services PMIs and a survey of investor confidence topping expectations. Eurozone final services PMI came in at 52.8 vs. 52.4 expected and last. German PMI was revised nearly 1 whole point higher to 52.9, while flash PMIs form Italy and Spain both came in higher at 51.1 and 54.9. Sentix Investor Confidence printed 7.6 vs, 0.7 last and 3.0 expected.

- GBP rose as UK’s final services PMI came in at 50.0, one whole point better than the initial estimate of 49.0, which easily beat expectations of 49.1.

- Coming up:

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM