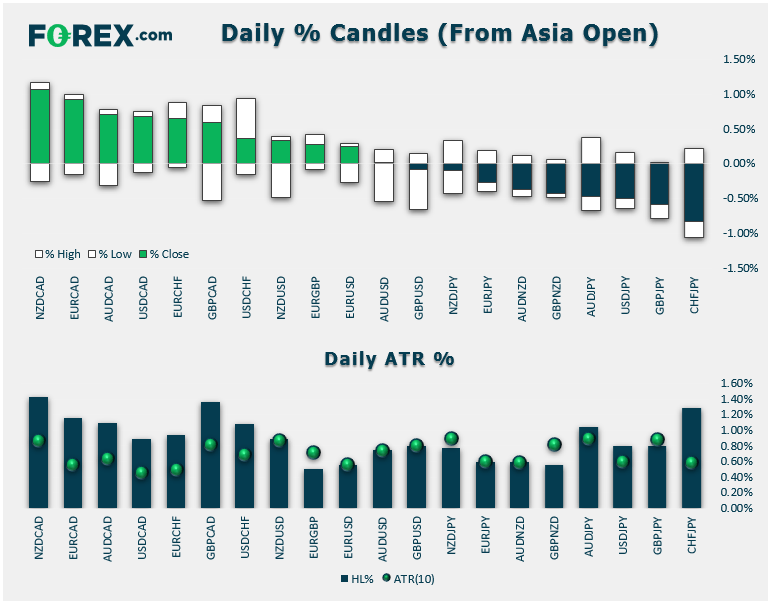

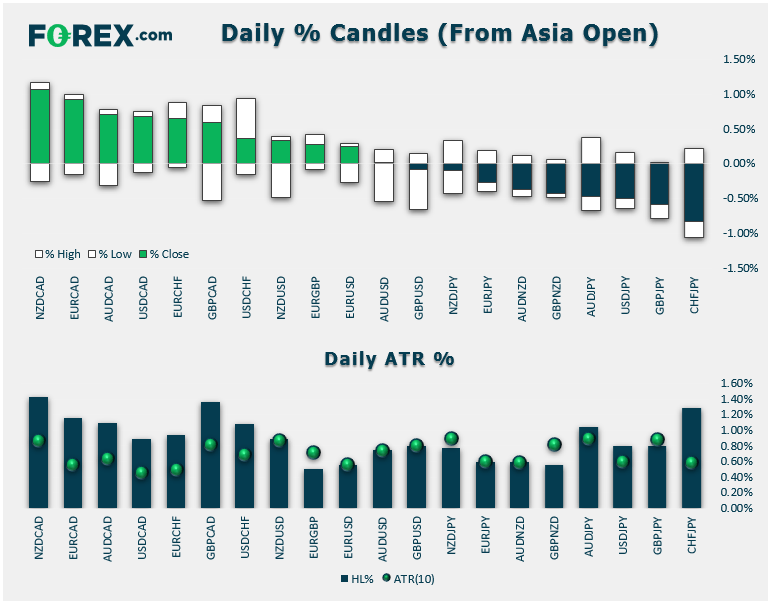

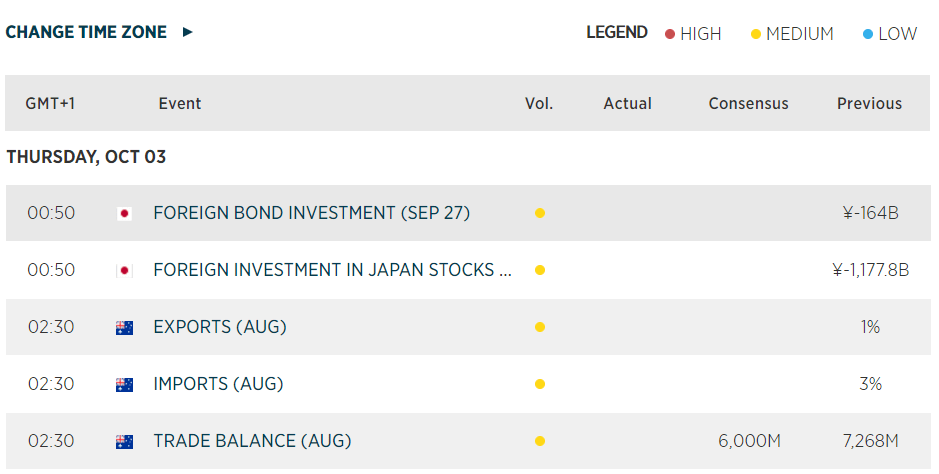

- FX: The safe haven Japanese yen was the strongest major currency on the day, while the oil-sensitive loonie fell the most, reaching a 1-month low against the US dollar. Meanwhile, AUD/USD continues to probe its lowest levels since the Great Financial Crisis.

- US data: The September ADP Employment report printed at 135k vs. 140k eyed, though there were substantial negative revisions to the previous month’s report.

- Commodities: Gold gained 1% while oil slumped -2% in its ninth consecutive loss as oil inventories rose by more than expected.

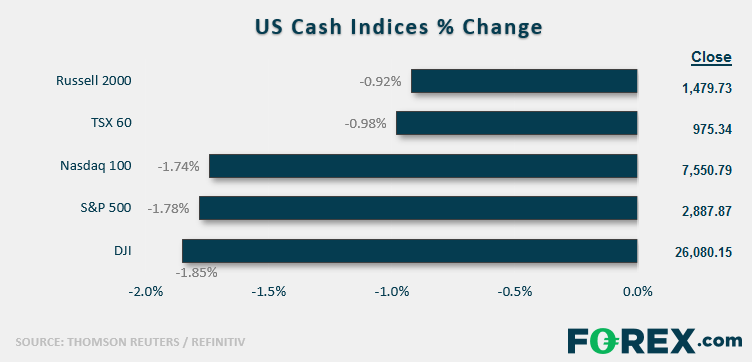

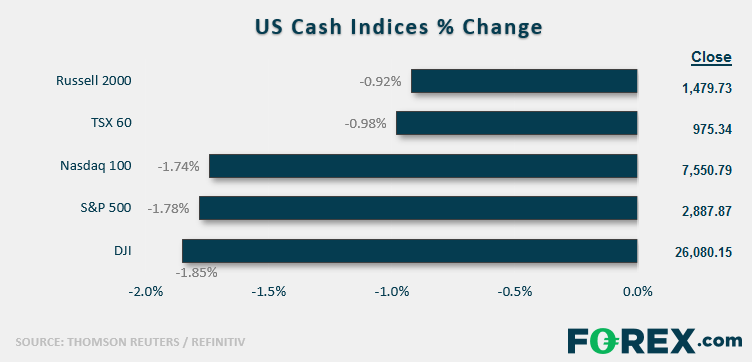

- US indices closed sharply lower on the day, marking the worst 2-day start to a quarter since 2008 (see here for more)

- All sectors fell on the day, with REITs (XLRE) falling the least and Energy stocks (XLE) losing the most ground.

- Stocks on the move:

- Online brokers extended yesterday’s drop as TD Ameritrade (TD, -3%) followed Charles Schwab (SCHW, -3%) in cutting commissions for online trades to $0. All eyes now turn to E-Trade (ETFC, -4%)

- Ford (F, -3%) and General Motors (GM, -4%) both fell after reporting weak quarterly auto sales figures.

- Johnson and Johnson bucked the broader selling trend to gain 2% after the company cut a deal to avoid a trial over its involvement in the opioid epidemic.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM