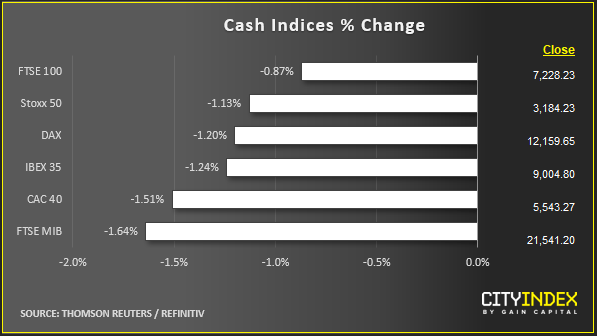

Stock market snapshot as of [25/9/2019 1:01 PM]

- Britain’s House of Commons has resumed in an atmosphere of rancour following the UK Supreme Court’s ruling that Prime Minister Boris Johnson’s decision to suspend Parliament “was unlawful”. It’s emerged that BoJo will attend the Commons to face the music after all, though he was not there at the time of writing and Downing Street has only stated that he’ll address Parliament in the afternoon, following a hasty return from a UN meeting in New York. In the meantime, it’s been left to Attorney General Geoffrey Cox to serve as lightning rod for MP's anger. Cox himself has faced demands for his resignation, as Johnson will later. Cox brushed those off whilst noting that the government will “respect the judgement of the court”, signalling that speculated ‘unconventional’ manoeuvres by the government that could end with another Commons suspension soon, are off the cards. But the Attorney General didn’t rule out another suspension entirely. Sterling has drifted off lows against the euro but looks far less moored vs. the greenback and the yen. A shift to UK safe havens sees government gilt yields shift lower across the curve whilst the FTSE 100 trades about 1% lower

- Across the Atlantic, U.S. Democrats’ have taken rather longer to take the law to their own country’s leader. So it’s perhaps little wonder that it took risk-sensitive assets half a trading session to react to the beginning of impeachment proceedings. Stocks are now slumping in Europe, after Wednesday’s unperturbed-looking close following House speaker Nancy Pelosi’s announcement that a formal impeachment inquiry had been opened. Trump is accused of violating his oath of office and obligations under the constitution. The specific trigger for the move was allegations that Trump coerced the president of Ukraine to investigate former Vice President Joe Biden and his son. With a Republican-controlled Senate set to face off with the Democrat-steered House, gridlock is a more likely outcome than impeachment

- U.S. stock index futures have pivoted off their lows though remain soft so far on Wednesday after the S&P 500 dropped the most in six weeks in the prior session. It looks like the market has temporarily lost its overriding hypersensitivity to trade-related headlines though. A Bloomberg News report that China is preparing to buy more U.S. pork as a possible concession ahead of the resumption of trade talks next month hasn’t been sufficient to change the mood. Oil shares aren’t doing their recent heavy lifting either. Aramco and Saudi Arabia’s guidance on crude oil output restoration following the drone attack is beginning to look more cogent. Brent and WTI crude futures were down 1.4%-1.6% a little earlier

Stocks/sectors on the move

- All FTSE 100 sectors are moderately to deeply in the red, with technology shares sharply underperforming with a 3% fall led by equipment maker Halma, which slides 4%. Brokerages don’t agree with the group’s trading statement that says performance has been in line with expectations, with revenue growth despite a tough comparable period in the previous half-year. Europe’s broad STOXX gauge is also entirely underwater, with IT at the bottom there too

- Swiss bank Credit Suisse keeps falling, down 2% on Wednesday. Declines reflect some alarm following allegations that private investigators were tasked to spy on a former employee, resulting in a car chase and confrontation in central Zurich

- EssilorLuxottica is another big loser, falling 3% on reports of boardroom feuding at the newly merged group, as well as Tuesday’s surprisingly poor U.S. consumer figures

- Uber should be in focus when U.S. cash trading starts after authorities in one of its most important patches, London, renewed its operating license for just two months. The capital’s transport regulator said on Tuesday that Uber had improved its culture and governance, signalling that the company can apply for another, longer, license in November. The stock fell 5% on Tuesday and pre-opening bids and offers are slightly lower

- Nike fell somewhat less in a sliding market after its solid earnings and surprisingly positive outlook comments kept its shares within sight of a record high. The shares are pointing 6% higher ahead of Wall Street’s open

- EssilorLuxottica is another big loser, falling 3% on reports of boardroom feuding at the newly merged group, as well as Tuesday’s surprisingly poor U.S. consumer figures

- Uber should be in focus when U.S. cash trading starts after authorities in one of its most important patches, London, renewed its operating license for just two months. The capital’s transport regulator said on Tuesday that Uber had improved its culture and governance, signalling that the company can apply for another, longer, license in November. The stock fell 5% on Tuesday and pre-opening bids and offers are slightly lower

- Nike fell somewhat less in a sliding market after its solid earnings and surprisingly positive outlook comments kept its shares within sight of a record high. The shares are pointing 6% higher ahead of Wall Street’s open

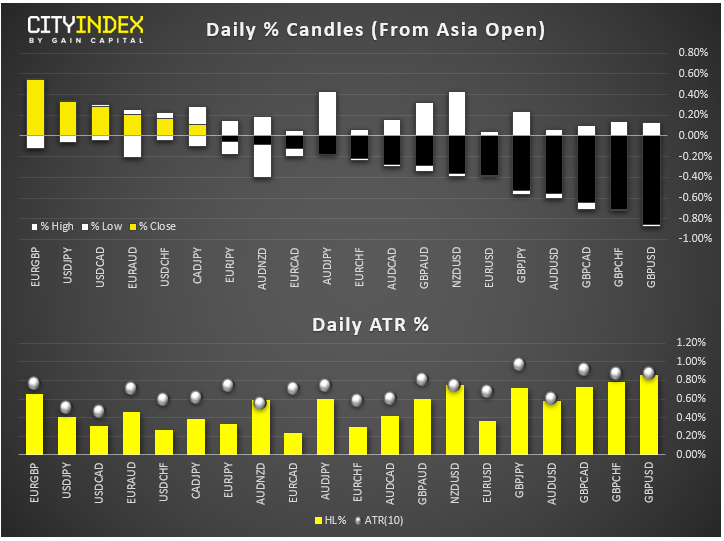

FX snapshot as of [25/9/2019 1:07 PM]

FX markets and gold

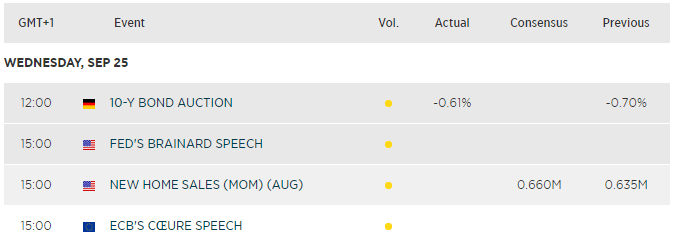

- Unsurprisingly, the pound is in the spotlight and under the cosh, with sterling falling hard against the dollar, franc, loonie and yen. Sterling’s positive move within a negative range against the euro looks partly down to dispiriting optics following a new 10-year bund auction where yields slumped to minus 0.70% compared to -0.61% the last time the Bundesbank floated paper that constitutes Europe’s benchmark debt

- Elsewhere, there are good signs of a dollar move, predicated on safety seeking on the back of Washington’s impeachment proceedings. A broader appetite for havens that would normally spotlight the yen may have been somewhat frustrated following dovish commentary from the Bank of Japan early on Tuesday. This leaves the yen marginally off-side vs. dollar whilst the Swiss franc looks underpinned

Upcoming economic highlights

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM