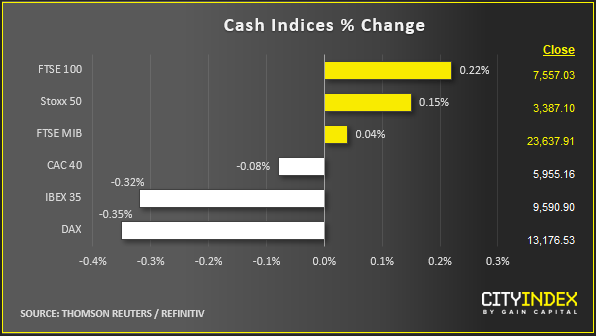

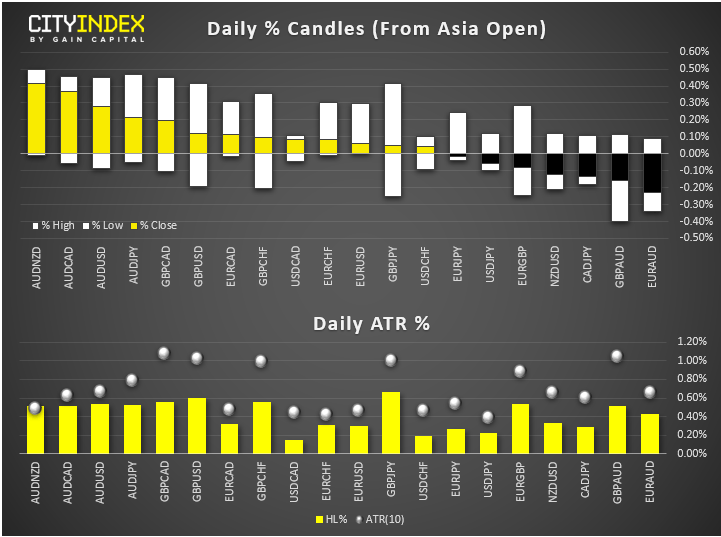

- Market update at 12:30 GMT: In FX, the AUD was the strongest, while the NZD and EUR brought up the rear. European stocks were slightly weaker in a quiet session. Gold and silver were a touch lower, while copper was higher. Bitcoin was lower after Wednesday’s big gains.

- Stocks barely reacted to news Donald Trump became the third US president in history to be impeached. The markets fully expect Trump will NOT be ousted by his GOP chums at the Senate. There was no other major fundamental news to provide direction for equity prices.

View our guide on how to interpret the FX Dashboard

- AUD rose as Australian employment data finished the year on a brighter note. Unemployment fell to 5.2% and almost 40K net jobs were added, beating 25.9K expected.

- GBP came off lows after the BoE’s rate decision. The central bank decided to leave rates and QE unchanged as expected, with the votes split 7-2 in favour of no rate cuts, also as expected. The Bank said global growth has shown tentative signs of recovery. But domestically, it was too soon to gauge the impact of Prime Minister Boris Johnson's election victory in terms of lifting the Brexit uncertainty that has hung over the economy. Earlier, UK retail sales had disappointed expectations with an unexpected 0.6% m/m drop vs. +0.3% gain expected.

- SEK weakened despite news Sweden's central bank (Riksbank) hiked interest rates by 25bps to take them back to zero.

- JPY strengthened slight after the BOJ decided to stand pat again at their final meeting of the year. The central bank kept rates at -0.1% and their 10-year JGBP yield at around 0%.

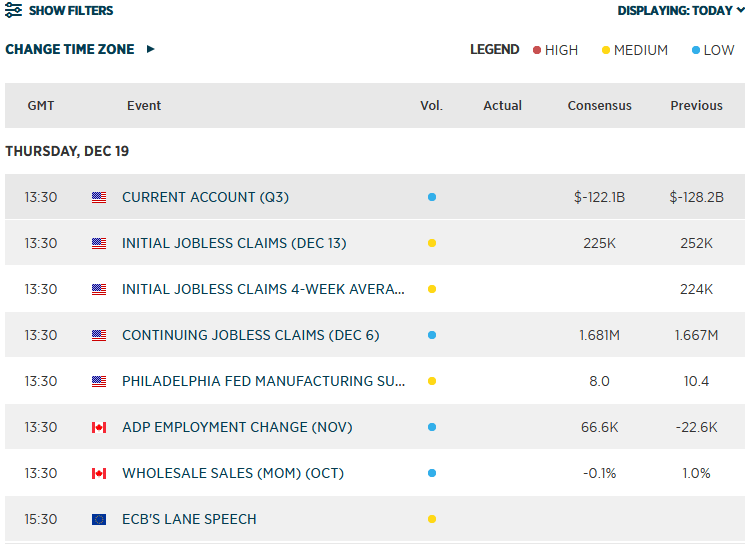

- Coming up:

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM