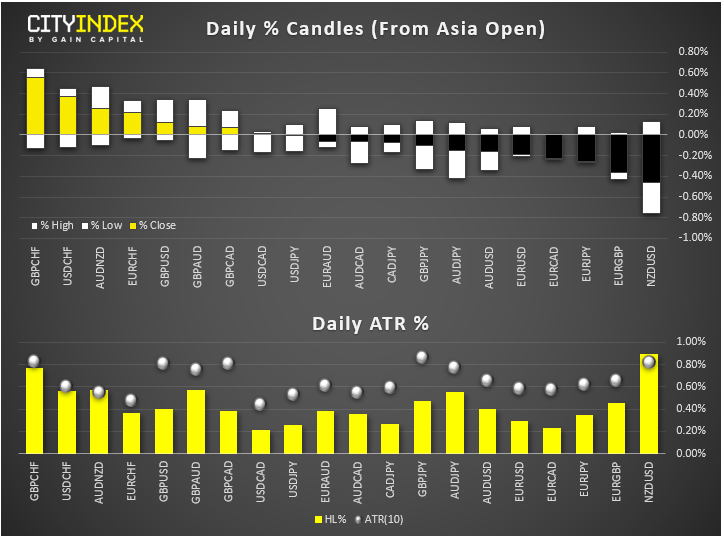

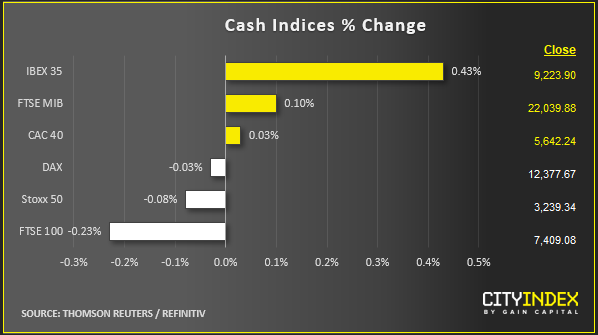

- At midday in London, the US dollar was again among the strongest major currencies, while the New Zealand dollar and Euro were among the weakest due to ongoing macro concerns in both regions. European stocks and US index futures were mostly higher, and key commodity prices mostly lower (see below).

- NZD fell on the back of a poor business sentiment survey, while somewhat positive Eurozone employment data released this morning couldn’t support the EUR, as inflation remained soft in Spain and Italy (see data recap below). Meanwhile on the Brexit front, traders will be watching the Conservative Party conference, which has kicked off in Manchester - although Boris Johnson isn’t due on the podium until Wednesday. However, the Prime Minister has re-iterated that there’s a “good chance” a deal with the EU can be reached, even if the latter continues to suggest otherwise.

- Data recap: according to official PMI data, China’s manufacturing sector shrank for a fifth month in September. However, Caixin’s PMI showed the sector expanded at its fastest rate since February 2018. German Retail Sales rose 0.5% m/m as expected and unemployment unexpectedly fell by 10,000 when a rise of 5,000 was expected. Italian Unemployment Rate fell unexpectedly to 9.5% from 9.8%. Eurozone unemployment rate also fell, down to 7.4% from 7.5% previously. However, weaker CPI inflation readings from Spain (+0.1% y/y vs. +0.3% expected) and Italy (-0.5% m/m vs. -0.3% expected). Finally, UK final GDP was left unrevised at -0.2% q/q. Coming up: US Chicago PMI at 13:30 BST.

- Stocks have bounced back after a sharp fall on Friday afternoon when Bloomberg reported that the US had discussed ways to limit American portfolio managers’ investments in China. However, a Treasury official over the weekend denied the reports and said that there were no plans to stop Chinese companies from listing on US exchanges.

- Key commodities were all lower: safe haven gold continued to struggle as stocks rebounded and the dollar remained firm; oil prices were lower with WTI finally filling that "Saudi oil attacks" gap on Friday and Brent following suit today, meaning we are now back to neutral territory on crude oil. Meanwhile copper has relinquished its earlier gains after it found support from supply worries after a 6.8-magnitude earthquake was recorded in Chile, which is a dominant producer of the metal.

- A week-long holiday in China potentially means quieter than usual Asian sessions for the next four days. But this is a non-farm payrolls week and so it is a big one for macro data. HERE is our week ahead preview to provide you a guide to the big events of the next five days.