- In a fresh blow to the BoJ, consumer prices in Japan hit a two-year low, which also follows on from weak export figures yesterday. Whilst the central bank held steady yesterday, they stated they’ll “pay more attention” the potential they’re falling behind their price target. This puts further easing on the cards in October.

PBOC provided more stimulus by lowering China’s new 1-year benchmark lending rate for a second consecutive month to 4.2%. - South Korea’s export growth was revised lower to -13.8%, their weakest level since January 2016.

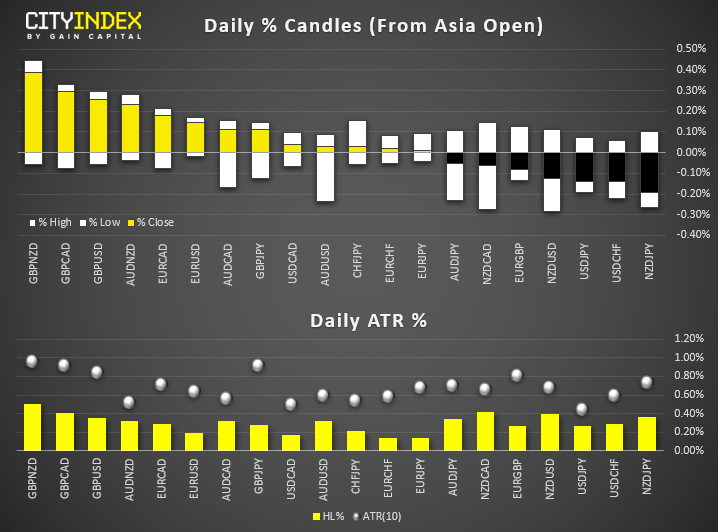

- GBP is the strongest major after Juncker said he believes Brussels could arrange a deal with the UK to leave the EU. GBP/USD is trading just off yesterday’s 2-month high. EUR is the second strongest major with signs USD is softening post-FOMC. NZD and CAD are the weakest, although volatility has remained contained overall.

- Asian equity markets ticked higher on Friday after a week of stimulus from the Fed and PBOC.

- Japan’s Nikkei 225 index is within striking distance of its year to date high, MSCI Japan (broad basket of stocks) is the leader of the session and sits at a fresh 1-year high. Sanbio, Amifa and Cluster Tech are the three top performers, rallying 16.4%, 17.9% and 17.3% respectively.

- The ASX200 hit a 7-week high with Premier investments, IOOF Holdings and Nearmap Ltd leading the gains whilst Speedcast International, NIB Holdings and New Hope Corp are the laggards. Across the broader ASX, 47.5% of equities advanced, 29.3% declined and 23.2% were unchanged. 70 made new highs, 10 new lows.

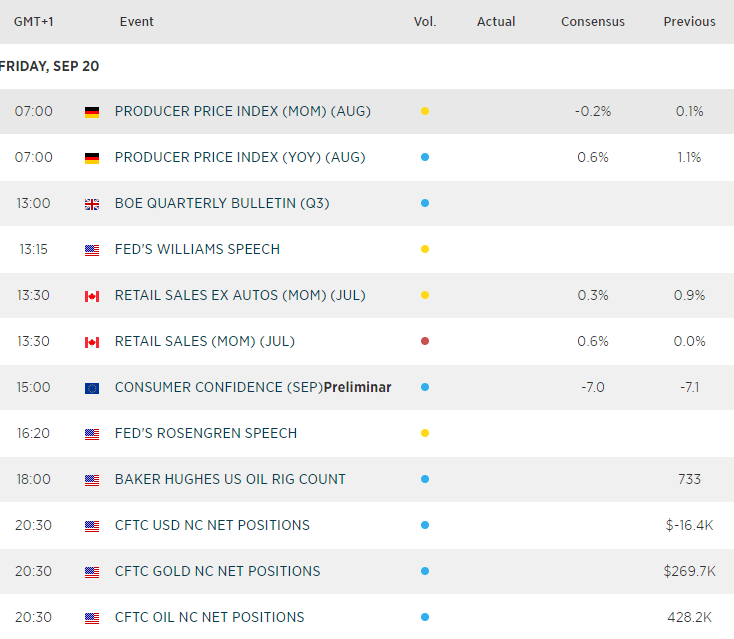

Up Next

- It’s a quiet send off on the calendar from what has been mostly a busy week (dominated by the oil surge, FOMC meeting and repo headlines).

- Canadian retail sales is expected to pick up to 0.6% (0% prior), although oil headlines are more likely to be a mover for CAD.

- CFTC data is released late session for FX, index and commodity markets. Expect the usual full report on Monday.

Latest market news

Today 08:33 AM