Stock market snapshot as of [19/11/2019 3:02 pm]

Reduced ‘noise’ as news flow falls in step with an almost-done earnings season and looming near-end, confirm that ‘trade’ remains the key undertone for sentiment. Earlier, reports from the day before suggesting scepticism in Beijing about a broad deal being reached anytime soon were shrugged off. Instead markets focused on word that the White House would extend a license allowing U.S. companies to do business with Huawei

Markets then roughly halved gains soon after Wall Street’s open. China’s state-run Global Times noted that “Big gaps remain in China-US trade talks”. Two years after the trade dispute began, few reminders are needed that improved prospects can unravel in the time it takes to post a tweet.

Still, risk assets have also had enough time to factor cumulative tariff impact. With global central banks on an accommodative footing, absent new deterioration in other global flashpoints, there’s a case for extended gains.

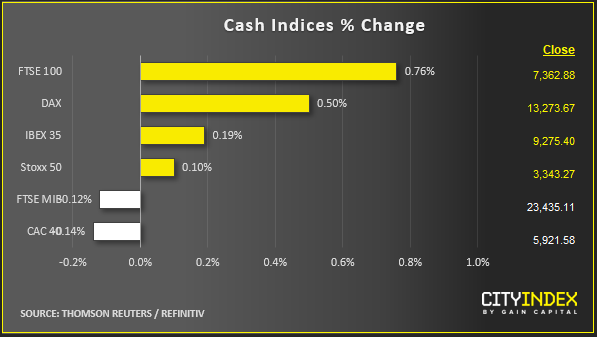

Stocks/sectors on the move

- DAX was a major standout in Europe as it eyed a record high, notes Senior Technical Analyst Fawad Razaqzada. Europe’s blue-chip underperformer index, the FTSE 100, also had a day in the sun, on the back of gains by key mega-caps. Miners Rio, Antofagasta, EVRAZ, BHP backed the positive contribution from two lesser known FTSE shares

- Halma and Intertek are rivals in the industrial testing, certification and hazards field. They rose 11% and 5% respectively after Halma’s much better than forecast first-half profit and FY outlook

- Materials (propped by miners), Financials, Industrials (with input from ‘research and consulting groups’ - see Intertek) Technology, and Energy are Europe’s best-performing super sectors

- U.S. standouts on the downside kept up a sober theme for the retail sector. Lowe’s (LOW) followed, Kohl’s (KSS) and Home Depot (HD) sharply lower on poorly received earnings, outlooks, or both. KSS dropped 12%, HD -4%, LOW, -2%. It’s not all one way down Main Street though as TJX bucks the trend. It beat forecasts, boosted its outlook and bought a Russian rival for $225m. The stock pared gains into the open however as investors scrutinised ‘holiday’ quarter guidance and found them to be cautious

- See our earnings preview for key U.S. retailers by Head of Research Matt Weller

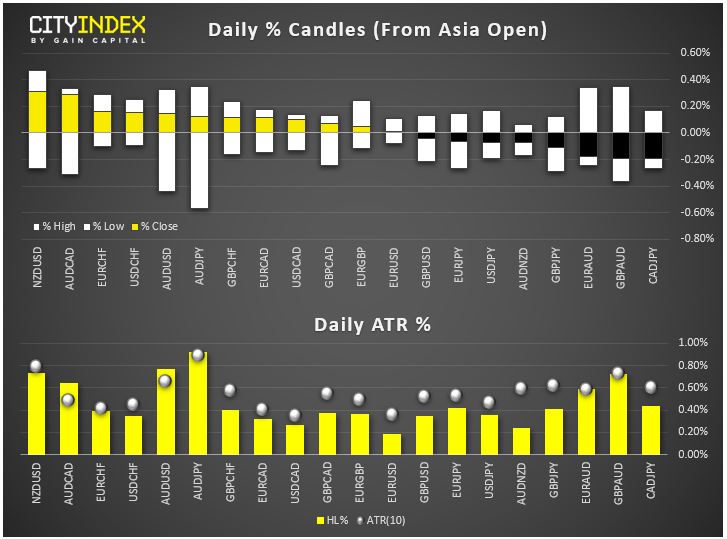

FX snapshot as of [19/11/2019 3:02 pm]

View our guide on how to interpret the FX Dashboard

FX markets and gold

- Meanwhile: Brazil’s lira nears a record low, spotlighting another Latin American economy under pressure (see Venezuela, Argentina and others). Ironically, there’s a dearth of drivers in Brazil itself. BRL selling is being precipitated by unrest in related and proximal regions. The central bank is heard offering spot in exchange of long dollar, ahead of scheduled comments from its president

- Currency havens are leading the losers, whilst Treasurys also retreat. The dollar index attempted to break higher for a spell with key majors on the backfoot, though ex-USD has since regained poise

- Aussie is among the worst G10 performers after minutes of the RBA’s recent policy meeting revealed rate setters had considered another cut

- Sterling looks a lot more hesitant than on Monday, ahead of a TV debate between the Conservative’s Boris Johnson and Labour’s Jeremy Corbyn

- Senior Technical Analyst Fawad Razaqzada adds: The risk-on tone is also evident in FX, with the risk-sensitive New Zealand dollar being the strongest and safe-haven Swiss franc the weakest at the time of writing

- News that the US President Donald Trump “protested” to the Fed’s Jay Powell that he should consider lowering interest rates in par with other developed countries was also greeted with cheer