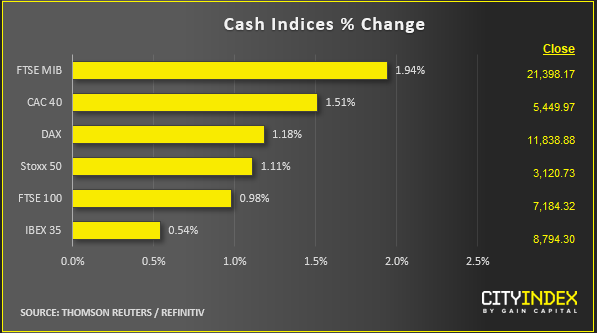

Stock market snapshot as of [29/8/2019 6:27 PM]

- ‘Trade talk’ continues to be pretty much all investors betting on sentiment need to know, as Wall Street backs up Europe’s solid session with the most confident gains seen there since the middle of the month

- The distinction between ‘talks’ and ‘talk’ is still a pithy one though. China tempered early consensus-seeking comments with a warning of “ample” means to retaliate, before indicating that ‘discussion’ was preferable. Later Beijing emitted even clearer signals that it is not inclined toward further retaliation against Washington’s tariffs. At least not yet

- China’s Commerce Department also said it was discussing a visit to the U.S. for talks next month. There’s still no concrete news though and stocks could well be one tweet away from their next down draft

- Typical month-end activities, such as portfolio re-balancing, month-end position squaring and perhaps even derivative contract expiries, are likely to be playing a part in the market’s outbreak of cheer

- On a similar note, a pattern that is typical to months where returns in U.S. fixed income outstrip those from equities may be in play. Bonds outperformed stocks by 5.5% in the month to 26th August according to Bloomberg News, forcing pension funds and other institutions to buy more stocks to preserve allocations. Data since 1996 show that in the final four days of any month when bonds outperformed stocks by more than 5%, stocks rose 2.4%

Stocks/sectors on the move

- Technology has come surging back from earlier week doldrums. Again, optimism about a breakthrough appears to be reflected in increasingly trade-sensitive major sector players

- The giants, now grouped under to S&P 500 ‘Interactive Media & Services’ all bounced; leaving Facebook, Alphabet, Twitter and TripAdvisor all 1%-3% higher

- Hardware and software was also all in the green, particularly semiconductor names, but in fact tech from ‘new’ to ‘old’ is in demand: IBM clearly participated with a 1.7% lift alongside Microsoft’s 2% advance, whilst Autodesk and rival Adobe unwound some of their sell-offs of the day before

- Britain’s Microfocus went sharply counter the day’s tech trend with a 32% crash, as the ‘legacy’ software and services group posted its latest outlook warning

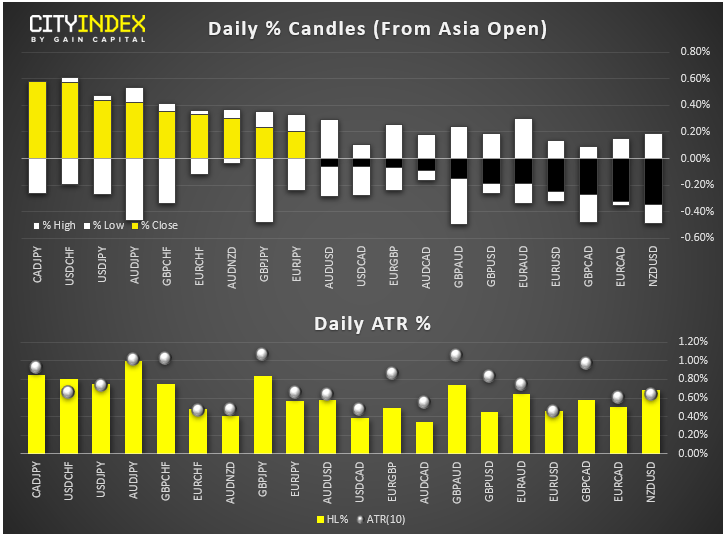

FX snapshot as of [29/8/2019 6:27 PM] FX markets

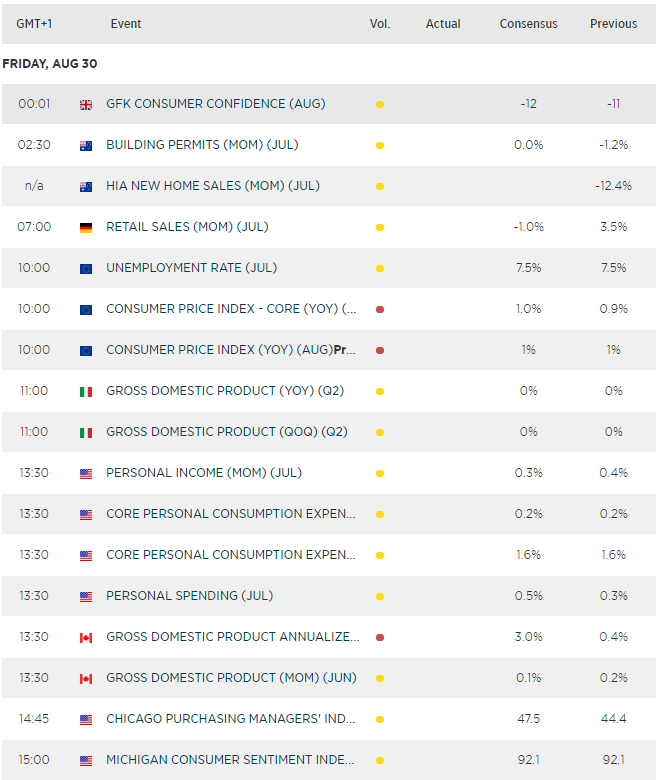

Upcoming economic highlights