Stock market snapshot as of [3/1/2020 3:48 pm]

- …And in a flash, it was gone. U.S. and European stock markets have ceded the best levels gained on one of the most bullish starts of the year seen for decades.

- Massive street demonstrations in Iran have followed the U.S airstrike on Iraq that killed Qassem Soleiman, a notorious general who commanded proxy militias that extended Iran’s power across the Middle East. The demos add to concerns that Tehran will feel compelled to retaliate

- As such, chances that a further escalation of tensions with Washington can be avoided, appear to be low. Risk assets therefore look unlikely to reclaim their solid advance out of the gates in 2020 anytime soon

- As ever, time will tell the true extent of investor reaction vs. over-reaction. (The VIX volatility gauge and U.S. oil have surged the most since early December)

- But it’s already clear that that volumes of 2020 outlook commentary mostly did not factor in a sudden and severe deterioration of Middle East risks. Worries that moderate stock market progress widely forecast for the year may be in jeopardy won’t be easy to allay

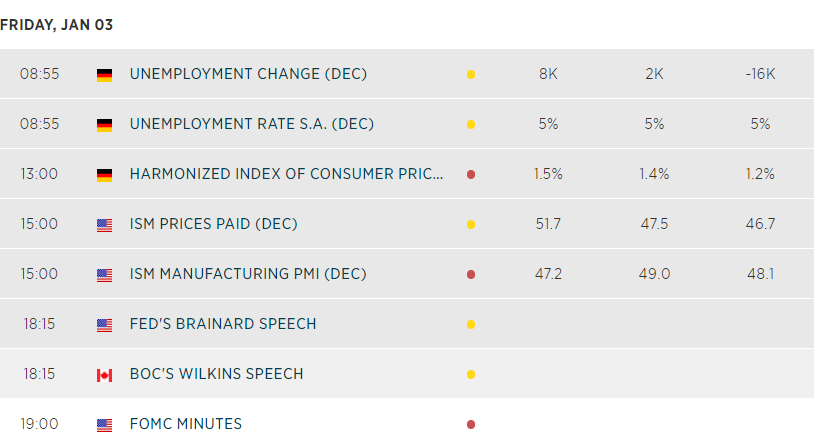

- A softer than forecast December manufacturing index from the ISM isn’t helping sentiment. It was weakest since June 2009. The employment component also ticked deeper into contractio territory, a negative omen for next week’s payrolls. The ISM’s more pivotal Non-Manufacturing data are due on Tuesday

Stocks/sectors on the move

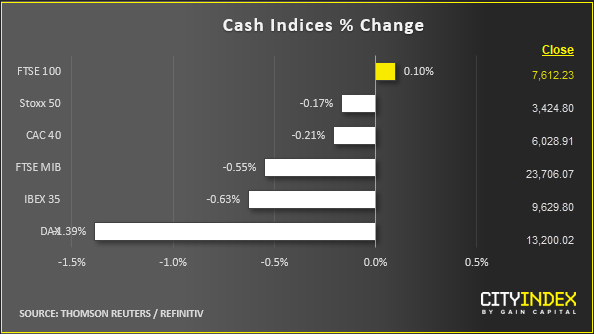

- U.S. stock indices made an early bid to break into positive territory, with a decent gradient off lows, but that has faltered. Of major markets, only the FTSE managed this feat (just). Thank inflated oil prices and the market’s outsize weighting of crude producers

- Energy is predictably among the few sectors in the green on both sides of the Atlantic

- BP is one of the oil supermajors in the spotlight, as my colleague Fiona Cincotta points out here

- British American Tobacco almost single-handedly lifts the consumer sector into positive as well. Smoking product makers are seeing a relief rally after the Trump administration indicated a temporary ban on flavoured vaping products could be lifted if manufacturers demonstrate they’re not targeting youngsters

- Technology leads the downside in Europe. However Apple continued to outpace U.S. blue-chip shares. A 0.5% fall earlier compared with the Nasdaq 100’s -0.8%. AAPL remains within touching distance of psychologically charged $300

FX snapshot as of [3/1/2020 3:48 pm]

View our guide on how to interpret the FX Dashboard

FX markets and gold

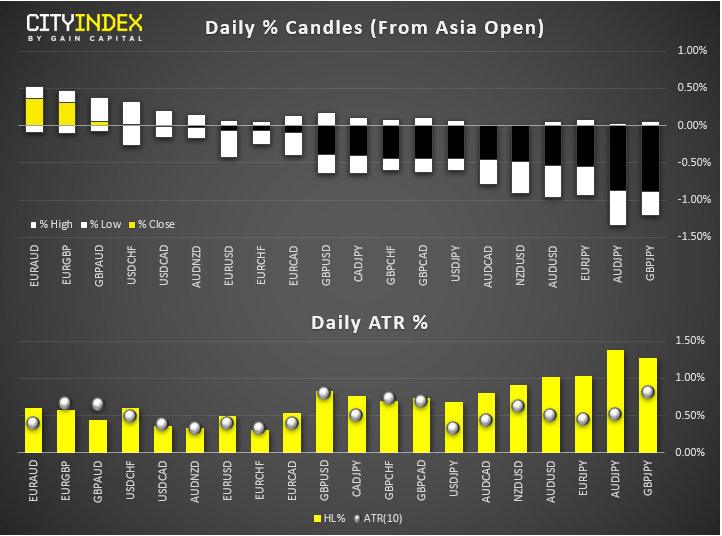

- The dollar’s haven characteristics kick-in, with the euro bearing the brunt

- Gold is back near six-year highs on its own haven demand. Bullion has been as much as 1.5% higher near 1551.52. Ironically, with a test of the September $1557 high brought on much earlier than expected, momentum conditions may not favour strongly extended gains from here

- Classic risk proxies are paired elsewhere as Aussie slumps the most amongst majors vs. the yen. Against the dollar, significant sell stops were very likely to have been intense around 0.6940

- Still, note that the single currency also exerts a significant toll on AUD. Assessments of the precise level of current risk appetite are not straightforward to make

- The loonie sees some protection due to its strong tie to oil, mostly at the expense of sterling

Economic highlights

Latest market news

Today 08:33 AM