Market Brief: Indices Cap Off Fourth Straight Up Week in Record Territory

View our guide on how to interpret the FX Dashboard.

- President Trump floated a “major” middle class income cut, though the market is skeptical about such a deal getting done. Speaking of deals getting done, optimistic comments from economic adviser Kudlow boosted risk appetite across the board today.

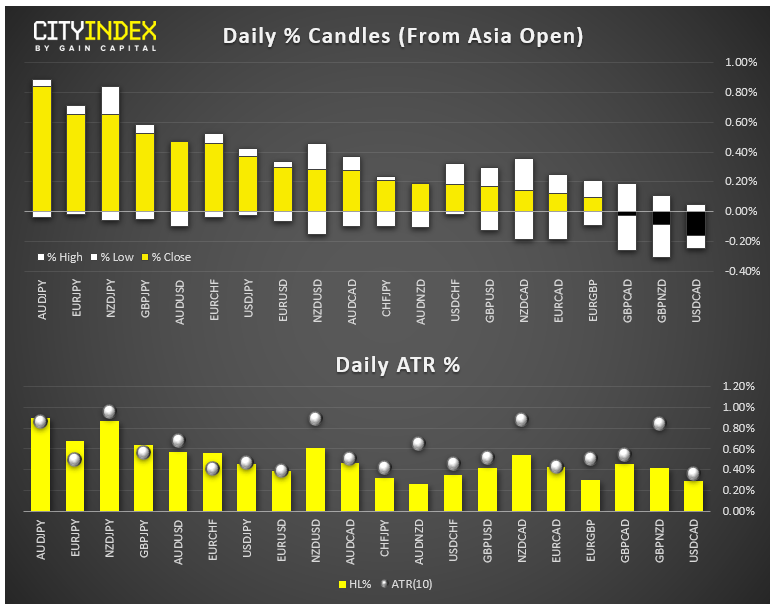

- FX: The risk-sensitive Australian and New Zealand dollars were the strongest major currencies, with safe haven currencies like the Japanese yen and Swiss franc bringing up the rear. The pound caught a bid after Brexit party candidates vowed to stand down in over 40 districts.

- US data: US retail sales beat expectations at +0.3% m/m, though “core” retail sales (excluding volatile auto purchases) came in below expectations at +0.2% m/m.

- Commodities: Oil rallied nearly 2% on the day (a surprise drop in oil rigs certainly helped) while gold eased back about 0.5%.

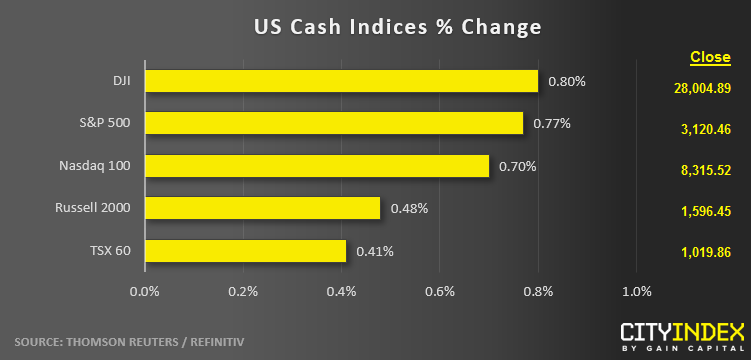

- US indices closed solidly higher on the day to hit fresh record highs.

- Health Care stocks (XLV) were by far the strongest sector on the day, while Materials (XLB) brought up the rear.

- See the key storylines and trends we’ll be watching in the coming week!

- Stocks on the move:

- Nvidia (NVDA) shed -3% on a weaker-than-expected outlook, even though the company’s Q3 earnings eclipsed analysts’ expectations.

- WalMart (WMT) dipped -1% after missing revenue forecasts, though the company’s key online business grew 41%.

- Applied Materials (AMAT) surged 9% after beating both earnings and revenue estimates.

- Chinese retailer JD.com (JD, -0%) was essentially flat on the day despite easily beating analysts’ earnings estimates. The stock is up nearly 70% year-to-date.

* No major economic releases are scheduled for Monday’s Asian session*

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM