- Trump says the US has reached a trade deal with Japan which could be rolled out without congressional approval and reiterated that the US could release oil from their reserves. Separately, Japan’s Industry Minister released a statement, saying they’ll consider a coordinated release of oil reserves if it’s required.

- NZ consumer confidence slipped for a third consecutive quarter, to its lowest since Q3 2012. According to the Westpac survey, consumers remain optimistic about personal finances but increasingly downbeat over the future of the economy. A Reuters poll shows that economists expect growth to slow.

- RBA Minutes revealed little new; downside risks remain for global growth and further easing worldwide is “widely expected”; outlook for consumption growth remains a key uncertainty; would ease monetary policy further if needed. Whilst this leaves the open for a cut next month, OIS suggest we may have to wait until December and prices around 60% probability of a 25-bps cut.

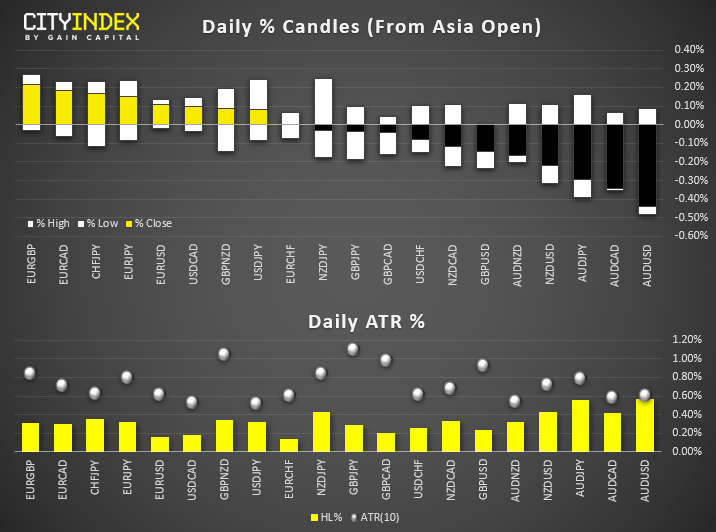

- AUD and NZD are today’s weakest majors, with AUD/USD testing key support around 0.6832 and the only pair to test its typical daily trading range. Iron ore has shed -1.9% on the session so far to weigh on the Aussie. NZD/USD hit a 10-day low, whilst USD/JPY printed a fresh 7-week high and now sits above the 108 handle.

- Most Asian stock markets have traded lower on the backdrop of higher oil prices and ahead of the key economic event for this week, the outcome of the Fed FOMC meeting on this Wed, 18 Sep.

- The worst underperformer as at today’s Asia mid-session is the Hong Kong’s Hang Seng Index where it has recorded an intraday drop of 1.00% for the 2nd consecutive day despite Hong Kong’s Chief Executive Carrie Lam’s announcement of dialouge sessions with the community to kickstart next week with the aim to ease the on-going domestic unrests that have lasted for over three months since Jun.

- Catalysts for the current weakness seen in Hong Kong stocks can be attributed to “China related factors” where the USD/CNH (offshore yuan) has staged a biggest 3-day rally as it surged by 225 pips to print a current intraday high of 7.0861 at this time of writing. Secondly, the biggest weightage component stock in the Hang Seng Index, AIA has dropped by 1.9% to print a 2-week low of 78.10.

- Japan’ Nikkei 225 is trading in the positive territory due to positive trade related newsflow where U.S. President Trump has announced that U.S. has struck trade agreements with Japan that can be implemented without U.S. Congress approval.

- The S&P 500 E-mini futures has trading sideways in today’s Asia session; so far it has inched down by -0.08% to print a current intraday low of 2996 as it has covered the weekend “gapped down” formed yesterday trigged by the risk of a prolong oil supply disruption caused by drone attacks on Saudi Arabia’s oil pipelines.

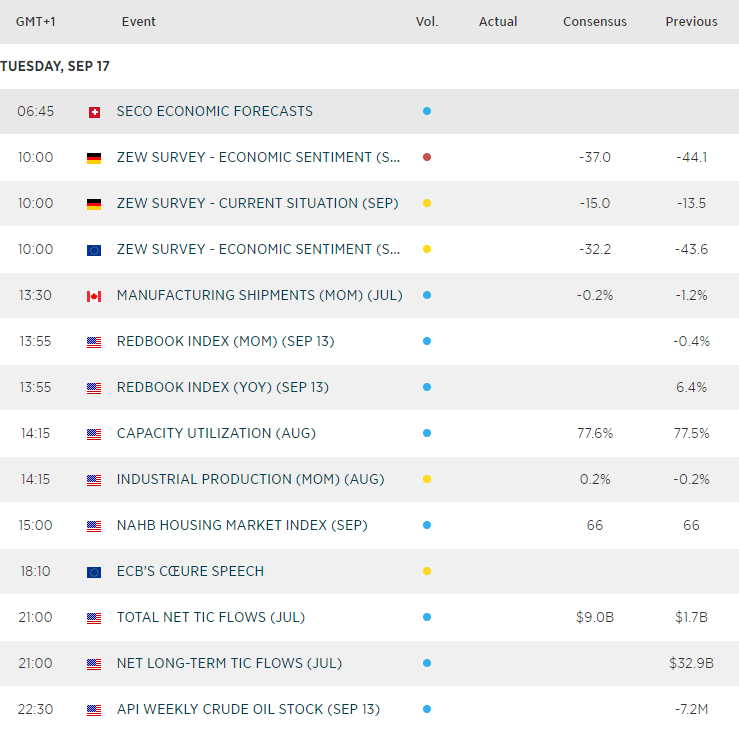

Up Next

- Germany’s ZEW survey has continued to set alarm bells ringing by hitting multi-year lows. Seen as a leading indicator for growth, a lower reading only sees expectations for Germany to enter a technical recession rise. Keep Euro crosses on your radar.

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.Latest market news

Yesterday 11:48 PM

Yesterday 11:16 PM

Yesterday 05:00 PM