Market Brief: Impeachment Worries and Weak US Data Drive Markets Down

- US political developments took center stage today, with Speaker of the House Pelosi reportedly on the verge of announcing a formal impeachment inquiry into President Trump over calls with the President of Ukraine. While the odds of Trump ultimately getting removed from office (which requires the approval of the Republican-controlled Senate) are long, the injection of political uncertainty still led to a risk-off move across most markets.

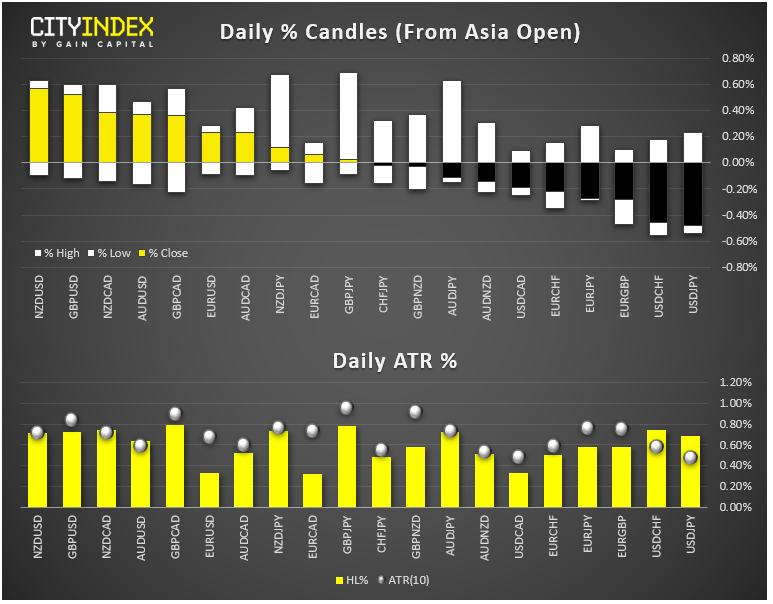

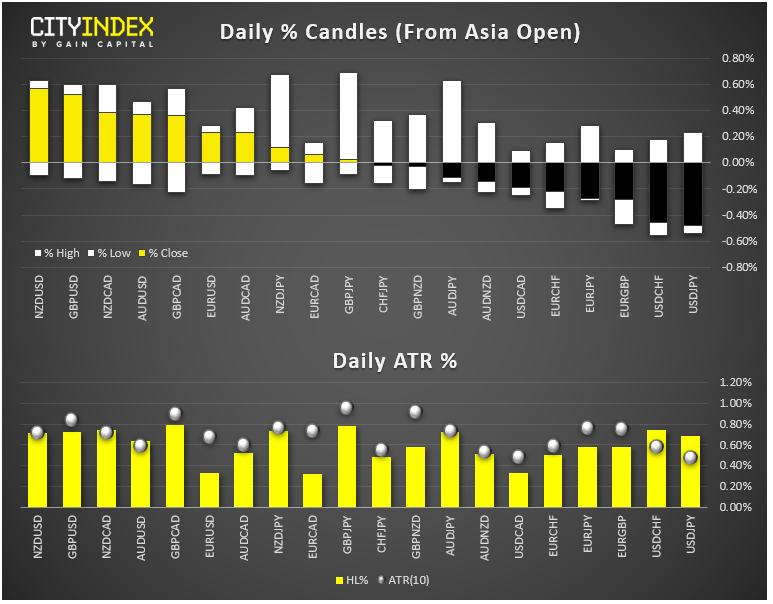

- FX: The New Zealand dollar and the British pound (following the UK Supreme Court’s decision that Boris Johnson’s Parliamentary prorogation was illegal) were the strongest major currencies on the day. The US dollar was the weakest.

- US data: Consumer confidence fell to 125.1 (down from 134.2 last month). The Philly Fed survey beat expectations, but the Richmond Manufacturing index fell deeper into negative territory at -9. Housing data (Case-Shiller and FHFA) essentially met expectations.

- Commodities: Gold ticked higher on the day while oil fell nearly 3%.

- Cryptocurrencies were routed on no clear news. Bitcoin dropped -12% on the day, while Ethereum and Ripple each fell by more than -17%.

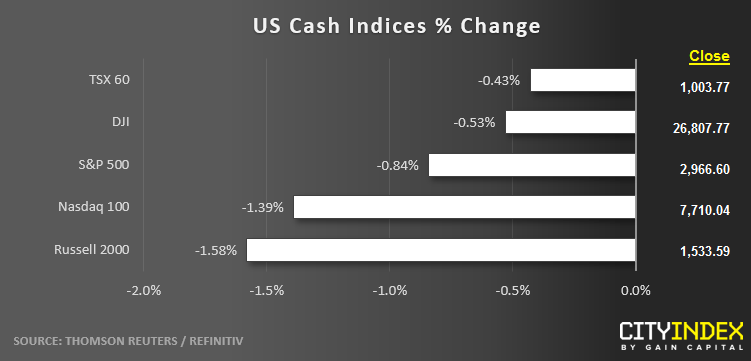

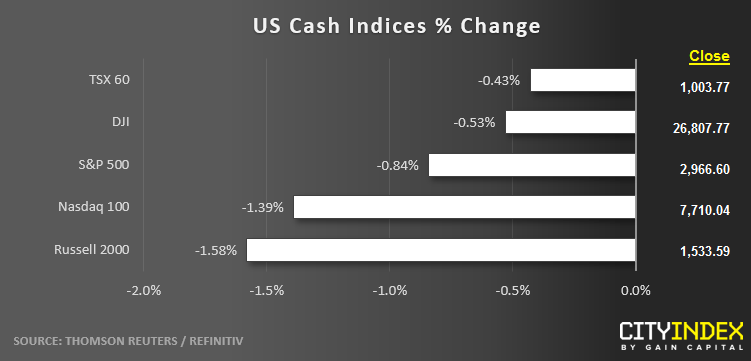

- US indices closed lower amidst the aforementioned impeachment fears and weak US data.

- Utilities (XLU) were the strongest major sector on the day (hitting a new record high), while Energy stocks (XLE) brought up the rear.

- Stocks on the move:

- Enterprise software firm Blackberry (BB) dumped -23% after reporting disappointing Q2 revenue figures.

- Automaker Tesla (TSLA) lost another -7% as a lawsuit brought increased scrutiny over its acquisition of SolarCity, another of CEO Elon Musk’s companies.

Latest market news

Yesterday 11:23 PM

Yesterday 10:19 PM

Yesterday 08:00 PM

Yesterday 04:54 PM

Yesterday 01:15 PM