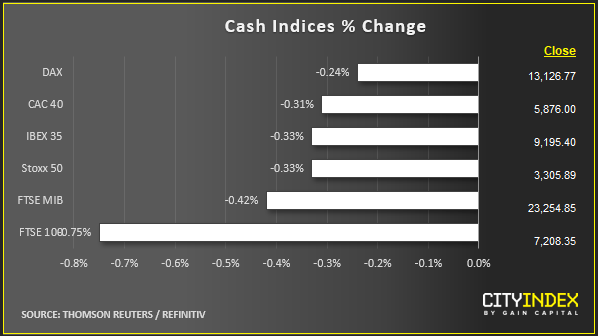

Stock market snapshot as of [21/11/2019 3:35 pm]

- “Confusion” is not really a mental state that seems to apply much to Liu He. But markets are going with it. China’s chief trade negotiator, a Harvard educated classmate of president Xi Jinping, said he remains cautiously optimistic about a deal though “confused” by Washington’s various positions. That less than ringing endorsement of the state of trade talks is guiding the session

- An official invitation of U.S. negotiators to Beijing is being shrugged off, perhaps demonstrating that trade headlines aren’t markets’ be all and end all, after all. (U.S. Trade Representative Robert Lighthizer reportedly has not accepted the invitation)

- World shares held off lows as Wall Street trade got underway, though the bias only inched reluctantly towards ‘risk’. Treasury and Eurozone yields were off Thursday troughs, 1-to-2 basis points higher. Yen and franc havens looked heavy; spot gold traded $1.80/Oz lower

- Optimistic or not, “still communicating” or mute, Beijing has made its displeasure with Congress’s ‘Hong Kong bill’ clear. And it is encouraging a link with talks. Trump is widely expected to sign the bill, which was expedited through Congress amid unusual bipartisan support

- Apparently rising chances that the U.S. tariff hike scheduled for 15th December may be postponed could offset a downdraft in sentiment. But if such a delay doesn’t look forthcoming, a more committed unwinding of positions tied to notable peaks is likely

Stocks/sectors on the move

- U.S. retailers can’t seem to catch a break. The latest let-down is Macy’s (M). M fell nearly 4% and was last down 3%. It slashed its view of 2019 comparable sales after Q3 sales fell even more sharply than negative estimates

- Still, the sector was cushioned by data showing U.S. retail sales grew a solid 4.1% in the week to 16th November, according to Johnson Redbook. The month is forecast to be about 6% better than in the year before

- S&P 500’s consumer staples stocks fell 0.5%, with only Real Estate worse, losing 0.9%. Energy leads, with Brent and WTI elevated following surprisingly fast oil inventory drawdowns in the previous week

- Alibaba Group Holding’s U.S.-listed stock barely rose, though at least it rose, compared to a 0.4% drop by the Nasdaq 100. Positive sentiment from an oversubscribed Hong Kong share sale helped China’s e-commerce giant, as well as a last-minute discount

- European super-sector relative performance largely mirrors the U.S., though ‘Materials’ leads the downside, weighed by increasingly pessimistic ThyssenKrupp, after its latest outlook warning

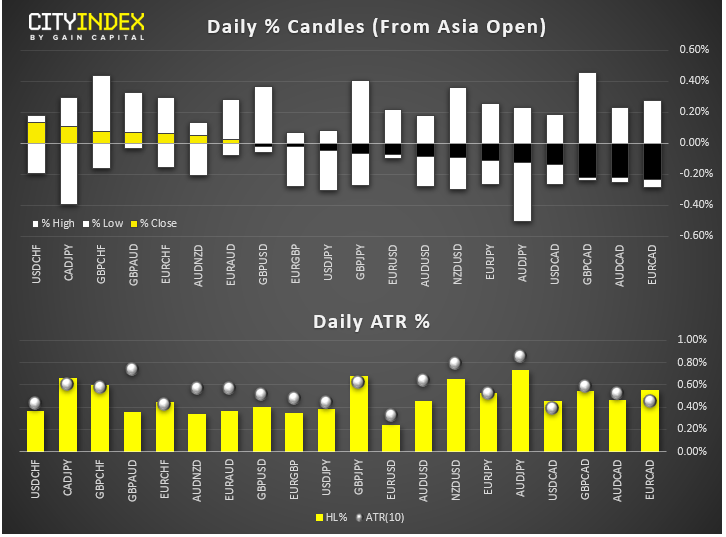

FX snapshot as of [21/11/2019 3:32 pm]

View our guide on how to interpret the FX Dashboard

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM