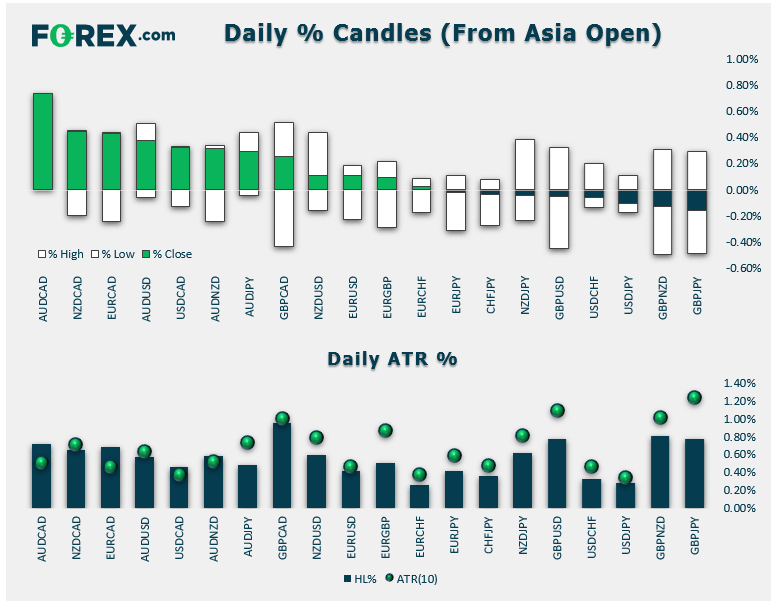

View our guide on how to interpret the FX Dashboard.

- The UK is honing in on a general election in the December 9-12 window, and with Conservatives sporting a comfortable lead in the polls, there’s optimism that a new majority could finally deliver Brexit. That said, UK polls have been proven wrong before, so the risk of a potential hung Parliament remains.

- FX: The aussie was the strongest major currency, while the loonie brought up the rear. All the other majors were quiet, moving less than 0.10% against one another.

- US data: Conference Board Consumer Confidence (Oct) came in at 125.9, a tick below expectations of 128.0. Pending Home Sales (Sept.) rose 1.5%, above 0.8% anticipate. The Case-Shiller home price index rose 2.03% y/y, roughly in-line with the 2.1% rise eyed.

- Commodities: Both gold and oil edged lower on the day.

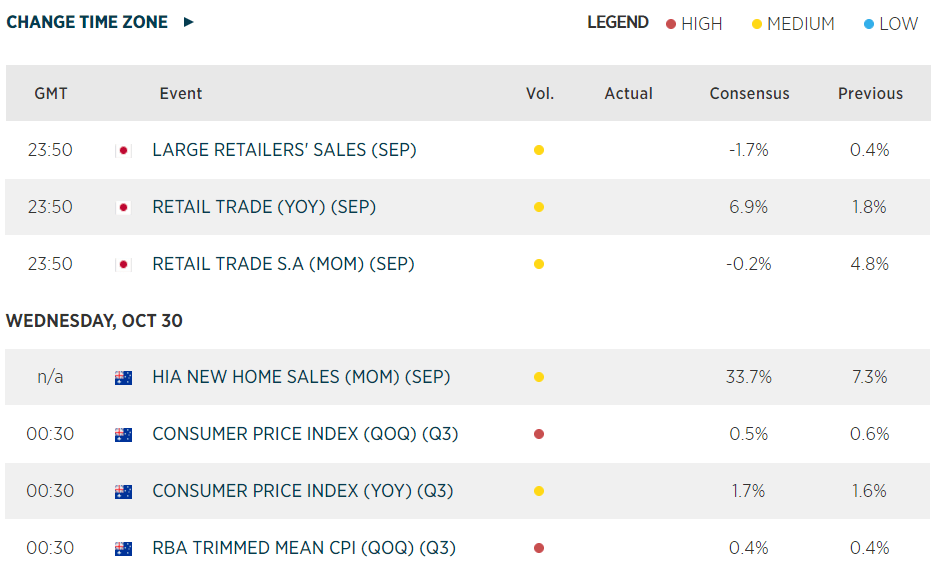

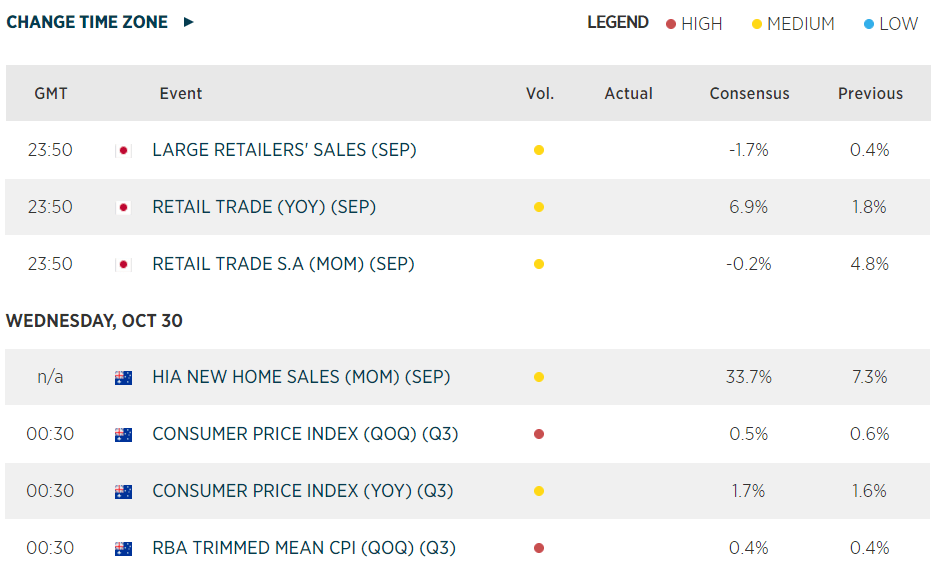

- See our preview of tomorrow’s Federal Reserve meeting, as well as a twofer on tonight’s AU inflation report here and here.

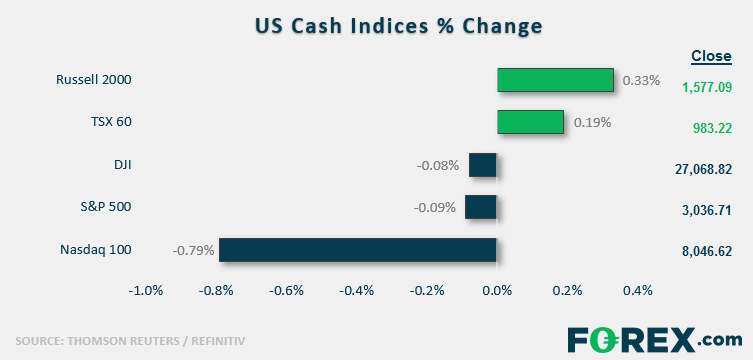

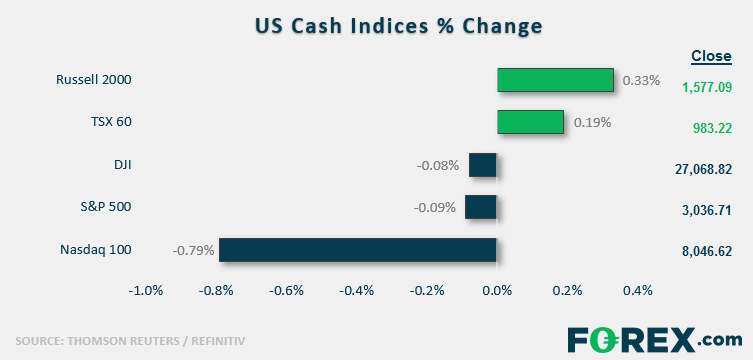

- US indices finished a choppy day moderately lower as traders continued to digest earnings reports.

- Health care (XLV) was the strongest sector on the day; Communication Services (XLC) was the weakest.

- Stocks on the move:

- Beyond Meat (BYND) dumped -22% after reporting its first ever profit. It’s worth noting that the initial lockup on insiders selling shares expired today, so profit-taking undoubtedly played a big role in the stock’s selloff.

- Google parent company Alphabet (GOOG) shed -2% after reporting disappointing earnings after the bell yesterday.

- Grubhub (GRUB) dumped -43% as the company reported disappointing earnings amidst heavy competition. Five major analysts all downgraded the company’s stock.

- General Motors (GM) tacked on 4% after reporting better-than-expected earnings, despite a nearly $3B hit from the UAW strike.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM