Market Brief: Good (and Bad) Signals Out of China Ahead of Tomorrow’s Trade Talks

- Risk appetite was boosted today by headlines that China would purchase an extra $10MM tons of US soybeans in a possible sign of goodwill ahead of trade talks kicking off tomorrow. That said, late headlines that Beijing was “lowering expectations” for the talks took stocks off their highest intraday levels heading into the close.

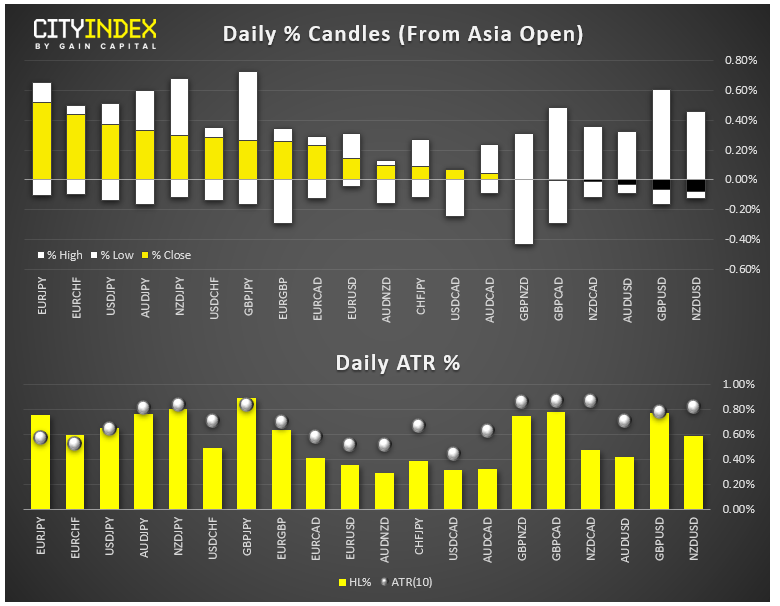

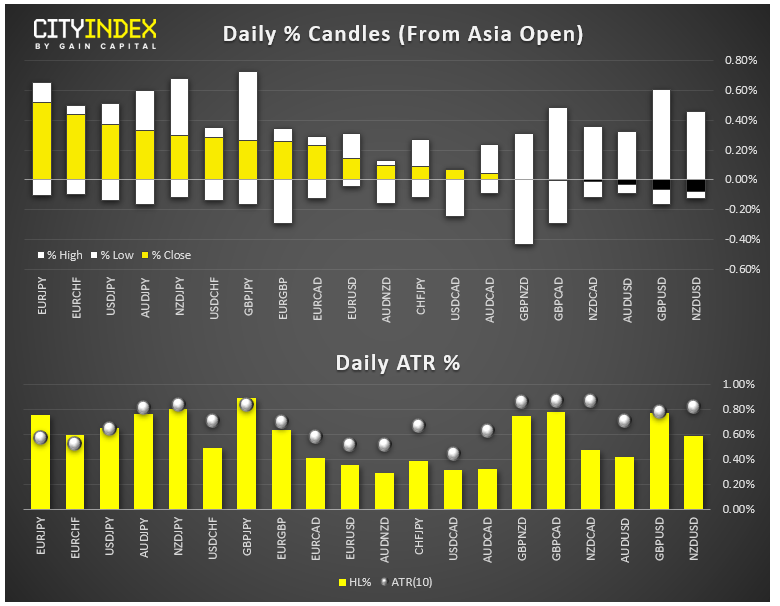

- FX: The euro was the strongest major currency, though it held below the widely-watched 1.10 level. The safe haven Swiss franc and Japanese yen were the weakest major currencies on the day.

- US data: JOLTS job openings fell to their lowest level since March 2018, though they remain historically strong. The FOMC minutes showed that “several” participants favored keeping interest rates steady before ultimately aligning with the majority in favor of a rate cut. That said, a run of weak economic data over the last couple weeks may have them reconsidering the need for further rate cuts.

- Commodities: Gold ticked higher on the day, while oil finished essentially flat despite a larger-than-expected inventory buildup (after trading higher earlier in the day).

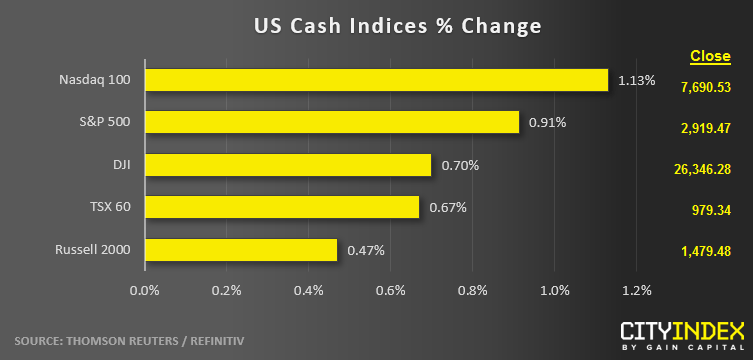

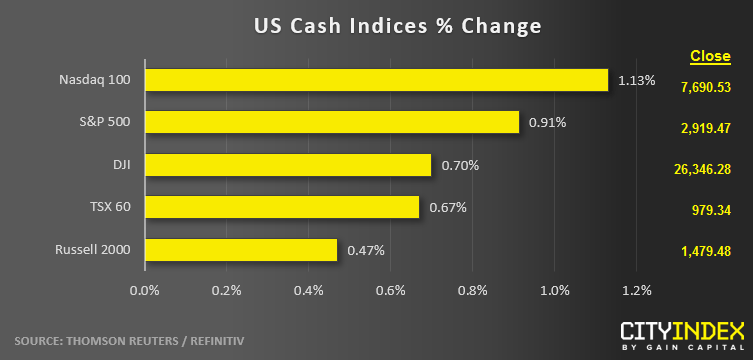

- US indices closed solidly higher on the day to erase most of yesterday’s loss. The tech-heavy Nasdaq led the way higher.

- All eleven sectors rose on the day, led by Technology (XLK). REITs (XLRE) rose the least.

- Stocks on the move:

- American Airlines (AAL) rallied 3% despite announcing that it expects Boeing’s 737 MAX jet would remain grounded until January.

- Johnson and Johnson (JNJ) dropped -2% after a court ruled the company must pay $8B in damages after the company’s drug Risperdal led to enlarged breast tissue.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM