Market Brief: GBP/USD Hits a 30-Month Low

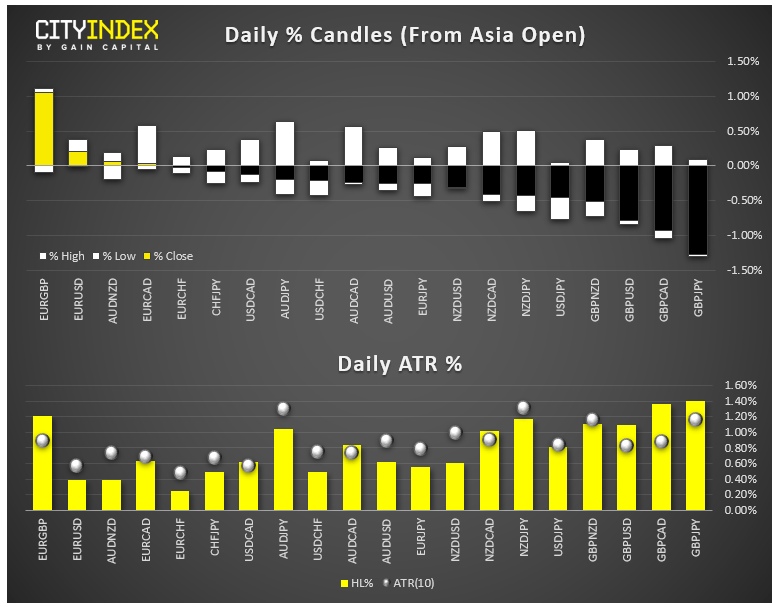

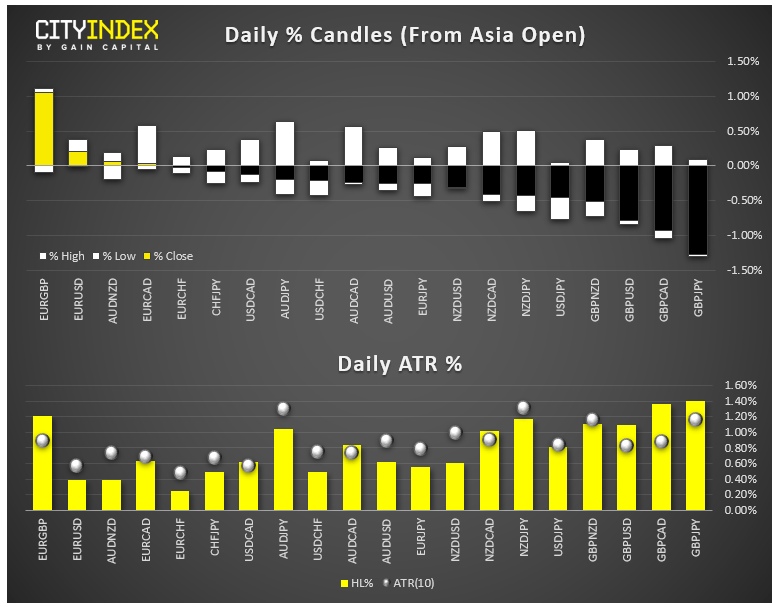

- FX: The Japanese yen was the strongest major currency, while British pound was the weakest, taking GBP/USD through 1.2100 to its lowest close in more than 30 months.

- President Trump was (of course) tweeting today, stating that the US doesn’t have to devalue the dollar, but that he’d like to see the Fed cut interest rates by 1.00%. Initial fears about the US government banning Huawei were assuaged by news that Federal authorities are still accepting applications for certain non-sensitive companies to deal with the firm.

- Commodities: Oil prices rallied nearly 4% today to finish just below the week’s opening levels. Gold was flat on the day.

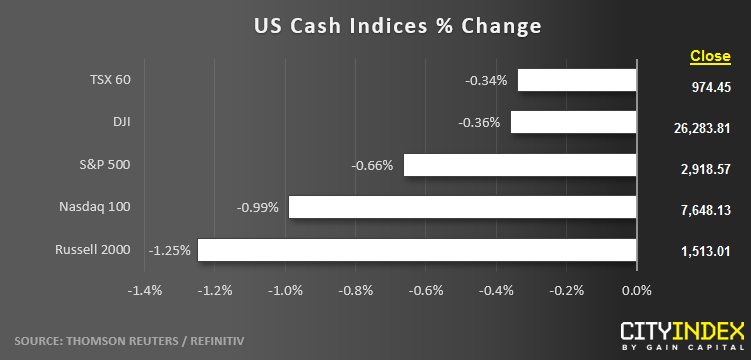

- US indices fought back from early losses but still closed lower on the day and down slightly on the week overall

- Health Care (XLV) was the strongest sector on the day, while Communication Services (XLC) brought up the rear.

- See the key economic data and market trends we’ll be watching in the coming week!

- Stocks on the Move:

- Uber (UBER) ultimately closed down -1%, despite slightly disappointing earnings after the bell yesterday. Lyft (LYFT) outperformed its rival, tacking on 1% today.

- Advance Micro Devices (AMD) surged 16% today, completely erasing yesterday’s big drop.

- Overstock.com (OSTK) surged nearly 20% after the online retailer reported strong earnings.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM