Market Brief: GBP Walloped as No-Deal Brexit Fears Return

View our guide on how to interpret the FX Dashboard.

- US data: US Industrial Production (Nov) came in at +1.1%, above expectations of a 0.8% rise. US Housing Starts (Nov) also beat expectations at 1.365M annualized vs. 1.345M expected. The JOLTS report showed a higher-than-expected 7.267M job openings.

- The Atlanta Fed’s GDPNow estimate of Q4 growth rose to 2.3% as a result of recent solid data out of the US. The next report comes out on Friday.

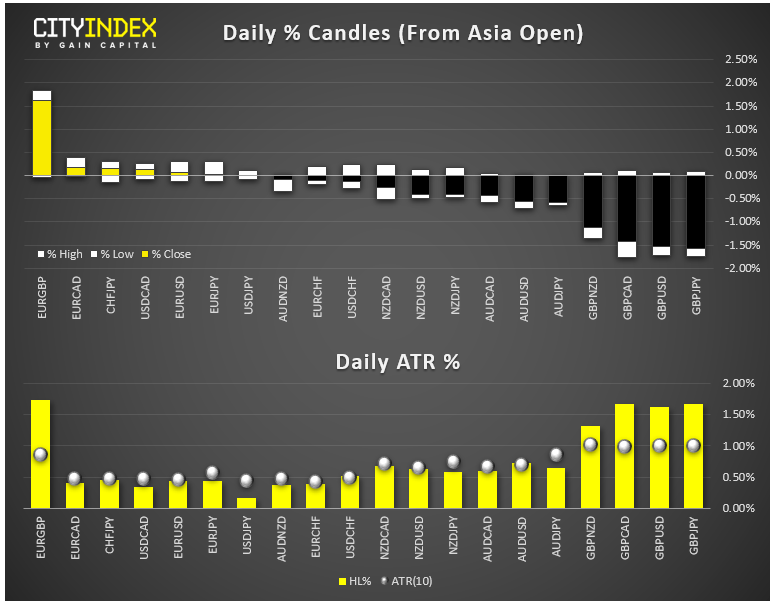

- FX: The British pound was by far the weakest major currency as PM Boris Johnson put a no-deal Brexit back on the table. GBP/USD has now retraced its entire election surge from last week to trade back near 1.31.

- The New Zealand dollar also fell after the biweekly GDT auction showed prices of dairy products, a key export, fell -5.1%. The Swiss franc was the strongest major currency on the day.

- Commodities: Oil gained 1% on the day while gold was essentially flat.

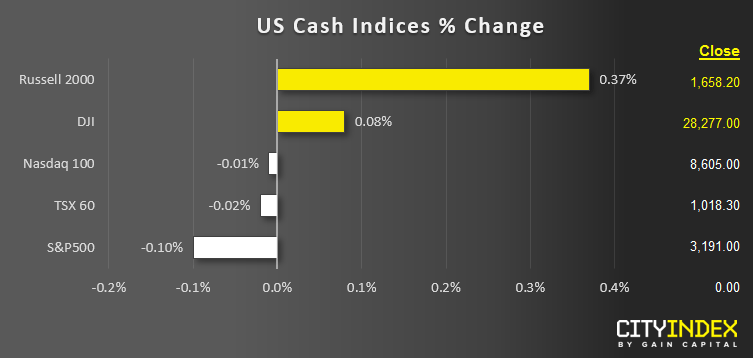

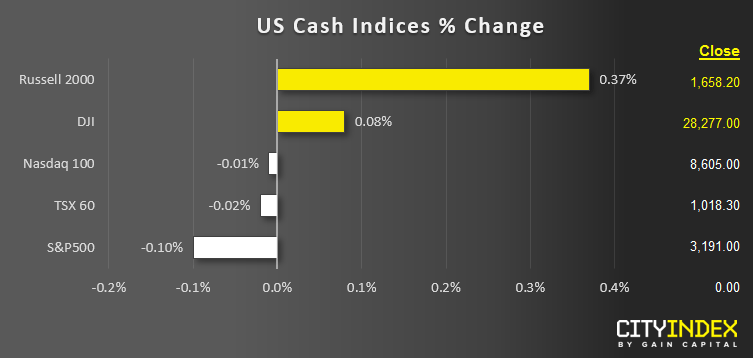

- US indices closed modestly higher on the day. European indices closed mixed, with the UK FTSE 100 flat, while bourses in Germany and France fell. Italy’s FTSE MIB bucked the trend to close the day higher.

- Financials (XLF) were the strongest major sector today; REITs (XLRE) brought up the rear.

- Stocks on the move:

- Netflix (NFLX) gained 4% after revealing strong growth data in overseas economies

- UK healthcare provider NMC Health (NMC) dumped -32% as noted short seller Muddy Waters Research revealed a bearish position in the stock.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM