Market Brief: GBP Rallies as Debate Shifts to When, Not If, There Will Be Another UK Election

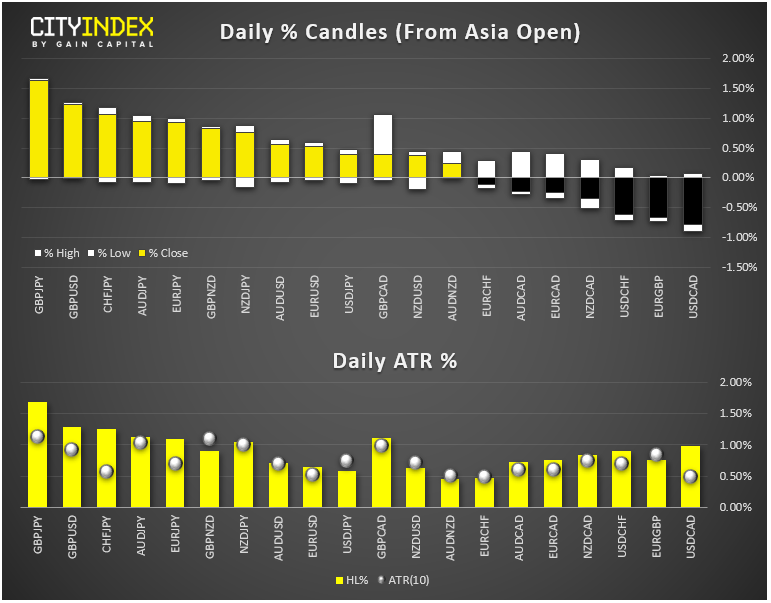

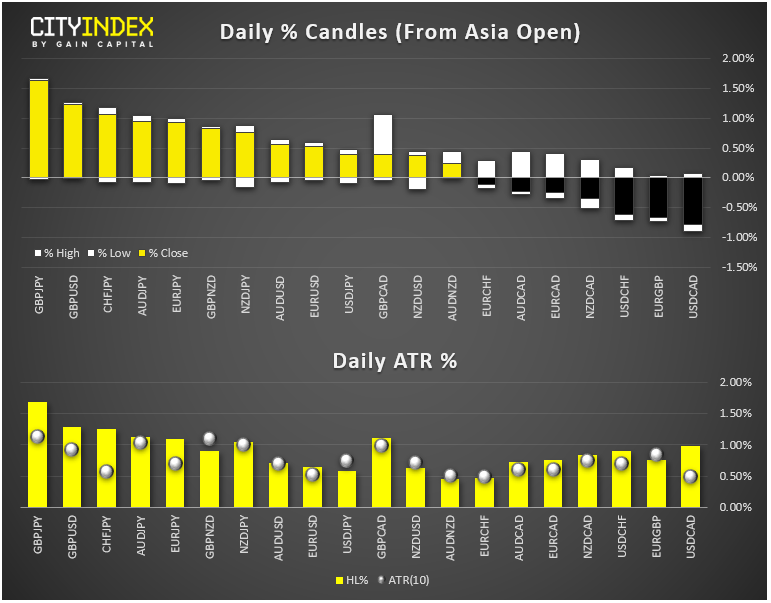

- FX: The pound was the strongest major currency today as Parliament voted to block a no-deal Brexit for at least three more months and the conversation shifted to when, not if the UK would have an election, with PM Johnson pushing for an earlier election (by mid-October).

- The Bank of Canada left interest rates unchanged and failed to hint at a rate cut in October, driving the loonie higher against most of its major rivals.

- Commodities: Oil surged more than 4% on the day on tighter US sanctions on Iran while gold ticked higher to retest last month’s 6-year highs.

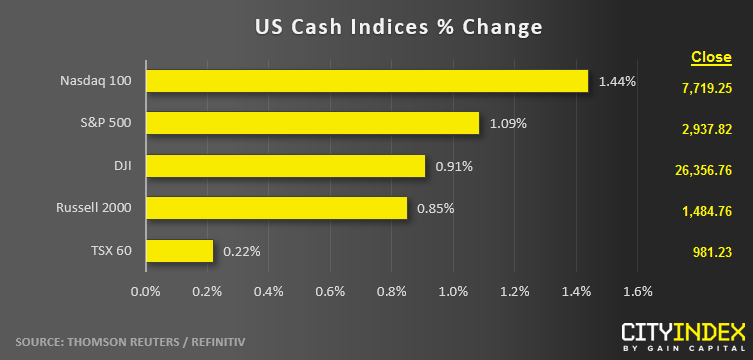

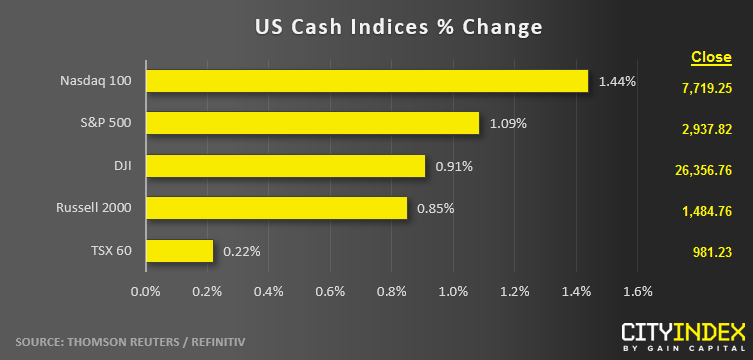

- US indices closed roughly 1% higher on the day, led by the tech-heavy Nasdaq.

- Communications Services (XLC) were the strongest sector on the day while Utilities (XLU) were the worst performer.

- Stocks on the move:

- Guidance cuts galore: Starbucks (SBUX) shares fell -1% after cutting forecasts for the year. Tyson Foods (TSN) shed nearly -8% on lowered guidance of its own. JetBlue (JBLU) shed nearly 5% after reducing its revenue outlook.

- Retailer Michaels (MIK) surged 12% on strong earnings and guidance.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM