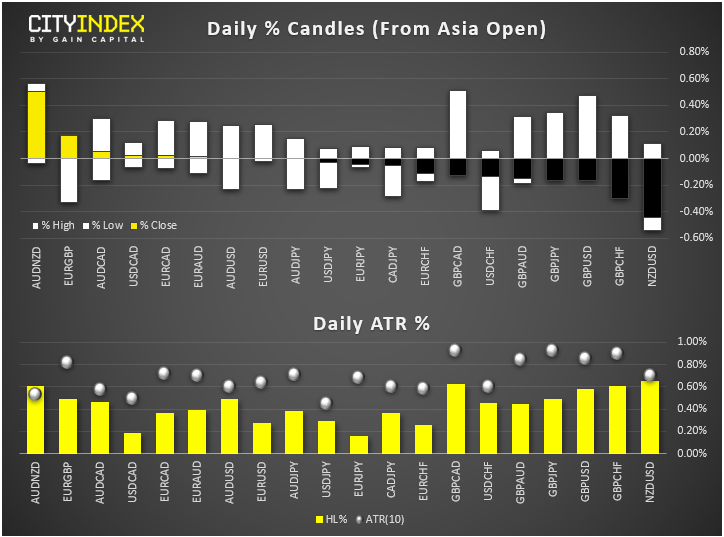

- At midday in London, the GBP has gone from being the strongest yesterday to one of the weakest currencies today, although only bettered by the NZD which tumbled to a new 2019 low against the dollar today.

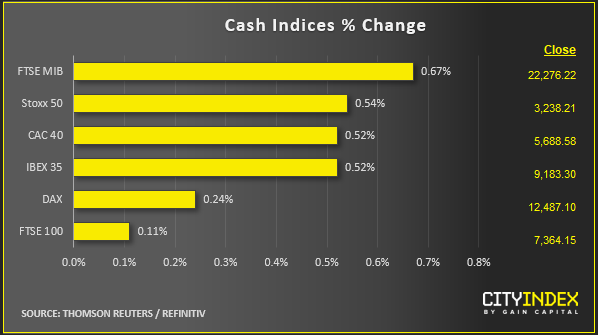

- GBP/USD has come sharply off overnight highs, allowing the FTSE to rebound again, after Irish Foreign Minister dashed hopes a Brexit deal was imminent. At the time of writing, the cable was testing the key 1.2500 area as support, with FTSE being near 7370-80 resistance. Irish Foreign Minister Simon Coveney said: “I think we need to be honest with people and say that we’re not close to that deal right now. But there is an intent I think by all sides to try and find a landing zone that everybody can live with here." On Thursday, the pound jumped to a 2-month high on after European Commission President Jean-Claude Juncker said a deal was possible.

- Key data from North America is Canada’s retail sales due at 13:30 BST. Headline sales are expected to have risen 0.4% month-over-month in July, while core sales are seen rising 0.2% on the month.

- Stock markets remain supported with US equity indices near record levels after a week of central bank bonanza where the message was loud and clear: global interest rates will remain at or near record lows for the foreseeable future. Indeed, the People’s Bank of China became the latest major bank to reduce interest rates overnight. The central bank cut its one-year Loan Prime Rate from 4.25 to 4.20%.

- Corporate news, courtesy to colleague Ken Odeluga:

- Brexit-sensitive shares are in focus after sterling's recent rebound appeared to get fresh legs from fresh Brexit deal optimism, albeit fairly short-lived

- Pound-sensitive FTSE 250 outperformed the FTSE 100 at the open, rising 0.4% vs. +0.1% by the benchmark index, although the latter caught up as the pound eased off its highs.

- Next has rebounded 2.6%, as one of the UK's biggest clothing retailer recoups some Thursday's drop linked to a sales warning. Europe's apparel sector benefits, with M&S, Inditex, H&M and Boohoo also firm.

- House builders advanced, led by Barratt Developments, supermarkets also got a look, triggering rallies of 1%-2% for Sainsbury's, Tesco and Morrisons though UK-focused banks benefited most. Metro and CYBG both rose more than 6% at one point.

- Thomas Cook shares dropped more than 15% to a new all-time low after it requested an extra £200m from stakeholders as the talks continues to finalise the restructuring plan to save the company.

- Rolls-Royce slumped almost 4% after the company said it expects problems with its Trent 1000 engines to take longer than expected to fix.

Latest market news

Today 04:24 AM

Yesterday 10:48 PM

Yesterday 02:00 PM

Yesterday 01:14 PM