Market Brief: FX Subdued Ahead of ECB Tomorrow, US Indices Rally Across the Board

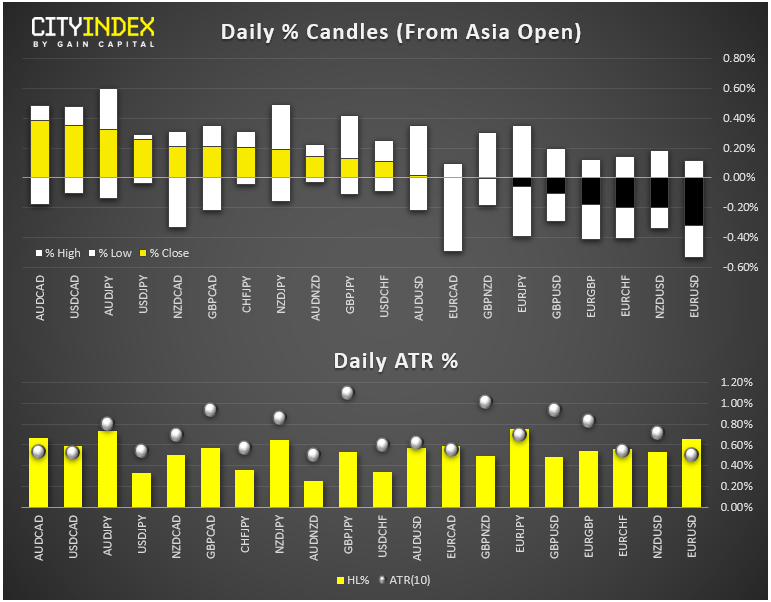

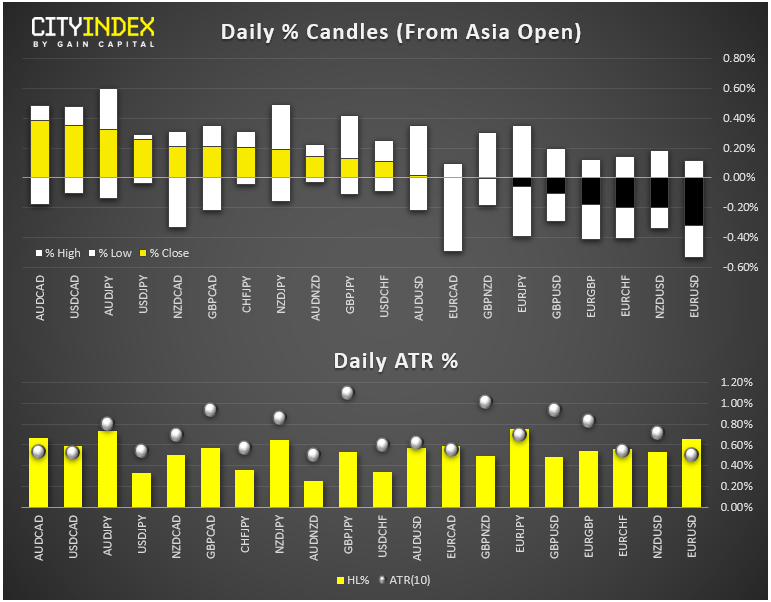

- FX: The aussie was the strongest major currency and the loonie was the weakest as PM Trudeau called for an election on October 21, introducing an element of political uncertainty into the currency. For more on today’s moves and the outlook for major currencies moving forward, today’s articles on GBP/USD and USD/CHF.

- US data: August PMI came in at +1.8% y/y, above expectations of a +1.7% reading. Continued solid inflation readings have caused traders to cut back the odds of a 50bps “double” rate cut from the Fed next week, though a 25bps cut looks like a done deal at this point.

- Separately, President Trump met with his advisors to discuss a possible capital gains tax cut.

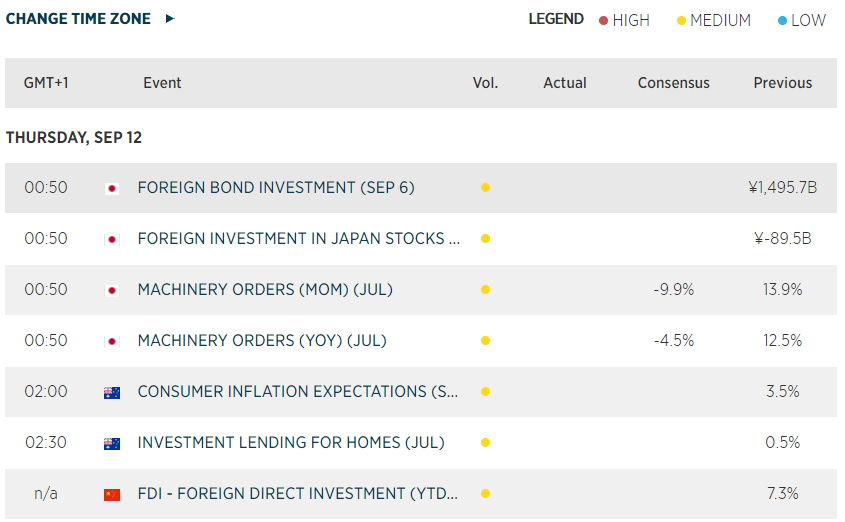

- Tomorrow’s ECB decision will be the week’s marquee event – see our full preview here!

- Commodities: Oil fell around -2.5% on the day while gold edged higher after four straight days of selling.

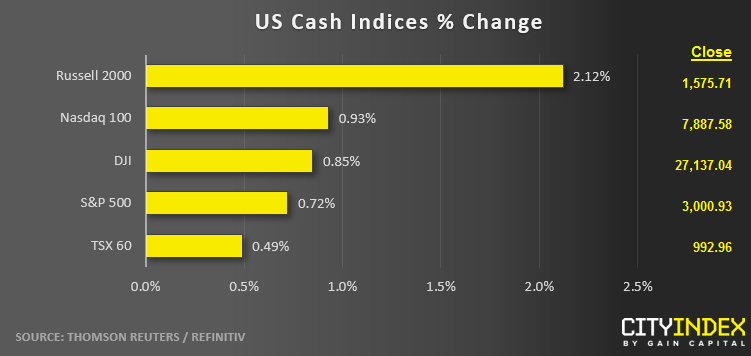

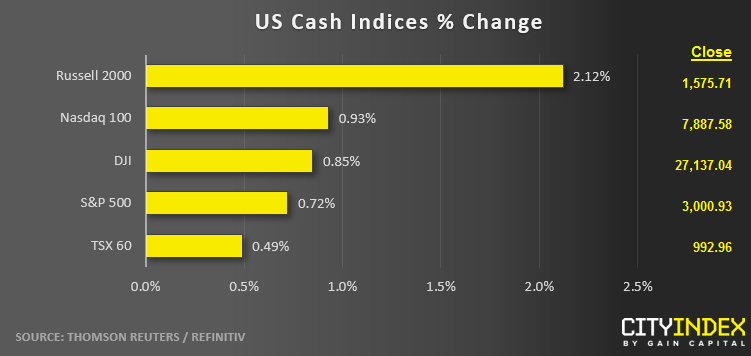

- US indices traded higher across the board, with the tech-heavy Nasdaq leading the way.

- Utilities (XLU) and Materials (XLB) were the strongest major sector on the day, while REITs (XLRE) brought up the rear.

- Stocks on the move:

- A couple of retailers rallied on no company-specific news: J.C. Penney Company (JCP) tacked on 25% today, while embattled Overstock.com (OSTK) gained 7%.

- All was not well for retailers though as GameStop (GME) lost -10% after reporting worse-than-expected earnings.

- RH (RH) rallied 5% on better-than-expected earnings figures.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM