- RBA cut rates to a new record low and retained a dovish bias in their statement.

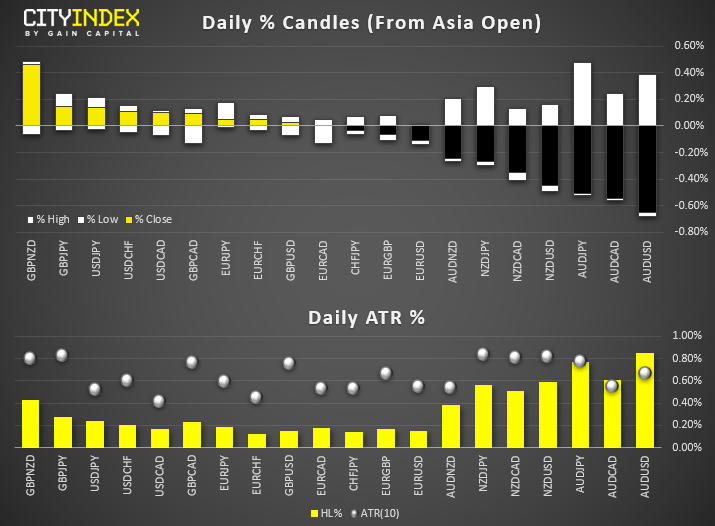

USD remained king in Asia with the US dollar index hitting its highest level since May 2017. - Manufacturing PMI data across Asia saw further deterioration for the sector, with South Korean PMI contracting for a fifth consecutive month and the broader ASEAN read for a fourth. Japan’s PMI finished at a 7-month low, with output and new orders mostly weighing on the headline read.

- Australian building approvals contracted for a third month at -1.1%, missing the consensus view of +2.5%. Private house approvals also declined -2.4%. Separately, Moody’s expect mortgage delinquencies in Australia to continue to rise.

- Bitcoin rallied to a 6-day high following yesterday’s bullish outside candle.

Equity Brief:

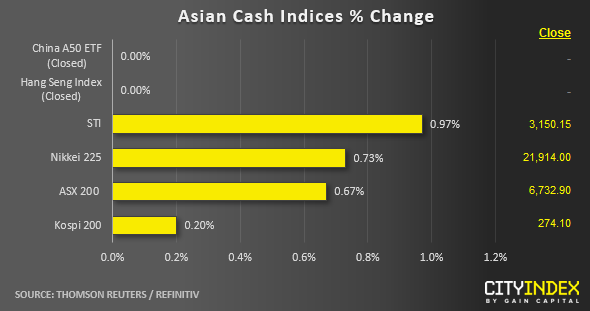

- All key Asian stock markets are showing positive gains today after close to a week of losing streak. The China and Hong Kong stock exchanges are closed today for China’s National Day. Hong Kong will resume trading tomorrow while China stock exchanges will be shut till next Mon, 07 Oct.

- Positive trade flow news is the primary catalyst for the current optimism that downplayed U.S. President Trump’s impeachment troubles. The most hawkish official in the U.S. administration; Peter Navarro, the White House trade advisor has dismissed reports that U.S. is considering delisting Chinese companies from U.S. stock exchanges as “fake news”.

- The current outperformer as at today’s Asian mid-session is the Singapore’s STI which has rallied by close to 1.00%, its best performance seen so far in the past 5 days. Heavy weightage index component banking and high-tech manufacturing related stocks are leading the gain where DBS Group and Venture Corp have advance by 1.36% and 3.98% respectively on the backdrop a positive flash estimate from Singapore’s Urban Redevelopment Authority that has shown overall prices of private homes rose 0.9% q/q in Q3. Also, the positive performance of key U.S. technology stocks seen overnight in the U.S. session where Apple has staged a rally of 2.35% to print a 5-day high.

- The Australia’s ASX 200 has also joined the bullish party wagon in the later part of today’s session as it rallied by 0.66%. RBA has cut its key policy interest rate to a record low of 0.75% as expected. In addition, its monetary policy statement has also hinted more cuts could be on the way due to sluggish wage growth that has dragged down domestic consumption.

Up Next

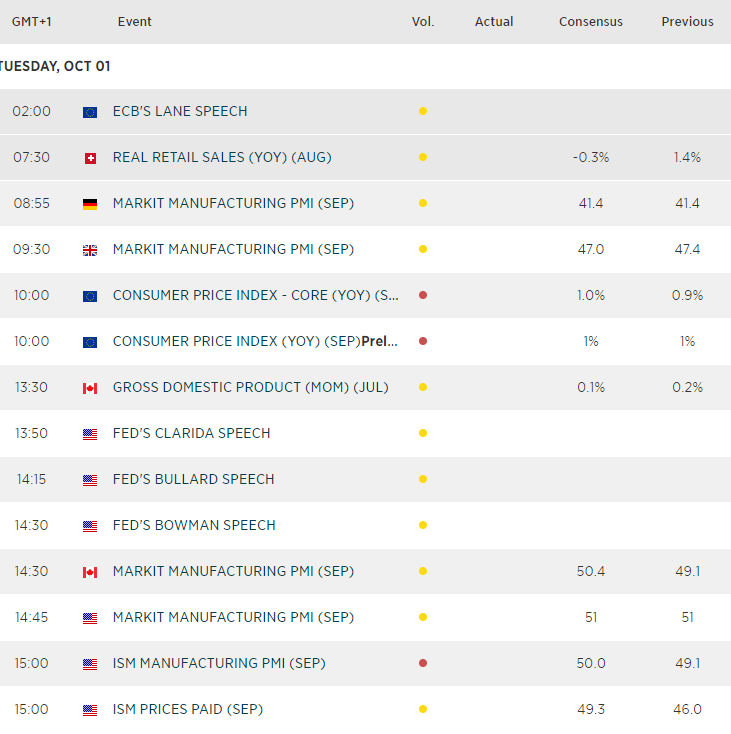

- Preliminary Eurozone Core Consumer Price Index for Sep where consensus is pegged at 1.0% y/y over 0.9% y/y seen in Aug. A weaker print may see further downside pressure in the EUR as ECB is likely to intensify its QE programme.

- RBA’s Governor Lowe’s speech where further dovish remarks may reinforce further downside in the AUD.

- Manufacturing PMI remains the key economic data set for traders as the month gets underway. In September, the ISM manufacturing print contracted (below 50) for the first time in three years. And the sub-indices had little to be desired as well. Analysts are expecting it to cross back above 50 (albeit slightly) but could be taken as a sign that last month was just a blip, if it can indeed expand. Whereas a print below 49.1 could be taken as confirmation that things are not all well with the economy and provide a risk-off theme to the session.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM