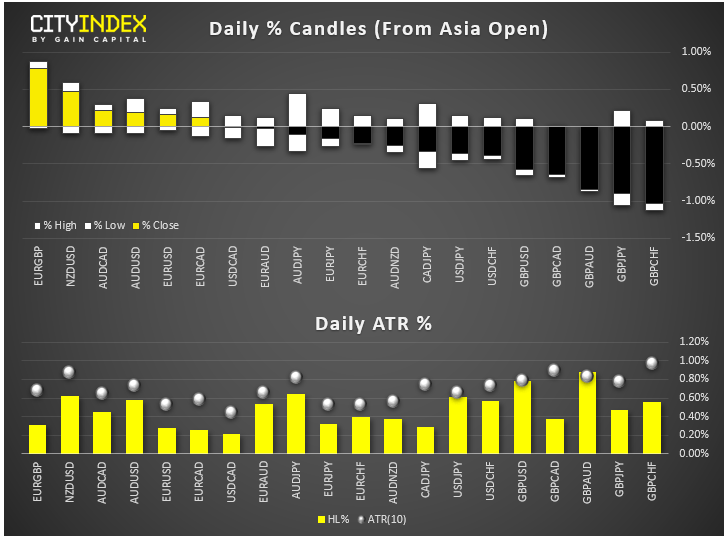

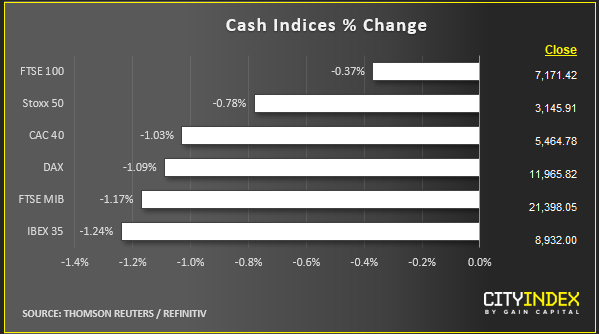

- Just half an hour before the open on Wall Street, the Dollar Index was trading lower again. The likes of the CHF, JPY and EUR were leading the pack. US was lower against most currencies, except the Brexit-hit GBP – which fell sharply. This also explains why the FTSE was outperforming her rivals with only a 0.4% drop, compared with mainland European indices which were down between 0.8 to 1.25 percent.

- Safe-haven gold was shining brightly again after a grim session the day before, as stocks, yields and dollar all fell back, boosting the appeal of safe haven assets

- Stocks fell noticeably after a positive start in Europe. Investors are waiting for the start of high-level trade talks between the US and China, scheduled for later this week. With Donald Trump putting several more Chinese technology companies in a blacklist, investors are erring on the side of caution in case the talks collapse again without any agreement.

- In UK company news:

- EasyJet shares dived after silence on outlook

- London Stock Exchange fell more than 5% after HKEX decided to abandon its bid.

- Two of the UK’s largest listed recruitment groups – PageGroup and Robert Walters – have provided profit warnings, sending their shares lower. They have blamed Brexit uncertainty, Hong Kong protests and US-China trade situation.

- Data recap:

- US PPI (Sept) printed -0.3% m/m, well below +0.1% expected. Core PPI also came in at -0.3%, missing expectations of +0.2%.

- Canadian Building Permits rose 6.1% m/m vs. 2.3% expected while Housing Starts came in at 221K vs. 217K eyed.

- German industrial production rose 0.3% m/m vs. a fall of 0.2% expected – the news boosted the euro. However Italian retail sales disappointed (-0.6% m/m vs. -0.1%).

- Fed Chair Powell is speaking at 18:50 BST

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM