Market Brief: Deluge of US Data Drives Indices to Fresh Records

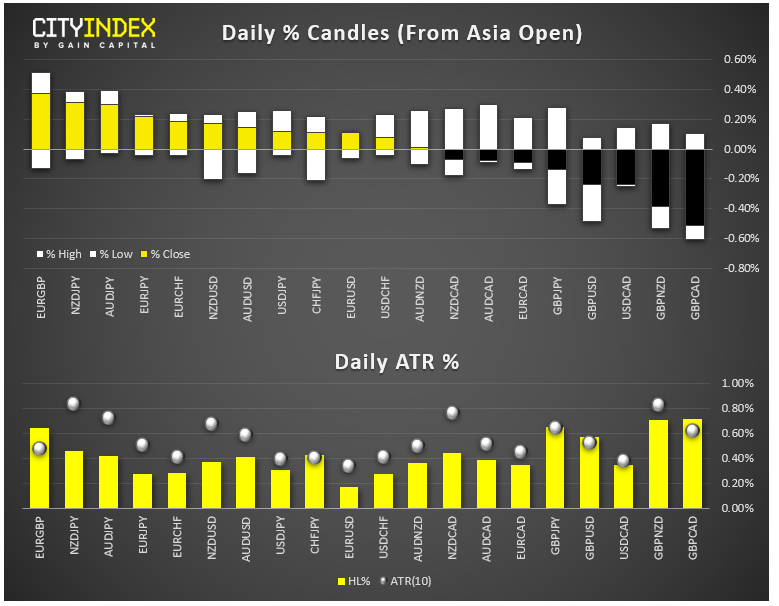

View our guide on how to interpret the FX Dashboard.

- Trade rhetoric was once again front and center, with China expressing optimism and noting that the ball is in the US’s court. For its part, the White House noted that the two sides are “really close” (indeed, in the “final throes”) but “sticking points” remain.

- OPEC is reportedly considering extending its recent production cuts for 3-6mos at next week’s highly-anticipated meeting.

- US data: Conference Board consumer confidence printed at 125.5, a tick below the 127 reading eyed ahead of the crucial holiday shopping season. New home sales beat expectations at 733k annualized. October’s goods trade balance showed a smaller deficit than expected (-$66.5B vs. -$71B) Wholesale inventories rose 0.2% as expected. The Richmond Fed manufacturing index fell to -1, well below the +5 reading expected.

- FX: The commodity dollars (AUD, NZD, and CAD) led the way higher today, while the British pound was the laggard on growing unease ahead of next month’s general election.

- Commodities: Both gold and oil edged higher on the day.

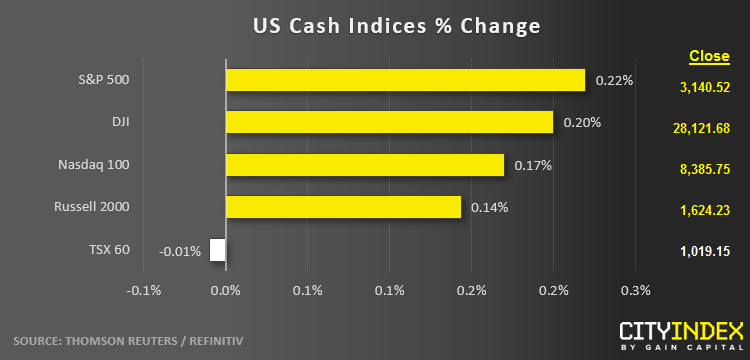

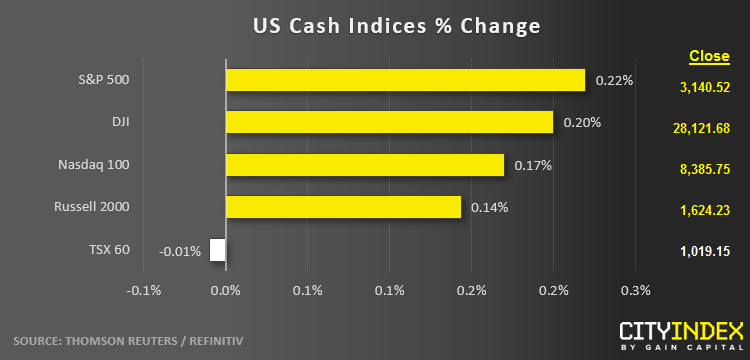

- US indices closed modestly higher, in all-time record territory once again.

- REITs (XLRE) were the strongest sector on the day, boosted by falling interest rates and a strong housing report. Energy (XLE) was the weakest sector, despite the rise in oil prices.

- Stocks on the move:

- Best Buy (BBY) surged 10% after beating earnings expectations and raising guidance ahead of the holiday season.

- On the other side of the retailer coin, Dollar Tree (DLTR) fell -15% today after missing earnings estimates.