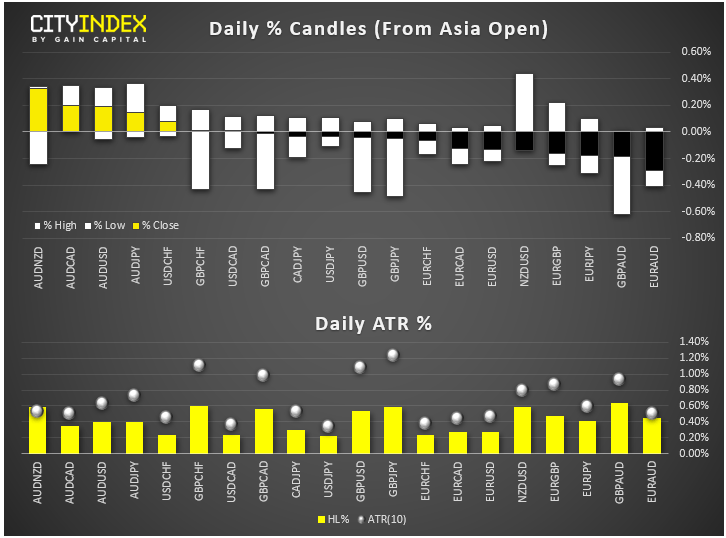

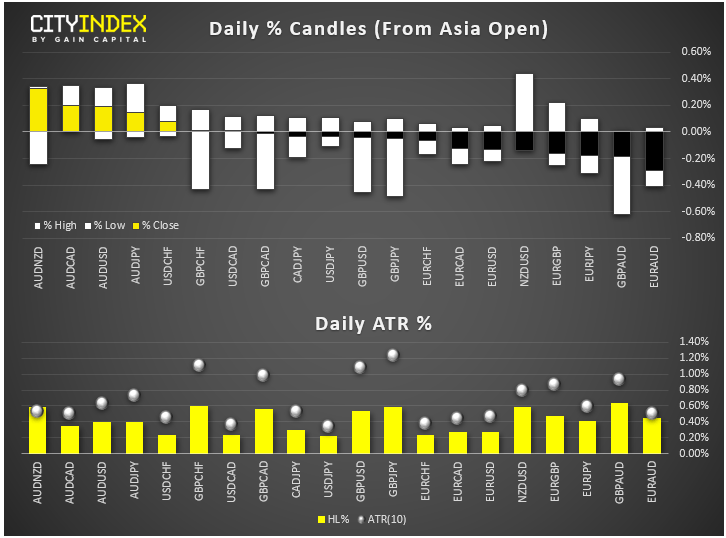

- At midday in London AUD and GBP were among the strongest while NZD and EUR were among the weakest.

View our guide on how to interpret the FX Dashboard

- GBP erased earlier losses after Labour Leader Jeremy Corbyn said his party will now support an early general election in December because his key condition that a no-deal Brexit option should be off the table "has now been met". This is significant because a snap general election could bring back a Conservative majority and end the Brexit deadlock. Corbyn said his party will now “launch the most ambitious and radical campaign for real change our country has ever seen.” Will this include a second referendum?

- NZD gave up earlier gains after New Zealand’s Treasury said they suspect the S&P may remove their positive ratings outlook.

- Among key commodities, both crude oil contracts fell for the second consecutive day on excessive supply concerns, while gold prices fell abruptly to extend the decline from the day before. Gold’s weakness comes as the dollar has regained ground in recent days and bond yields have risen. It is perhaps a sign that investors are pricing in a potentially hawkish rate cut from the Fed - a 25 basis point trim accompanied by a hawkish outlook (e.g. a pause in the cutting cycle). My colleague Matt Weller will be posting a preview for the Fed meeting in due course.

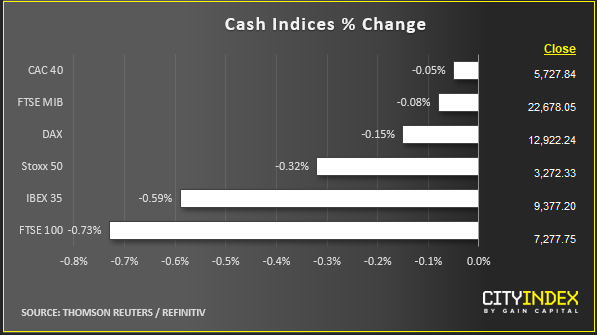

- European stock indices and US index futures have given back some of their gains made from the day before when the S&P 500 burst into a fresh record high amid growing optimism over a truce in US-China trade war with the phase 1 of the trade deal likely to be signed off when Trump meets his counterpart Xi at the APEC Summit on 16-17 November. Today’s small yet noticeable retracement can be explained away by profit taking and as earnings from Google disappointed expectations last night.

- In company news:

- BP (BP) shares fell 2.6% after the company’s profits dropped sharply in the third quarter, thanks to lower oil prices.

- Pfizer (PFE) shares rose more than 3% in pre-market after the drug maker posted a third-quarter profit well ahead of analysts' estimates. Sales of breast cancer drug Ibrance boosted the bottom line. The company also raised its earnings forecast for the year.

- General Motors (GM) saw its shares rise 2% in pre-market after the company reported a forecast-beating profit and said sales of high-margin pickup trucks and SUVs in the US offset the impact of a labour strike and weak sales in China.

- Alphabet (GOOG) reported an EPS of $10.12 after Wall St closed last night compared with $12.35 expected. The stock fell about 1% and hasn’t recovered much since.

- Saudi Aramco is aiming to announce the start of its initial public offering on Nov. 3, says Reuters, citing three people with direct knowledge of the matter.

- It is set to be a quiet day in terms of economic data, ahead of a busy next few days: We have rate decisions from the BoC, Fed and BoJ, as well as more company earnings and top their economic data including US GDP and non-farm payrolls to look forward to. See our week ahead report for details.

Latest market news

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM