- The US dollar held steady after the slightly-less dovish than expected FOMC minutes, although volatility remains subdued ahead of key PMI data from Europe and US and, of course, Jackson Hole Symposium tomorrow.

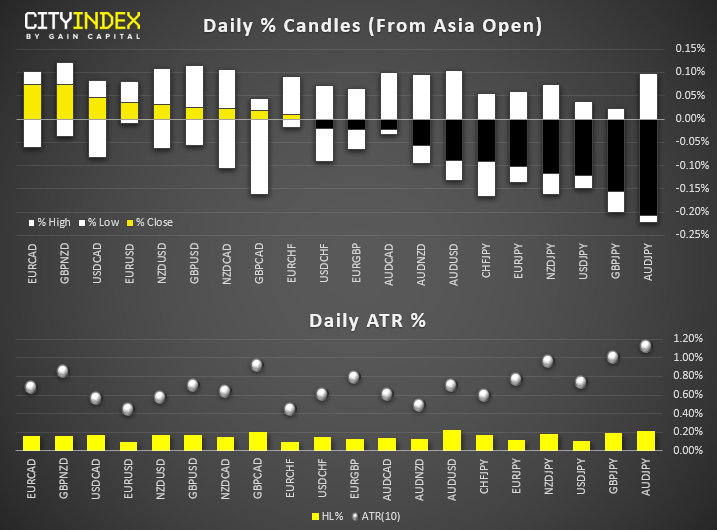

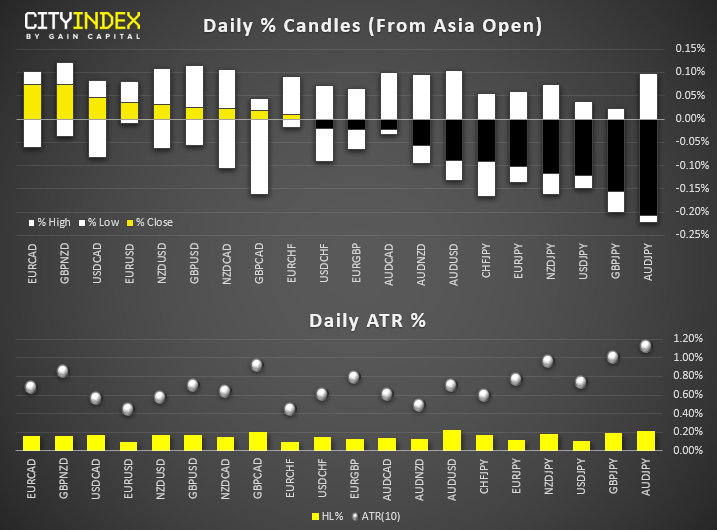

- JPY is the strongest major, NZD and AUD are the weakest.

- USD/CNY nudges its way to a fresh high of 7.073, although USD/CNH (the offshore counterpart) remains beneath cycle highs.

- Macron said that a no-Brexit deal would be Britain’s fault, adding that Boris Jonson’s demands for a renegotiation were not workable.

- Australia’s composite PMI contracted for the first time in 5-months, with services and construction weighing the broader read down. Manufacturing expanded by 51.3 to break a 1-month hiatus within contraction mode (below 50).

- Japan’s manufacturing PMI contracted for a 4th consecutive month, up slightly from 49.4 in July. New orders were also weaker.

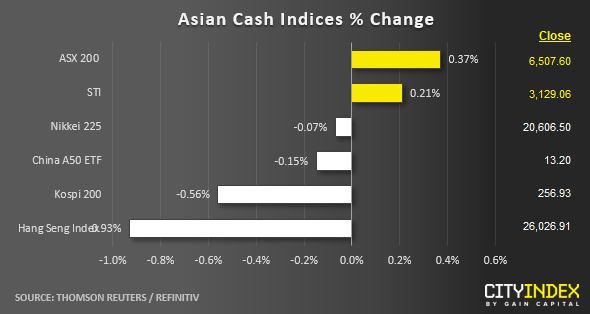

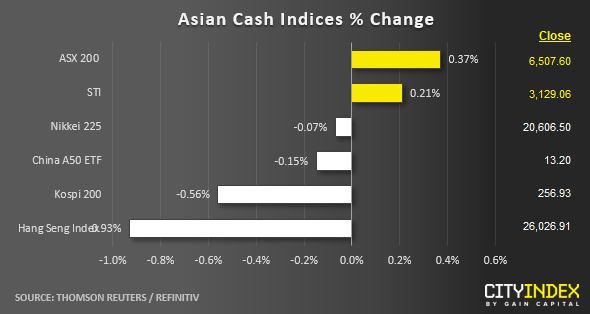

- Ahead of the European opening session, Asian stock markets are trading in a mix fashion despite a positive close seen in the key U.S. benchmark stock indices yesterday; both the S&P 500 and Nasdaq 100 have gained by 0.82% and 0.90% respectively.

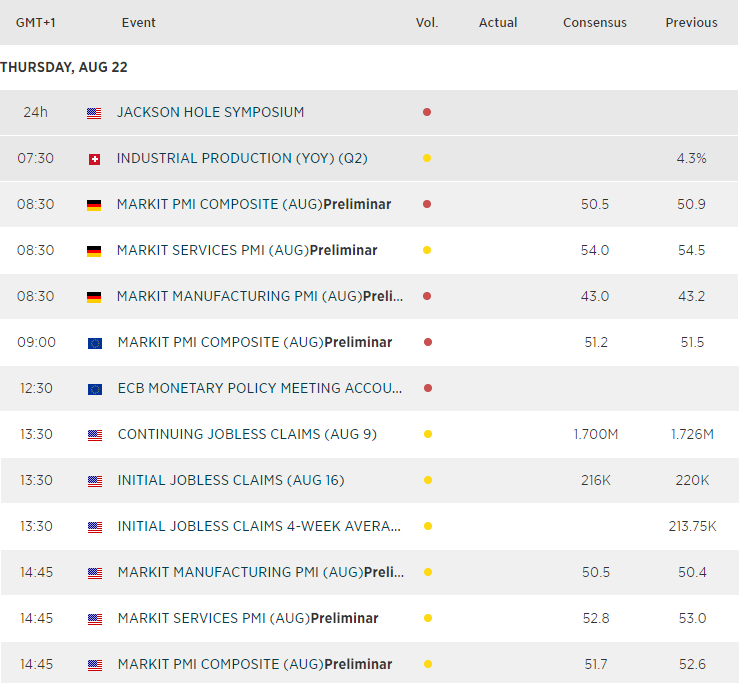

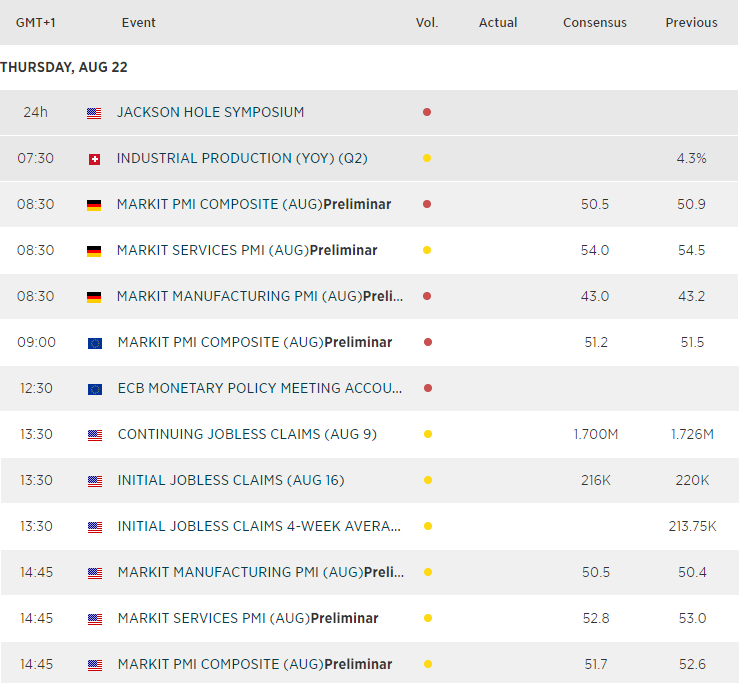

- Market participants now wait for Fed Chair Powell’s speech on Friday, 23 Aug during the Jackson Hole Symposium at 1400 GMT for clues on the Fed’s latest guidance on its monetary policy after yesterday’s release of the previous FOMC minutes that has indicated a diverse set of views from Fed officials.

- The underperformer as at today’s Asian mid-session is Hong Kong’s Hang Seng Index where it has shed -0.98%. Key property developer stocks are the main drag on the HSI; Sun Hung Kai Properties and Henderson Land Development have tumbled by -2.15% and -3.74% respectively.

- After a dismal performance seen yesterday on Australia’s ASX 200, the Index has managed to recover some lost ground by inching up 0.35% supported by the energy sector through better than expected earnings results from Origin Energy and Santos.

- The S&P 500 E-mini futures is showing some profit-taking activities at this juncture where it has inched down by -0.14% in today’s Asia session to print a current intraday low of 2926.

- Similar performance can also be seen on the FTSE 100 and German DAX CFD futures; both are showing losses of around -0.40%.

Up next

- Germany Markit Manufacturing & Services PMI for Aug out at 0730 GMT

- Eurozone Markit Manufacturing & Services PMI for Aug out at 0800 GMT

- U.S. Markit Manufacturing & Services PMI for Aug out at 1345 GMT

- A weaker than expected PMI data is likely to increase the impetus for ECB and Fed to implement more easing policies.

Latest market news

Today 08:33 AM

Yesterday 11:48 PM