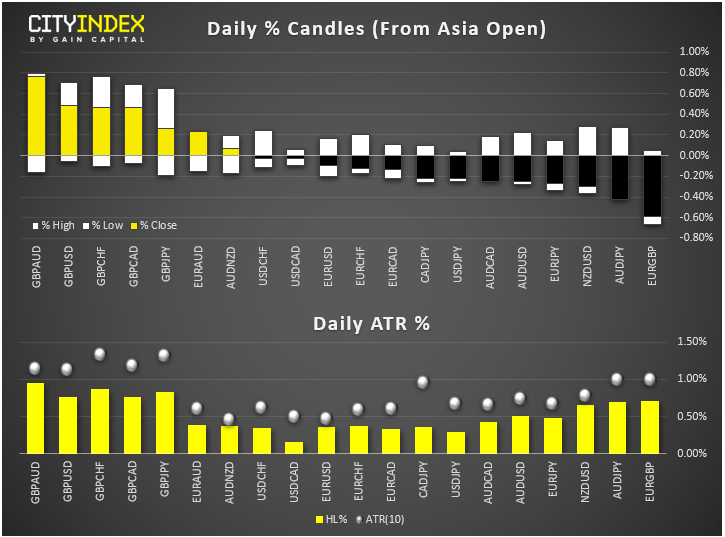

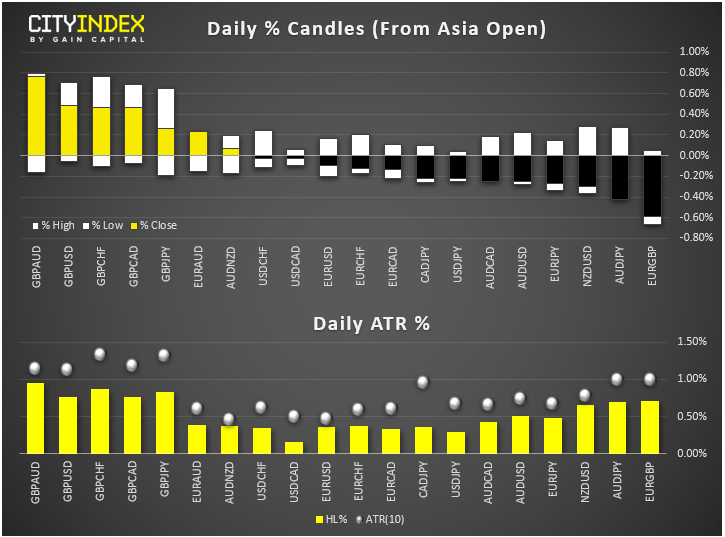

- At midday in London, GBP was the strongest and AUD among the weakest. Gold was trading higher, copper and oil lower. Stocks were coming off their best levels after futures rose earlier in the day.

- GBP was holding steady following recent sharp gains, undermining the FTSE. The EU's chief negotiator Michel Barnier, who had previously said "big gaps" remained between the UK and EU, has now said a Brexit deal could be struck as early as this week. However, he has warned it was "time to turn good intentions into legal text". The UK and EU officials are set to meet at a summit on Thursday and Friday. This meeting could determine whether UK is headed for a no-deal Brexit at the end of this month.

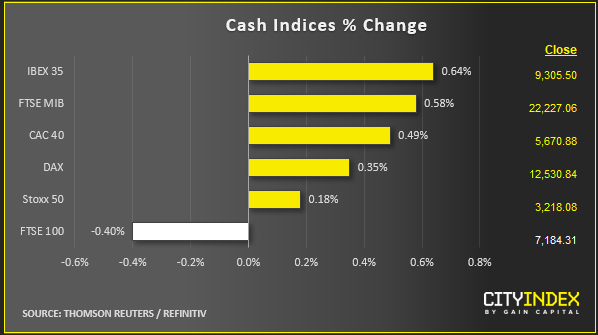

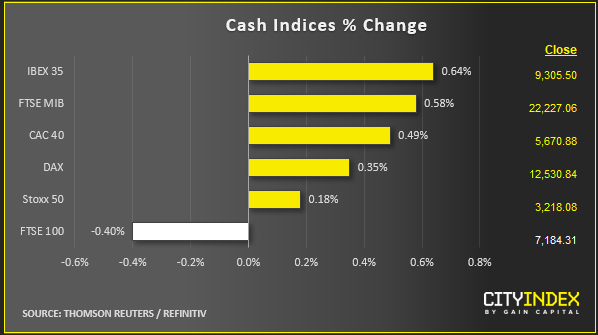

- European stocks were sharply higher earlier but gave up some of those gains after Bloomberg reported, citing people familiar with the matter, that China will struggle to buy $50 billion of US farm goods annually unless Washington removes retaliatory tariffs so they can afford it. The focus will turn to US Q3 earnings reporting session, which kickstarts this week. Lots of bank earnings will come in over the next few days, including Citigroup, JP Morgan, Goldman Sachs and Wells Fargo today and Bank of American tomorrow. HERE is my colleague Ken Odeluga’s bank earnings preview.

- Data highlights

- The German ZEW Survey revealed the “Current Situation” index deteriorated more than expected (to -25.3 vs. -19.9 in September and -23.6 expected), while the “Expectations” index deteriorated less than expected (-22.8 vs -22.5 last and -26.4 expected).

- Supported by raised Brexit optimism, the GBP barely reacted to news UK wages grew less than forecast at 3.8% 3m/y vs. 4.0% eyed or the fact the unemployment rate ticked higher to 3.9% y/y from 3.8% last. Sterling did ease off the highs but was still retaining most of its gains.

- Overnight, Chinese CPI inflation came in at +3.0% y/y, above 2.9% expected and 2.8% last. However, PPI measure of inflation declined 1.2% y/y as expected (vs. -0.8% prior). In other news, US President Donald Trump imposed steel tariffs on Turkey Monday night and threatened there could be more to come. This comes after Turkey’s military movement into Syria. The USD/TRY exchange rate was relatively stable at around 5.900

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM