- AUD/USD hit a 6-day high after GDP came in as expected, with markets seemingly pleased it didn’t undershoot expectations.

- Sentiment was lifted when China’s service PMI expanded at its fastest rate in 3-month, at 52.1 (below 50 denotes contraction). Hiring in the sector increased at its fastest rate in over and year and new orders rose.

- Japan’s service PMI slightly missed expectation at 53.3 vs 53.4 expected yet is clearly expanding as it is above the 50 threshold.

- BOJ’s Kataoka said that cutting rates is the most effective tool to lift the economy, and the central bank should act pre-emptively when economic, price risks rise. That said, he is the minority dissenter of recent BOJ decisions, so likely doesn’t currently speak for the team.

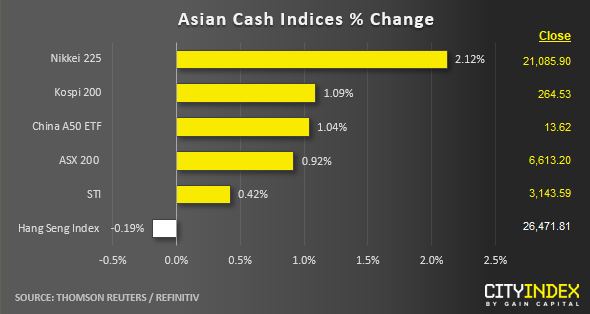

- The Hang Seng index broke abruptly higher on news that Carrie Lam is to officially withdraw the China-Hong Kong extradition bill, which has been at the centre of riots in recent weeks.

- Asian equities were firmer on upbeat service PMI data, led by Chinese forms and tech stocks.

- The ASX200 recouped earlier losses sustained on soft GDP data, and trades just -0.31% on the session (the session low was -7.7%).

- Huawei have accused the US of trying to coerce and entice staff members in providing company information.

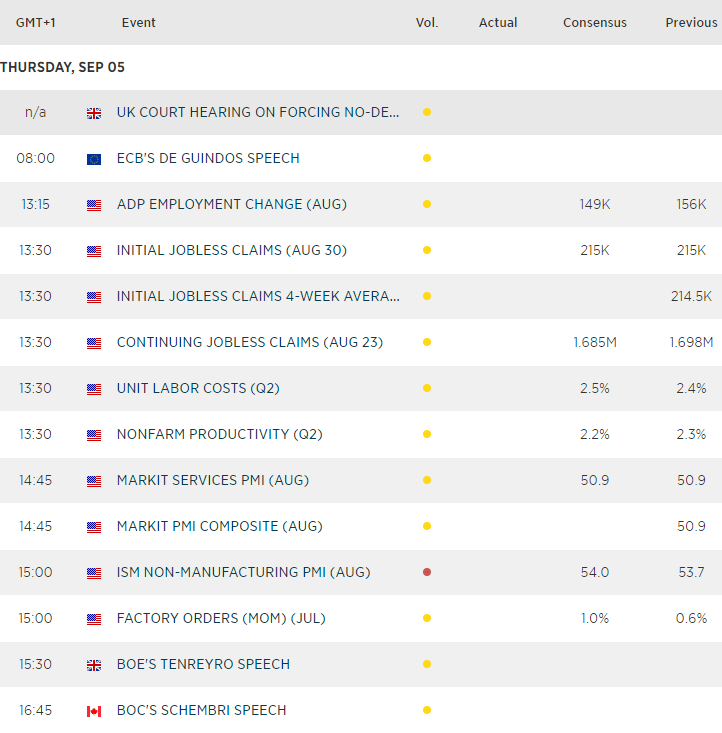

Up Next:

- Expect a lot of headline risks for GBP surrounding Brexit developments. Parliament set to vote on whether MP’s will take control of the House of Commons business, which could trigger Labour’s plan to block a no-deal Brexit which, in turn could then trigger a snap election.

- Service PMI’s for France, Germany and Eurozone are in a couple of hours. Given that manufacturing PMI’s have been contracting of late, it will be up to the service sector to keep the broader outlook afloat. Any weakness here only exacerbate calls for a global slowdown. Euro crosses and European equities are markets to keep in focus.

- BOC hold their cash rate meeting. The probability of a cut has edged lower to just 10% from last week and we’ve not heard any dovish comments from BOC members in the lead-up to guide markets for a cut. That said, this will only make the moves larger if we find out they do surprise markets with a cut, or add a more dovish tone to their statement. CAD crosses will be in the crossfire with this one.

- A host of central bankers speak today, kicking off in the European with Christine Lagarde who’ll be fielding questions from lawmakers before her vote for candidacy (to replace Draghi). BoE’s Mark Cary present’s the latest inflation report to the Treasury select committee. In the US session we have several Fed members speaking. Whilst a cut is already priced in for September, there have been murmurs of a 50bps cut, so we’ll be keeping an ear out to see if they align their views once more.

Latest market news

Today 08:18 AM

Yesterday 10:40 PM