Stock market snapshot as of [10/10/2019 2:16 PM]

- So it begins. For European stock market sentiment, the first substantive U.S.-China talks since July may be the single most important event of the year, outside of monetary policy decisions. Investors in the region’s dominant car industry in particular, have been on tenterhooks for more than two years, after then recently elected U.S. President Donald Trump, signalled a combative approach to trade matters with executive orders calling for tighter tariff enforcement and reviews of trade deficits and causes.

- Over the last two years, the STOXX Europe 600 Automobile & Parts sub-index, underperforms even the sector gauge for Europe’s embattled banks, falling 20% since the beginning of 2017 vs. STOXX Financials’ 16% fall. The U.S. is by far the biggest export market for European cars at 29% of the total. Little wonder the Washington-Beijing dispute is seen as a template for potential outcomes in Europe

- As such, any signs of a toughening stance on Chinese trade, rather than the thin beginnings of de-escalation that markets hope for, would probably widen the underperformance of Continental shares to the U.S.

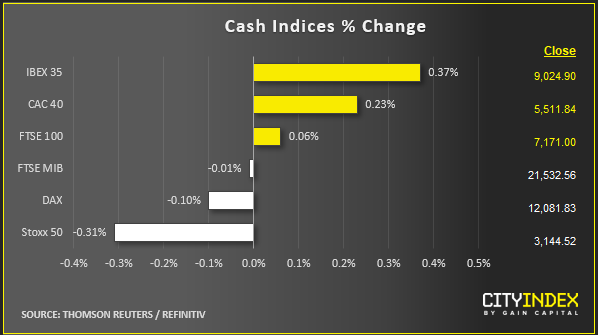

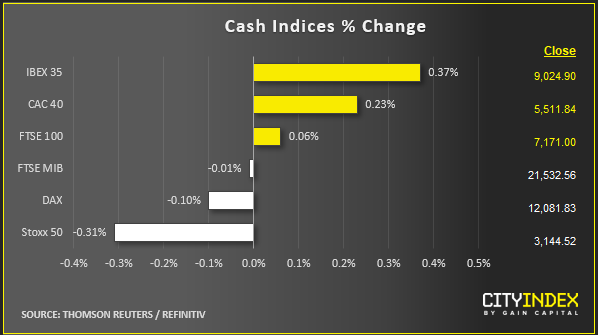

- Principal European indices continue to drift, albeit many smaller markets remained in positive territory, alongside France’s CAC-40. Virtual radio silence from Washington and Beijing as talks get underway, means Europe has avoided whipsaws that rocked the Asian equity session amid conflicting trade reports.

- Bunds, gilts and Treasurys yields are also moving sideways as investors await news. U.S. futures have been stuck slightly lower for most of the day

- Automobiles are also at the heart of the other political crises that’s coming to a head right now. The potential that EU-UK trade will revert to 10% WTO tariffs is a massive red flag for the industry, with the UK’s best-selling five cars alone currently manufactured in Germany

- In Brexit, only the clock is in motion. Talks remain stuck on the same key points that have stymied progress for multiple months. Last ditch talks slated on Thursday between Prime Minister’s Boris Johnson and Leo Varadkar, of Ireland might be all that stands between Johnson and the humiliating task of having to request an extension. Doing so would also very probably fire the starting gun on the process of a UK election. Meanwhile, UK economic counters continue to slip as shown by data out earlier. Therefore, further sterling pressure from here is an increasingly reliable prediction

Stocks/sectors on the move

- Those sensitive car shares are among the best performers in Europe, with components and parts makers, like Faurecia, Valeo and Continental AG rising as solidly as Daimler, Volkswagen, BMW and others, though Peugeot’s 2% advance kept it in front of relief hopes

- Beleaguered bank stocks also shone, though with swathes of non-cyclical segments, like consumer staples, utilities and health care lower, the STOXX had ticked down 0.2% into Wall Street’s open

- There, expect some focus on Bed Bath & Beyond among closely watched shares, as it appoints a new CEO after a fairly long search. The stock points about 20% higher

- Delta Airlines will also be watched after its fourth quarter EPS forecast was deemed questionable, leaving the stock down 4% in pre-market trade

- HP Inc’s woes continue on a Goldman downgrade. The legacy hardware name’s major restructuring announcement last week saw the stock lose almost 10% and it’s facing another slide of at least 2% on Thursday

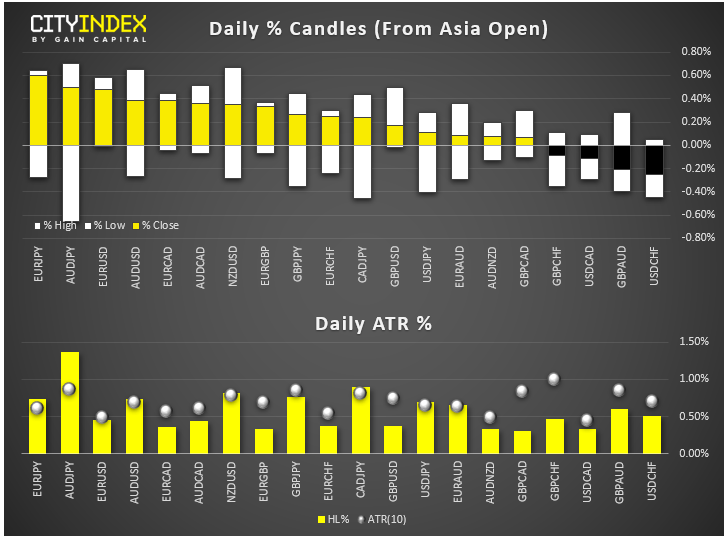

FX snapshot as of [10/10/2019 1:45 PM]

FX markets and gold

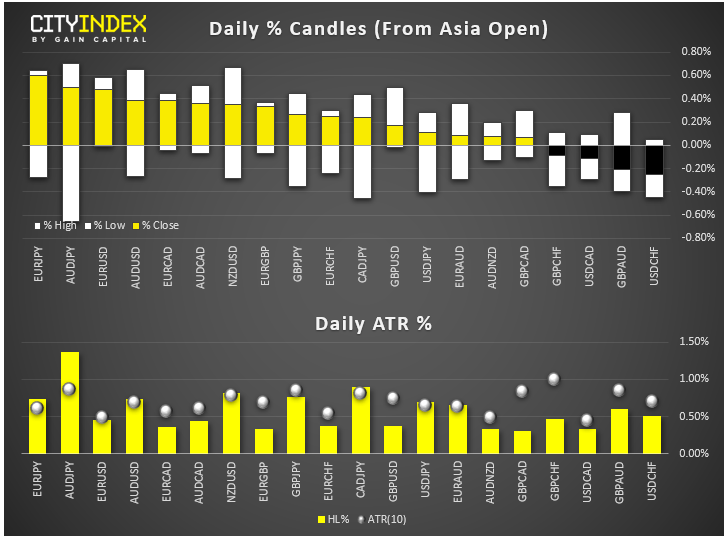

- Weak U.S. CPI that saw the core gauge dip to zero in September looks to have reined in a dollar rebound, though the greenback remains in a steady rising trajectory that’s resulted in a 1% rise from early-October lows against the yen

- Dwindling Brexit deal hopes are bringing an eerie calm to sterling trading and implied volatility as much as they’re keeping tension and uncertainty high

- A tell-tale shift to haven-seeking is well evident in a creeping Swiss franc rise against the dollar and sterling, though the yen finds least resistance for gains vs. the Aussie risk proxy for now

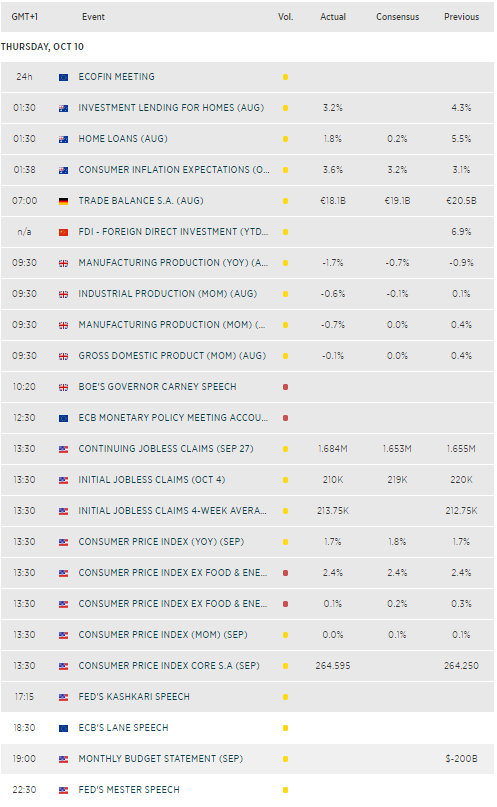

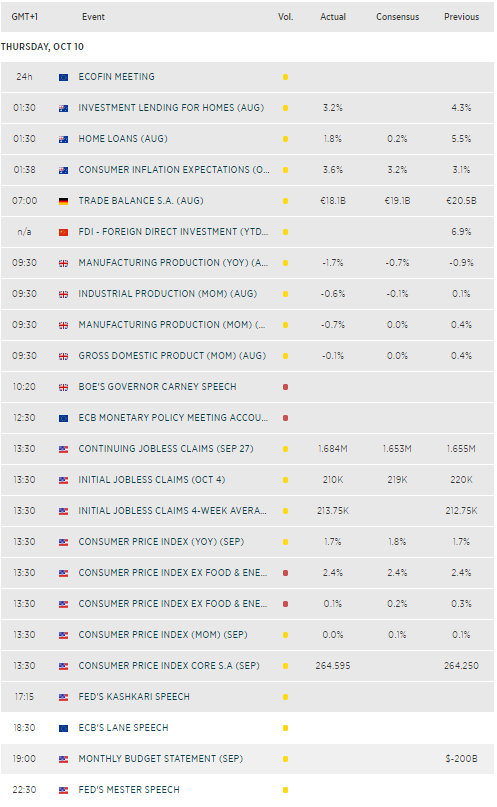

Upcoming economic highlights

Latest market news

Today 01:15 PM

Today 07:49 AM

Today 04:24 AM