Market Brief: Canadians Head to the Polls – Will Trudeau Prevail?

- UK Speaker Bercow prevented a “meaningful vote” on BoJo’s Brexit deal, though the EU withdrawal deal could still be voted on sooner rather than later. PM Johnson continues to push for the UK to leave the EU at the end of the month, with a deal or without, while traders continue to expect big moves out of the pound. The vote takes place tomorrow at 18:00 GMT.

- Separately, policymakers on both sides of the Pacific spoke positively about the prospects for the “Phase One” trade agreement between the US and China, highlighting the potential for December tariffs to be averted.

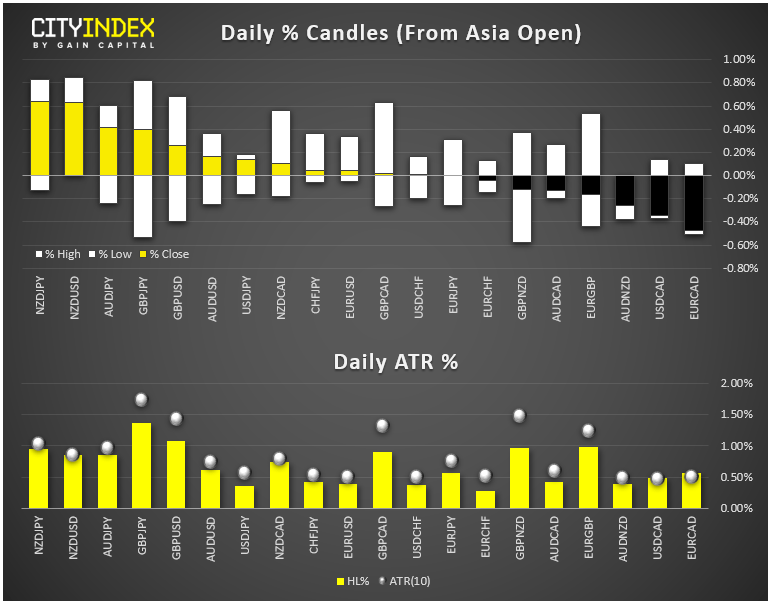

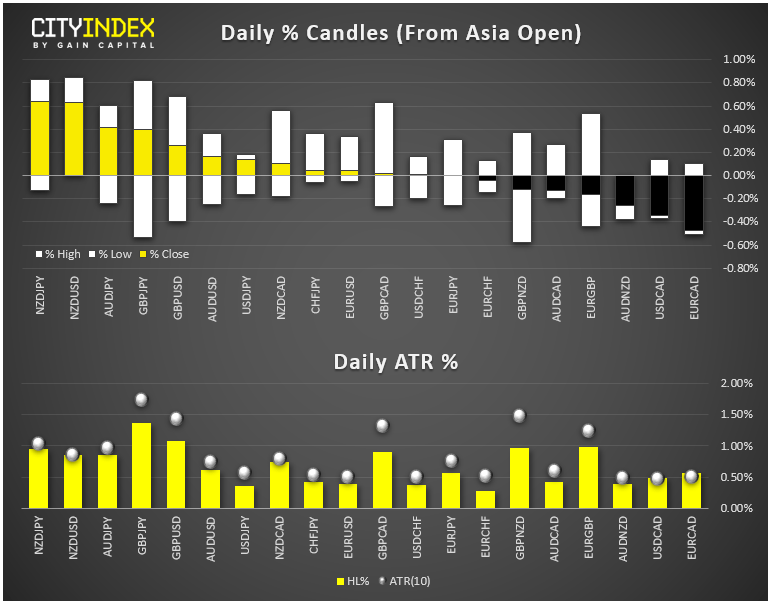

- FX: The loonie was the strongest major currency heading into tonight’s Federal election (see our preview of the vote here), taking USD/CAD to its lowest level in three months. The Japanese yen was the day’s weakest major currency.

- Commodities: Both gold and oil edged less than -1% lower on the day.

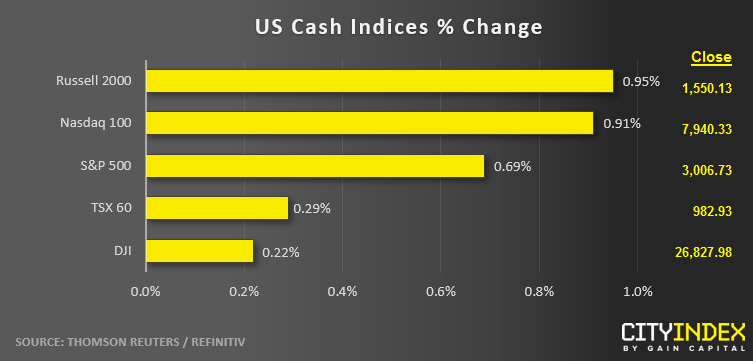

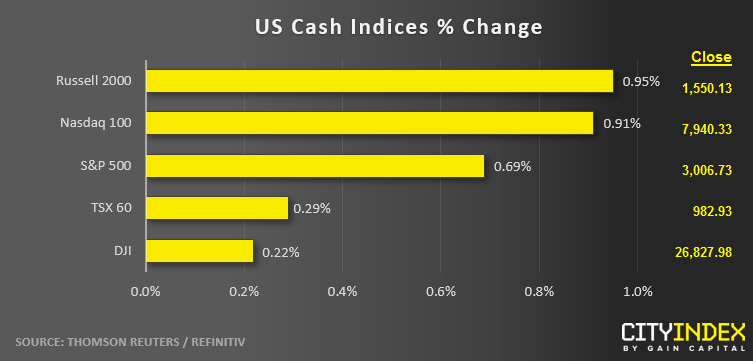

- US indices closed higher on the day, led by the tech-heavy Nasdaq index.

- Energy stocks (XLE) led the way higher on the day, while Materials (XLB) were the laggards.

- Check out the key economic events and themes we’ll be watching in the coming week!

- Stocks on the move:

- Halliburton (HAL) gained 6% after reporting solid earnings, though the company’s revenue did miss expectations.

- After gapping nearly 30% higher at the open, oil infrastructure firm McDermott International (MDR) reversed lower and ultimately shed -13% amidst talks that it was considering restructuring its balance sheet.

- Boeing (BA) dropped -4% on continued fallout from Friday’s report that the company misled regulators around its 737 MAX jet.

- Snapchat (SNAP) tacked on 8% in today’s trade in the runup to tomorrow’s hotly-anticipated earnings report (after the bell).

- Apple (AAPL) rose 2% after Raymond James analysts raised their price target to $280.

*There are no high-impact macroeconomic events scheduled during today’s Asian session trade.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM