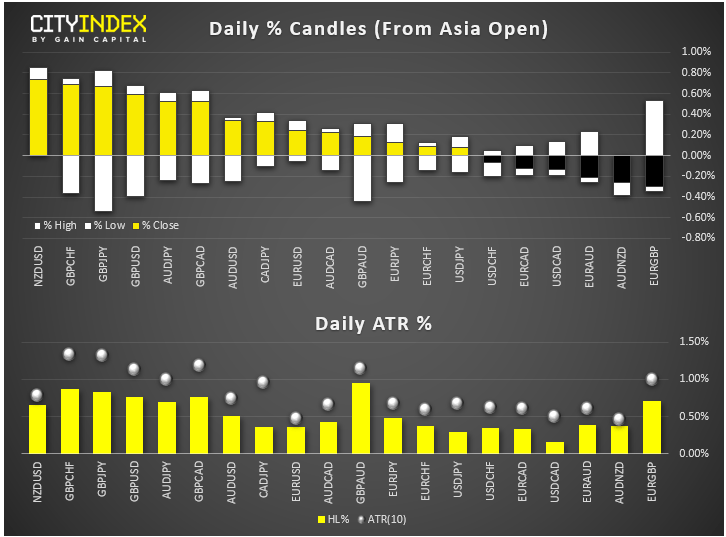

- Market snapshot: At 13:00 BST, NZD and GBP were among the strongest and JPY and USD the weakest. Stocks were on the rise, and commodities mixed. It was risk ON ahead of the open on Wall Street.

- Brexit update: The UK parliament triggered the Letwin amendment on Saturday, which effectively meant the “meaningful vote” was delayed. However, reports that the government may have the required number of votes to secure a deal saw the GBP quickly regain its poise, causing the GBP/USD exchange rate to break above the 1.30 handle this morning. The UK government is still seeking a meaningful vote later today but the decision whether to allow it is in the hands of Commons speaker John Bercow.

- Canada elections 2019 is underway today and it be a hotly-contested race. Incumbent Prime Minister Justin Trudeau is desperately seeking a second term for his Liberal Party but the latest polls from CBC news shows his party is holding an average of 32% of support, only just ahead of the Conservative Party which is trailing at 31.6%. HERE is what we think the result of the elections mean for the Loonie.

- Commodities: Silver was attempting to break higher, but gold remained range-bound as investors weighed the impact of falling dollar against a still-buoyant stock market. Will silver follow the lead of copper and palladium and rise, or will gold hold it back? We are turning bullish on the white metal for THESE four reasons. Meanwhile, crude oil extended its losses this morning after Friday’s breakout attempt failed as investors worried about rising US supplies. However, oil prices were rebounding off their worst levels at the time of writing. The upcoming earnings will provide clues about the level of demand for the black stuff.

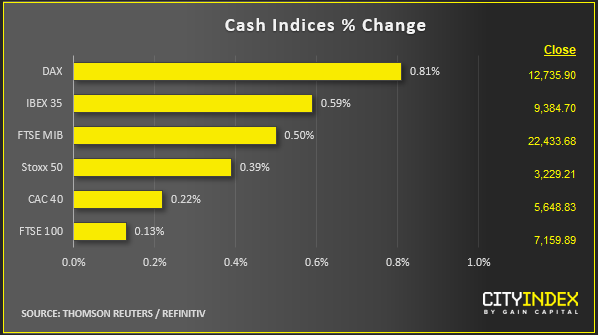

- Stocks: were marginally highs in Europe with the DAX outperforming with a gain of 0.8% while the FTSE was just about in the positive territory, weighed down by the appreciating pound amid Brexit optimism. Sentiment remains supported – for now – amid growing optimism over resolutions for Brexit and US-China trade deal. On a micro level, US earnings will be in focus this week, although there aren’t any big household names reporting today.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM