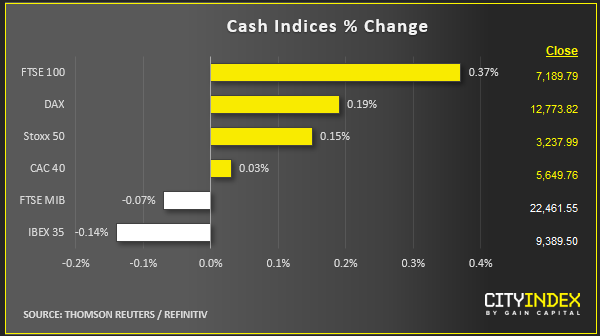

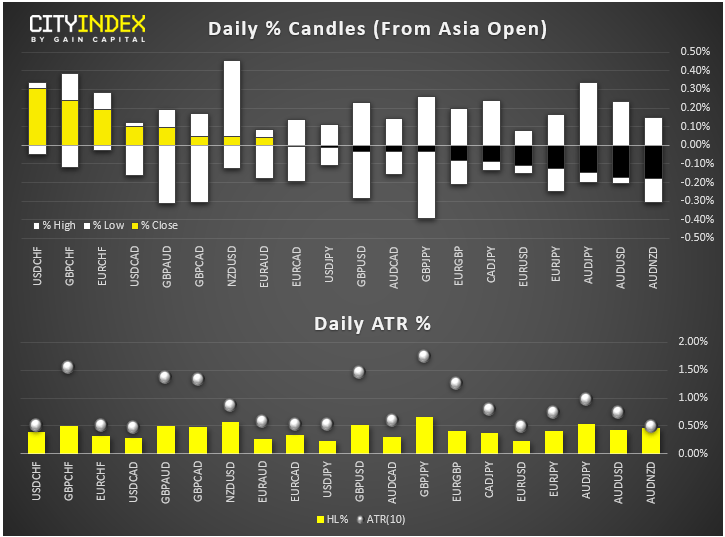

- At 12:40 BST in London, NZD and USD were among the strongest in FX while CHF, AUD and CAD were among the weakest. Volatility was on the thin side amid the lack of any important macro data. Stocks were mostly higher, recovering from a weaker open. Commodities were mostly higher including gold, silver and crude oil, while copper was a touch lower.

- In a largely data-void session, the focus remained predominantly on Brexit, thawing US-China trade dispute and corporate earnings.

- On the trade front, US President Donald Trump said a deal with China was “coming along very well,” while China’s vice foreign minister said some progress had been made. Hopes that a deal will be agree upon in the coming months has kept the stock markets supported despite growing concerns over valuations and weaker earnings guidance amid a slowing global economy.

- The Canadian dollar gave back some of its recent gains after Prime Minister Justin Trudeau hung onto power following Monday’s election. His Liberals were reduced to a minority government, winning only 156 seats (a decrease of 21). A potential coalition with the left-leaning New Democrats (who won 24 seats) will give them a majority in the 338-seat House of Commons.

- The pound held below $1.30, giving back some gains, as investors awaited fresh developments in parliament today. Prime Minister Boris Johnson will be trying to push legislation through to enact his EU exit deal within just three days and fend off attempts by opposition MPs to attach a second “confirmatory” referendum to a Brexit deal.

- Company news was light too:

- Shares in Reckitt Benckiser dropped sharply after the British household goods maker cut its full-year sales forecast for the second time this year.

- Logitech shares climbed after the Swiss tech firm reported a 4.5% increase in quarterly operating income.

- UBS led financials higher after the Swiss banking giant posted a loss which was smaller than expected.