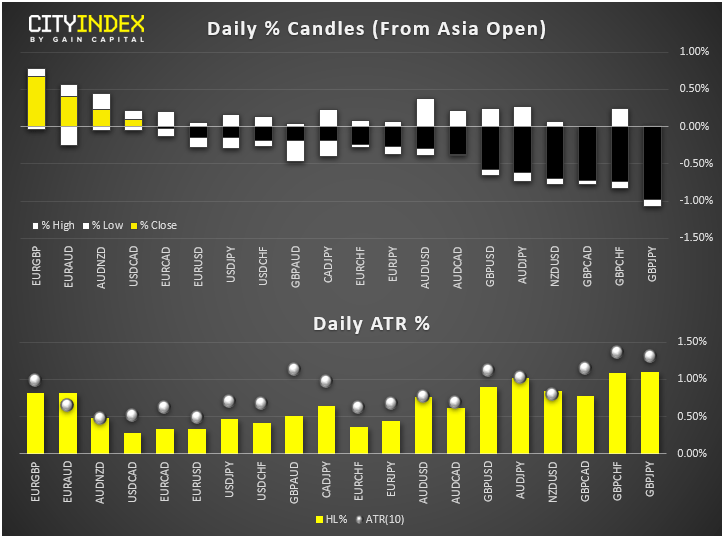

- At 12:30 BST, GBP was the weakest and JPY the strongest among the G10 currencies. Elsewhere, stocks were lower following Friday’s rally, gold was higher again and Bitcoin was flat.

- The pound gave back some of the sharp gains it made at the back end of last week, when optimistic investors rushed to buy the beleaguered currency at oversold levels as hopes were raised that the EU and UK were finally reaching a Brexit agreement. However, as my colleague Fiona Cincotta noted earlier, “hopes of a resolution were dashed after EU negotiators commented that they are not getting even into the ballpark range of where they would like to be with negotiations. This gives Boris Johnson only one more week to pull the rabbit out of the hat…”

- The euro found some mild support on the back of news Eurozone industrial production rose by an above-forecast 0.4% in August. However, China’s exports and imports shrank more than expected in September, weighing on the Aussie and Kiwi.

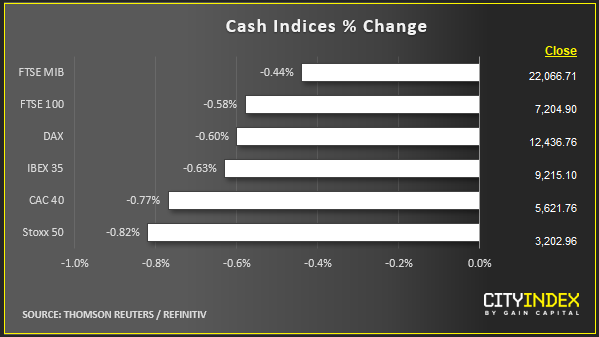

- STOCKS: After a big rally last week, risk assets sold off earlier today on the back of news that China wanted more talks before signing Trump’s ‘phase one’ deal. The news sent stocks, oil and commodity dollars all lower, while safe haven gold and yen gained ground. This comes after the US and China agreed on outlines of a partial trade accord on Friday. US President Donald Trump said he and China’s Xi Jinping could sign the deal as soon as next month. However, today’s news that China wants more talks certainly raises a few questions – enough to scare investors a little.

- There are no major economic data scheduled for release from North America, where the Americans are celebrating Columbus Day and Canadians are observing Thanksgiving.

Latest market news

Today 08:15 AM