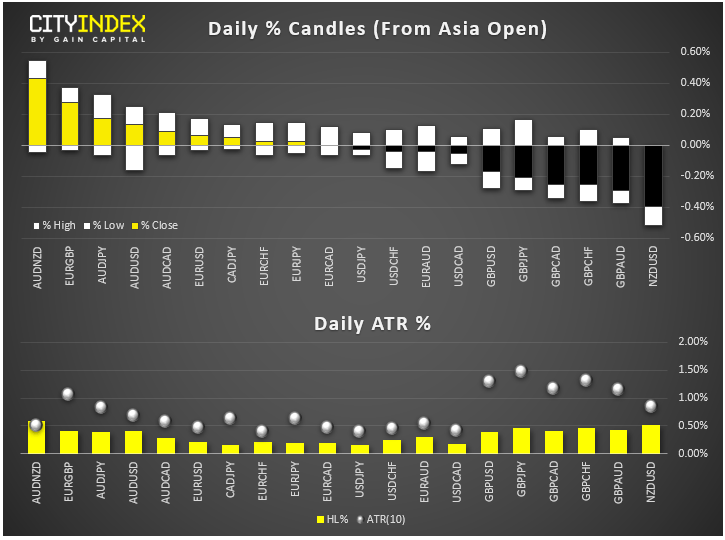

- FX update: At midday in London the AUD was the strongest while NZD and GBP were among the weakest:

- Thanks to the Brexit uncertainty, GBP was giving back more of its recent gains as investors awaited fresh developments. The Aussie was boosted by rallying metal prices (see below).

- Brexit update: UK PM Boris Johnson’ bid for an early election was effectively blocked on Thursday as Labour Party leader Jeremy Corbyn said he first wants to know the length of the Brexit extension granted by the EU before deciding whether to back the call. Well, today, the EU ambassadors have agreed in principle to delay Brexit. BUT they have not set a new date yet. According to Reuters, an EU official said: "Work will continue over the weekend. (27 EU ambassadors) are expected to meet early next week, on Monday or Tuesday, to finalise an agreement."

- US-China trade update: According to Reuters, top trade officials from the US and will discuss over the phone plans today “for China to buy more US farm products, but in return, Beijing will request cancellation of some planned and existing US tariffs on Chinese imports.”

- In commodities, prices of metals were showing further signs of strength with silver breaking out today. Precious metals prices have risen partly because of expectations than central banks globally will continue to keep monetary policy extraordinary loose, while base metals have found support amid optimism over a US-China trade deal. See “Metals galore: Gold, silver, copper, platinum and palladium all breaking higher” for more.

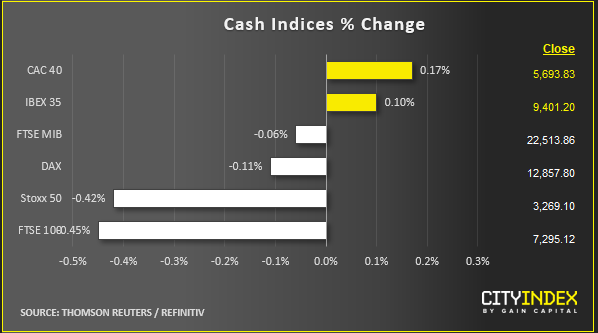

- Stocks were mixed in Asia and similarly in Europe with FTSE down and CAC higher. Investors awaited fresh developments from US-China and Brexit situations. The focus has been on earnings over the past couple of weeks with lots of US companies reporting this and next week. In Europe too, earnings have been coming in thick and fast:

- Amazon published its first profit drop in two years yesterday and the company’s shares were set to open around 6% lower. Yesterday’s other reporters included Tesla (TSLA, +18%), Paypal (PYPL, +9%), Intel (INTC, +6.0%), Microsoft (MSFT, +2%), Ford (F, -7%), eBay (EBAY, -9%), and Twitter (TWTR, -21%).

- Today’s Wall Street companies to report their results included Verizon Communications (VZ) which rose slightly on the back of positive results.

- In Europe, we heard from the likes of FTSE-100 listed Barclays (BARC, +1.1%) and WPP (7.3%) which reported better results. Meanwhile shares in Anheuser-Busch InBev (ABI, -9%) tanked as the world’s biggest brewer lowered its annual profit forecasts after a weak third quarter.

- There are no major economic data scheduled for release today, but next week will be very busy!

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM