Market Brief: BoJo’s Parliamentary Prorogation Punctures Pound

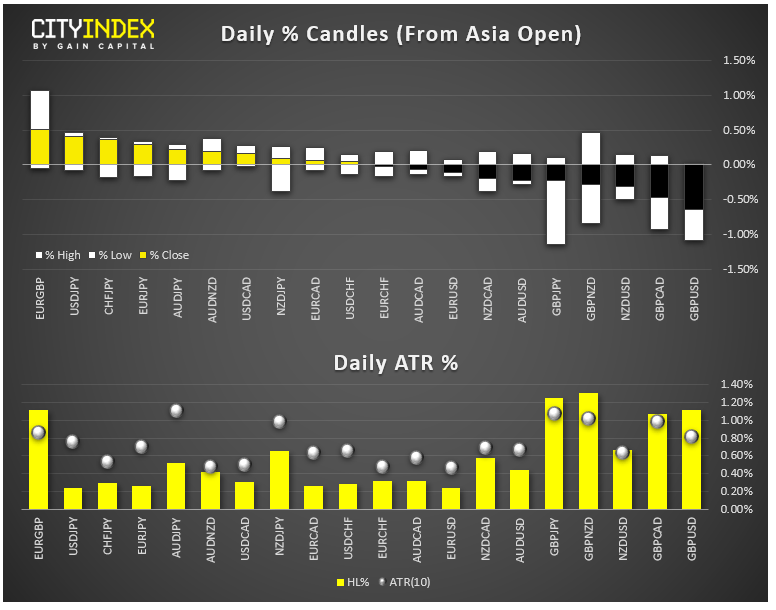

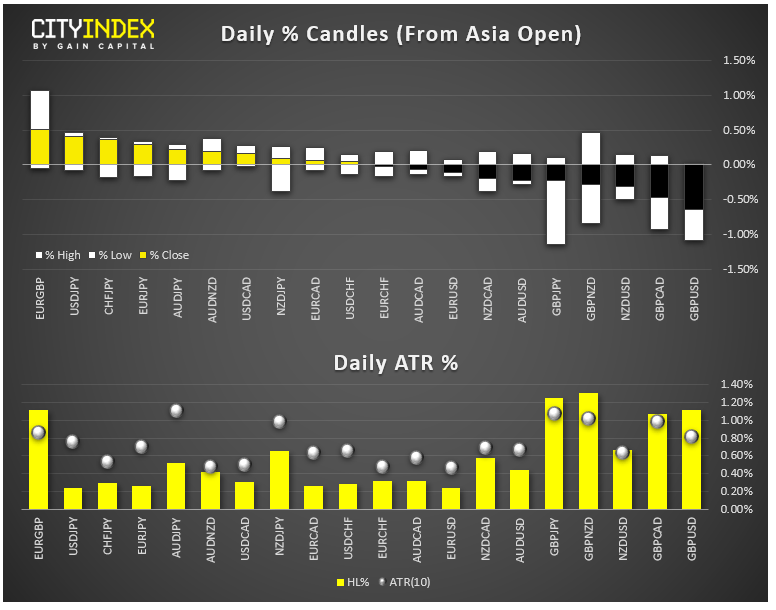

- FX: The US dollar was the strongest major currency on the day, and the British pound was the weakest after PM Boris Johnson successfully prorogued Parliament for five weeks until mid-October. That said, GBP/USD merely retraced yesterday’s rally and remains down only slightly on the week so far.

- Italy’s PM Conte was granted a mandate to form a new government with the 5-Star Movement, sidestepping (for now) the need for another election. The euro hardly reacted to the news.

- See why Sweden’s krone is approaching all-time lows against the US dollar.

- Commodities: Gold ticked lower while oil tacked on nearly 2% after a massive drawdown in US inventories.

- Cryptoassets saw strong selling pressure today, with Ethereum dropping to 8% to its lowest level since May near $170.

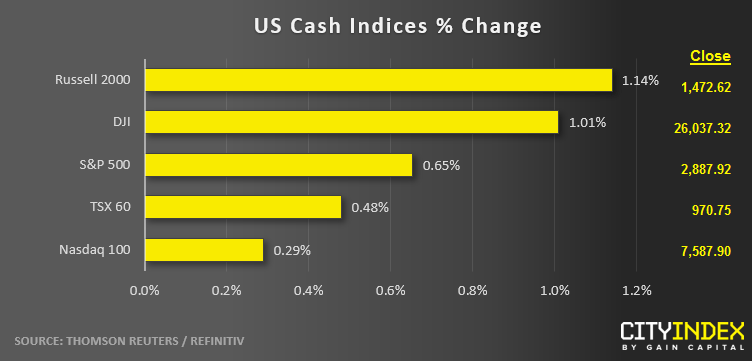

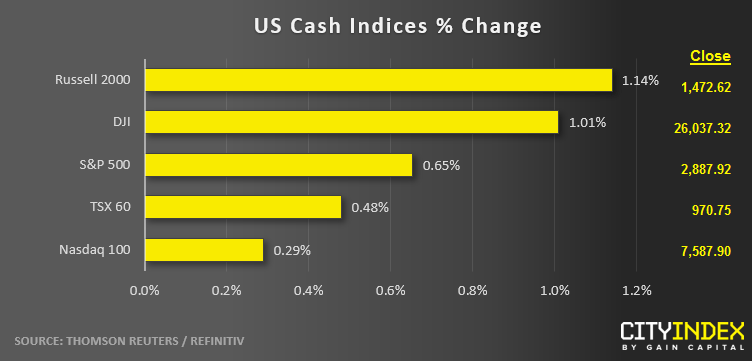

- US indices saw sub-1% gains across the board, partially driven by month-end rebalancing after a rough August.

- Energy (XLE) was the strongest sector while Utilities (XLU) went from first yesterday to worst today.

Latest market news

Yesterday 08:33 AM