Market Brief: BoJo’s Brexit Setback Hits Sterling

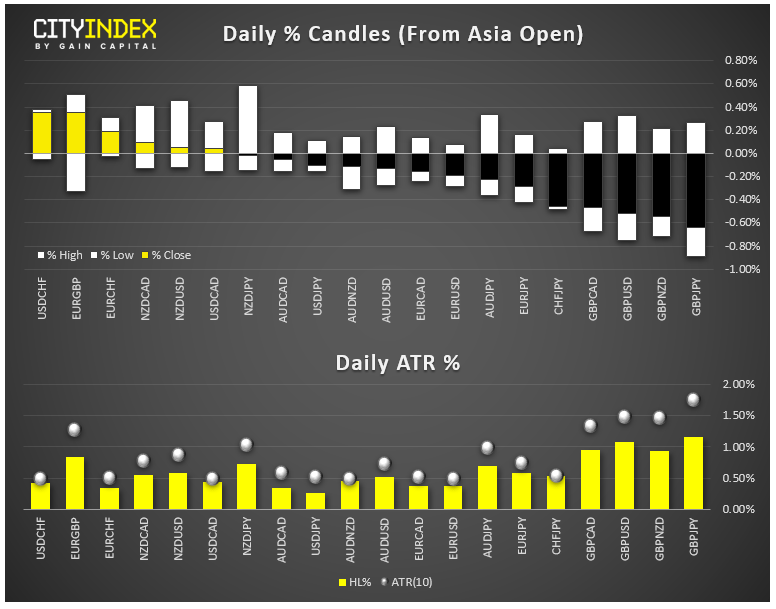

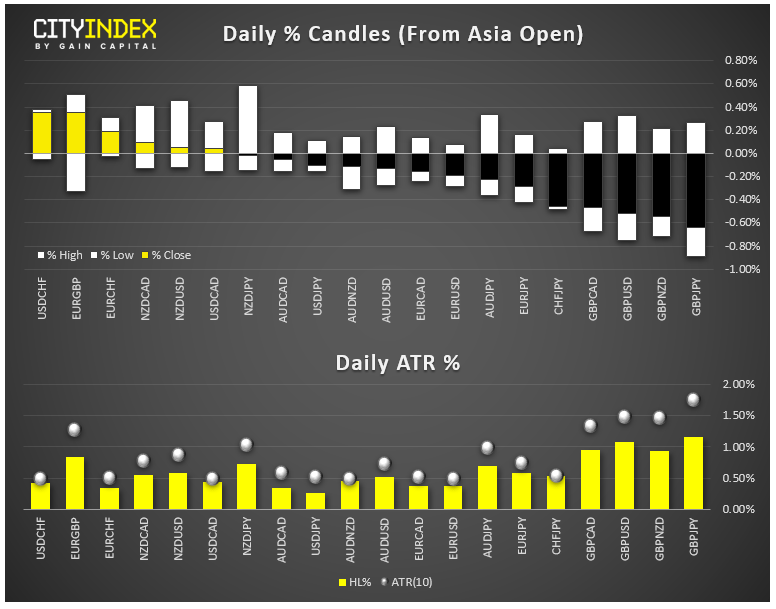

View our guide on how to interpret the FX Dashboard.

- Parliament voted down Boris Johnson’s Brexit “programme motion timetable” 322-308, meaning that the PM must request an extension, which the EU is likely to grant. Johnson has been outspoken that he still intends to have the UK leave the EU by the end of the month, though he may accept a “technical” extension to work out any sticking points.

- FX: The yen was the day’s strongest major currency after a late shift to risk-off trading. The pound was the day’s weakest major currency.

- The Canadian dollar initially ticked lower as traders digested the result of last night’s election, but the currency ultimately finished in the middle of the major currency pack, helped along by rising oil prices.

- US Data: Second-tier reports were mixed, with the Richmond Fed survey beating expectations but existing home sales coming in a bit soft.

- Commodities: Oil gained nearly 2% on the day on a report that OPEC was considering deeper production cuts at its December meeting due to weaker global demand forecasts. Gold was essentially flat.

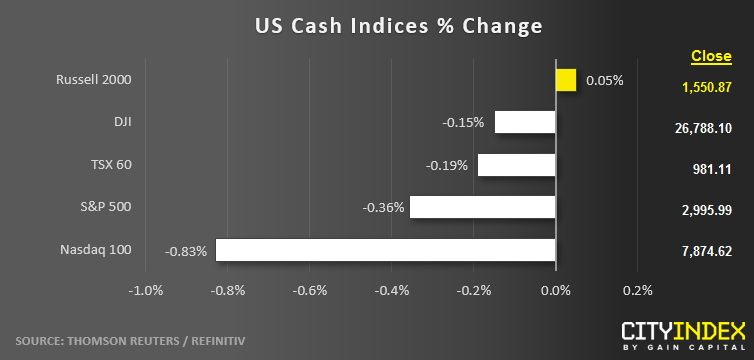

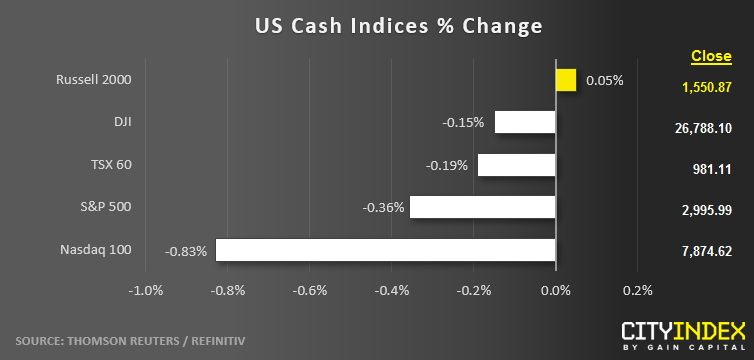

- US indices closed marginally lower on the day, with the tech-heavy Nasdaq leading the late afternoon selloff.

- Energy stocks (XLE) were the strongest major sector again today, while Technology (XLK) brought up the rear.

- Stocks on the move:

- Biogen (BIIB) exploded 26% higher after the company found data to help revive a potential blockbuster Alzheimer drug.

- McDonalds (MCD) shed -5% after missing earnings estimates for the first time in two years before the bell today.

- Facebook (FB) fell -4% on the day as more states joined an antitrust probe against the company. Now, 45 states, Guam, and the District of Columbia are working with the New York-led investigation. The company reports earnings next week.

- Procter & Gamble (PG) gained 3% after the company reported solid earnings and raised its guidance for 2020.

- Toy maker Hasbro (HAS) shed -17% after reporting disappointing earnings on the back of US-China trade tensions.

- Under Armour (UA) rose 7% on news that the company’s long-time CEO Kevin Plank was stepping down.

- Snapchat (SNAP) reported a loss after the bell today. The stock is trading -4% lower in volatile after hours trade as of writing.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM