Market Brief: BoJo’s Brexit Breaks Through the EU

- Brexit headlines once again flew hot and heavy today, with the UK government and the EU reaching an agreement, though the prospect of Parliamentary approval this weekend looks tenuous with the DUP vowing to vote against the deal (see more here and here).

- Turkish President Erdogan and US VP Pence reportedly reached an agreement to suspend Turkey’s assault on Syria. The Turkish lira gained ground against the US dollar for the third straight day.

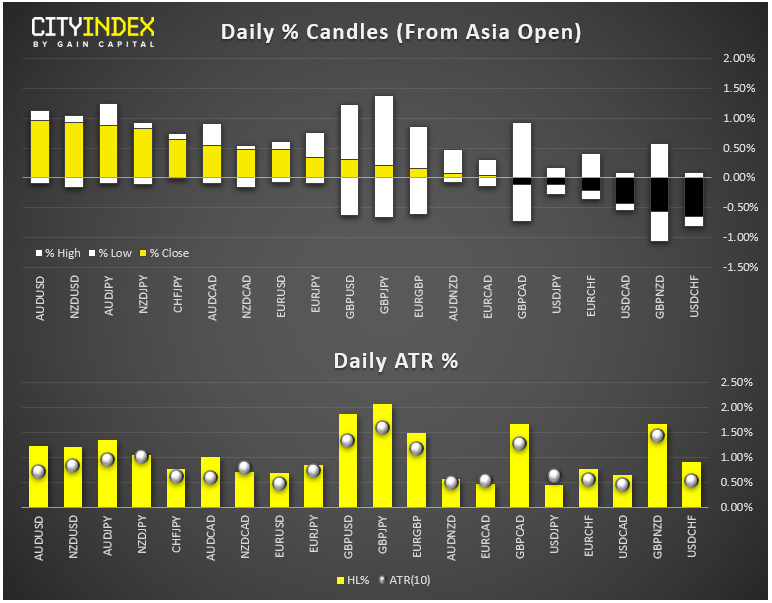

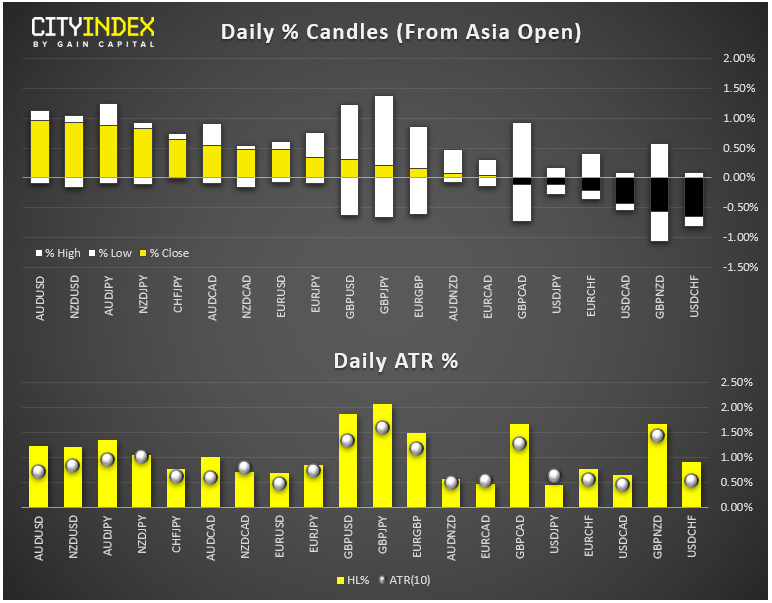

- FX: The aussie and the kiwi were the strongest major currencies on the day, while the US dollar was the day’s weakest major currency.

- US data: Industrial Production (Sept) came in soft at -0.4% vs. -0.2% eyed, though last month’s reading was revised up by 0.2%. US Housing Starts (Sept) were also weaker than expected at just 1256K. Finally, the Philly Fed Manufacturing Survey came in at 5.6, below 7.3 eyed.

- Commodities: Both gold and oil traded higher on the day, with oil prices gaining 1% on a late rally to hit their highest levels of the week despite a larger-than-expected buildup of EIA inventories.

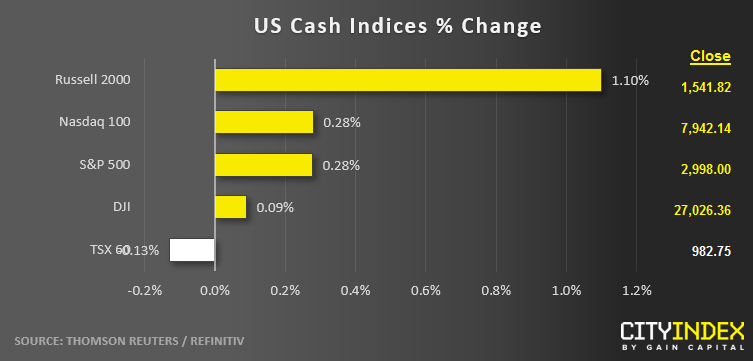

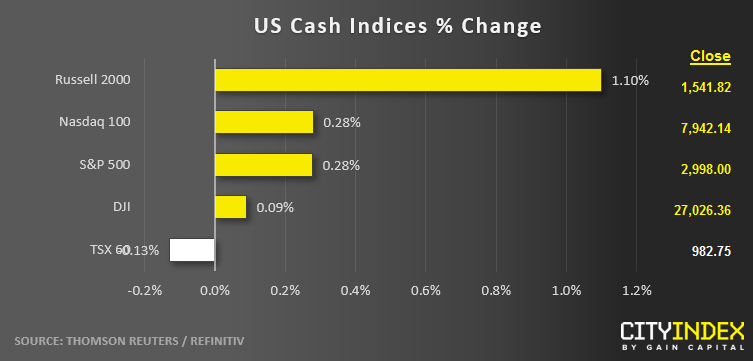

- US indices finished marginally higher on the day to close at a fresh 4-week high.

- Health care stocks (XLV) led the way higher, while Technology (XLK) was the laggard and the only sector to close lower on the day.

- Stocks on the move:

- After gapping more than 6% higher on yesterday’s earnings release, Netflix (NFLX) traded lower throughout the day, ultimately closing 3% higher on the day.

- JP Morgan (JPM, +1%) probed its record high near 122.00 intraday after CEO Jamie Dimon delivered another strong quarterly earnings report.

- IBM (IBM) dumped -6% after seeing revenue fall for the fifth consecutive quarter. Recently acquired Red Hat grew revenue 19% in the quarter.

- Marijuana company Cronos (CRON) gapped 25% higher on news that its partially owned Australian subsidiary would IPO next month, but the stock ultimately closed just 5% higher on the day.

- Recent IPO Beyond Meat (BYND) fell -4% today and is now down more than 50% from July’s record high.

Latest market news

Today 01:15 PM

Today 07:49 AM

Today 04:24 AM