Market Brief: Bloom Comes Off the Risk Rose Amidst Middle East Bombing

View our guide on how to interpret the FX Dashboard.

- Markets assumed a clear risk-off posture following last night’s US missile strike in the Middle East, with safe haven assets in particular demand.

- The minutes from the December Federal Reserve meeting were mostly uninspiring, with officials suggesting that rates were likely to remain steady unless there was a material change in the underlying economic situation.

- US data: ISM Manufacturing PMI (Dec) printed at 47.2 vs. 49.0 eyed, the lowest reading since 2009. The Employment subcomponent fell to just 45.1, signaling a relatively sharp contraction in hiring in the sector. Separately, Construction Spending (Nov) rose 0.6% m/m, more than the 0.4% reading eyed.

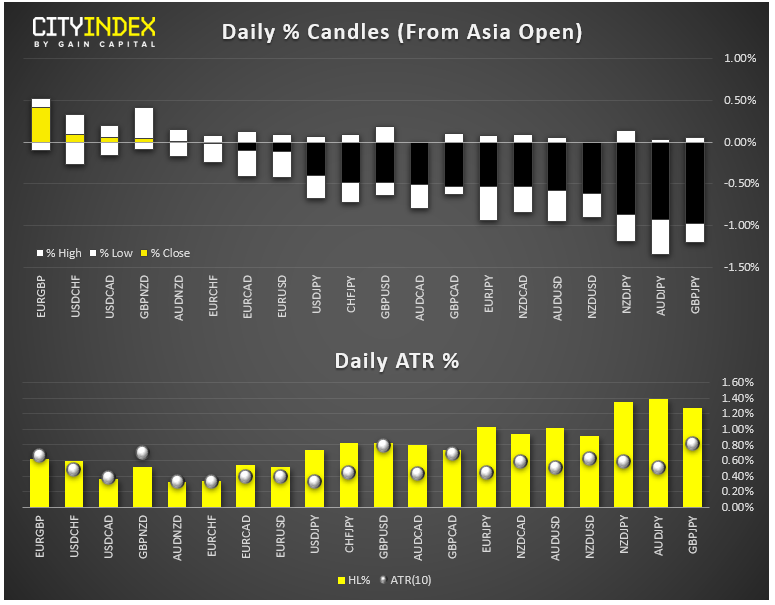

- FX: The Japanese yen was the strongest major currency today, followed by the US dollar. The British pound was by far the weakest, falling by more than 1% against the day’s leading currencies.

- Commodities: Oil rallied more than 3% on the day, boosted by the turmoil in the Middle East and a surprise drawdown in inventories. Gold tacked on about 1.5% in a safe haven bid.

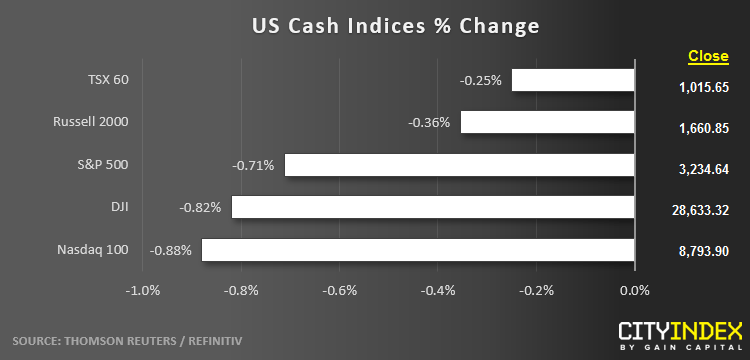

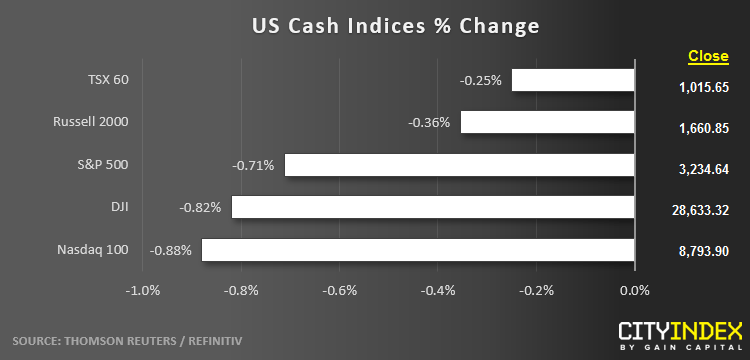

- US indices closed lower on the day, spooked by tensions in the Middle East.

- REITs (XLRE) were the strongest sector on the day, gaining more than 0.5%. Materials (XLB) was the weakest, falling by more than -1%.

- Stocks on the move:

- Aerospace and Defense names were the big movers, led by Northrop Grumman (NOC, +5%) and Lockheed Martin (LMT, +4%)

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM